If you get hurt in a car crash, you may worry about paying for doctor bills. MedPay stands for Medical Payments coverage. It can help you pay for health costs after a crash. It does not matter who caused the accident. MedPay pays either way. You might already have health insurance. Still, you may want to look at what MedPay can do for you. Some states offer MedPay or even make it a rule. Wisconsin and Maine are two examples:

State | MedPay Coverage Status |

|---|---|

WI | MedPay is part of auto insurance rules or options |

ME | MedPay is included with other coverages; you must have medical payments coverage |

Auto Insurance Med Pay Explained shows how this coverage helps you. Think about your own risks. Decide which benefits are most important to you.

Key Takeaways

MedPay is an extra part of car insurance. It helps pay medical bills after a car crash. It does not matter who caused the crash.

MedPay pays for things like ambulance rides and doctor visits. It also covers hospital stays. It can help with health insurance deductibles and copays.

You can use MedPay for yourself and your passengers. It also helps your family members. It even helps if you get hurt walking or biking.

MedPay pays fast. You do not have to pay deductibles or copays. You can pick any doctor or hospital you want.

MedPay has limits on how much it pays. It does not pay for lost wages or long-term care. Check your needs and state rules before you add it.

Auto Insurance Med Pay Explained

What Is Med Pay

You might wonder, what is Med Pay? Med Pay stands for Medical Payments coverage. It is an extra part you can add to your car insurance. When you look at auto insurance med pay explained, you see that Med Pay helps pay for medical bills if you get hurt in a car accident. It does not matter who caused the crash. You, your passengers, or even a pedestrian can get help with medical costs.

According to major insurance sources, Med Pay is an optional add-on. It covers medical expenses from car accidents. This includes doctor visits, hospital stays, ambulance rides, and sometimes even medical equipment. Med Pay can help pay for your health insurance deductibles and co-pays. It works for you, your passengers, and even if you are a pedestrian or riding in someone else’s car.

Med Pay is not the same as other types of insurance. For example, it is different from Personal Injury Protection (PIP). PIP covers more things, like lost wages and funeral costs. Med Pay only pays for medical expenses. Here is a quick look at how Med Pay and PIP compare:

Aspect | Med Pay (Medical Payments Coverage) | PIP (Personal Injury Protection) |

|---|---|---|

Coverage Scope | Medical expenses only (ambulance, ER fees, etc.) | Medical expenses plus lost wages, rehab, psychiatric, funeral costs |

Coverage Group | Passengers, pedestrians, joggers, public bus riders | Typically insured driver and passengers |

Coverage Limits | Lower limits, commonly $5,000 to $10,000 | Higher limits, varying widely by state, can be unlimited |

Mandatory vs Optional | Optional in most states | Mandatory in most no-fault states |

Cost | Generally cheaper premiums | Generally higher premiums |

When you see auto insurance med pay explained, you learn that Med Pay is usually cheaper and easier to add to your policy. It is optional in most states, but some states require it.

How Med Pay Works

Let’s talk about how Med Pay works. If you get into a car accident, Med Pay steps in right away. You do not have to wait for someone to decide who caused the crash. Med Pay pays for your medical bills, no matter who was at fault. This means you can get help fast.

Here is what usually happens:

You get hurt in a car accident.

You visit the doctor or hospital.

You send your medical bills to your insurance company.

Med Pay pays for covered costs up to your policy limit.

You do not have to pay a deductible or co-pay when you use Med Pay. This makes it simple and quick. You can use any doctor or hospital you want. Med Pay can also help pay for your health insurance deductible if you have one.

Auto insurance med pay explained shows that Med Pay covers you, your family, and your passengers. It even helps if you are hit by a car while walking. Med Pay does not cover lost wages or damage to your car. It only pays for medical expenses.

Tip: Med Pay can be a smart choice if you want extra help with medical bills after a crash. It works well with your health insurance and can fill in the gaps.

When you look at auto insurance med pay explained, you see that Med Pay is a simple way to add more protection to your car insurance. It gives you peace of mind, knowing you can get help with medical bills right away.

Medical Payments Coverage Details

What’s Covered

When you add medical payments coverage, it helps pay for many medical costs after a car accident. This coverage starts right away. You do not need to wait for someone to decide who caused the crash. You can use this coverage for different injuries and treatments.

Here are some things medical payments coverage pays for:

Ambulance fees if you need to go to the hospital

Hospital stays and visits to the emergency room

Doctor visits and care after your first treatment

Surgery costs and tests like X-rays

Skilled nursing care if you need help after getting hurt

Prescription drugs and medical supplies

Chiropractic care and physical therapy

Dental care if you hurt your teeth in a crash

Prosthetic devices or things that help you move

Funeral expenses if someone dies in a car accident

Tip: Medical payments coverage can help pay your health insurance deductibles or copays. This means you pay less money from your own pocket for medical costs.

You do not need to worry about who caused the accident. Medical payments coverage pays no matter what. You can go to any doctor or hospital you want. This makes medical expense coverage a good choice for many drivers.

Who Is Protected

Medical payments coverage helps more than just you. If you have this coverage, you get help for yourself and others in your car. Here is who gets protection:

You, as the policyholder, if you drive or ride as a passenger

Your family members who live with you, even if they ride in someone else’s car

Passengers in your car during the accident

You, if you get hurt walking or riding a bike

If you or your loved ones get hurt in a car accident, medical payments coverage helps with medical expense coverage. This protection follows you, not just your car. So, if you ride in a friend’s car or walk and get hit, you still have coverage.

Note: Medical payments coverage works for each person, not just for each accident. Every person hurt can get help up to the coverage limit you pick.

Common Scenarios

You might wonder when you would use medical payments coverage. Here are some real-life examples where this coverage helps:

You drive to work and get into a car accident. You break your arm and need surgery. Medical payments coverage pays for your ambulance ride, ER visit, surgery, and doctor visits after.

Your child rides with a friend and gets hurt in a crash. Medical payments coverage helps pay for their hospital bills, even if you were not driving.

You walk across the street and a car hits you. You get hurt and need physical therapy. Medical payments coverage pays for your treatment, no matter who caused the accident.

You have health insurance, but your plan has a high deductible. Medical payments coverage helps pay those extra costs, so you do not pay as much.

You and your passengers get hurt in a car accident. Each person can use medical expense coverage up to the policy limit for their own medical costs.

Medical payments coverage usually has limits from $1,000 to $10,000 for each person, but you can pick higher limits if you want more help. Some states make you buy a minimum amount of coverage, while others let you choose if you want it. The cost for this coverage is often low, and you do not pay a deductible or copay.

🚗 Remember: Medical payments coverage gives you peace of mind. You know you have help with medical expense coverage for yourself and your loved ones, no matter where or how you get hurt in a car accident.

Medical Expense Benefits

Many drivers add MedPay to their car insurance for good reasons. Let’s look at the main ways this coverage helps you.

Immediate Payment

A big benefit is getting help with bills fast. After a car accident, you send your medical bills to your insurance company. MedPay pays quickly, faster than most other claims. You do not have to wait for someone to decide who caused the crash. This means you can focus on healing, not on money worries. Fast payment is a top reason people like MedPay.

Tip: Getting paid fast can help you avoid late fees or debt from doctors.

No Deductibles or Copays

Another benefit is you do not pay deductibles or copays. Most health insurance plans make you pay some money before they help. MedPay works differently. If you have health insurance, it pays first. Then, you can use MedPay to pay what is left, like deductibles or copays. Most of the time, you do not pay anything up front for covered care. This helps you save money after an accident.

MedPay pays your out-of-pocket costs.

You do not need to pay a deductible.

No copays are needed for covered care.

Provider Choice

With MedPay, you can pick any doctor or hospital you want. You do not have to use a certain network or list. This is helpful if you want to see a special doctor or get care near home. MedPay lets you choose what is best for you and your family. You get more choices and it is easier for you.

When you add up these benefits, you see why MedPay is a smart choice. Medical expense benefits like fast payment, no deductibles, and picking your doctor make MedPay a good option for many drivers.

Med Pay Drawbacks

MedPay gives good protection, but you should know about some problems before you add it to your plan.

Coverage Limits

MedPay has a set amount it will pay. Most people pick $5,000 or $10,000. Some companies let you pick as low as $1,000 or as high as $25,000. A few companies offer more, but that does not happen often. These amounts are like your health insurance deductible. If your medical bills are higher than your MedPay amount, you must pay the rest. For example, if you have $10,000 in MedPay and your hospital bills are $20,000, you pay the extra $10,000 yourself. MedPay only pays up to the amount you choose. This might not be enough if you get badly hurt.

Note: MedPay pays for medical and funeral costs right after an accident. It does not pay for long-term rehab or care you need later.

Exclusions

MedPay does not pay for every injury or accident. Most plans do not cover these things:

Injuries to business partners or people who work for you (except volunteers)

Vendors or independent contractors you hire

Tenants hurt on property they rent from you

Accidents with cars used for business, like ride-sharing or delivery

Injuries from things done on purpose

Some kinds of medical care or doctors may not be paid for

You must file claims in a certain time, usually one to three years

These rules mean MedPay pays for normal medical bills for you and your passengers. It does not pay for business injuries or some other cases.

No Lost Wages

MedPay is different from other coverage because it does not pay for lost wages. If you miss work after a car accident, MedPay will not pay you for lost income. It also does not pay for pain, suffering, or damage to your car. If you want help with lost wages or more coverage, you should look at Personal Injury Protection (PIP) or other types of insurance.

If you live in a state that makes you buy PIP, you might not be able to get MedPay. State laws decide if you can buy MedPay or if you must get other coverage.

Knowing these problems helps you see if MedPay is right for you. Always check your state’s rules and think about your own risks before you add this coverage.

Med Pay vs Health Insurance

Overlap and Differences

You might wonder how med pay stacks up against health insurance or even Personal Injury Protection (PIP). Each one helps you pay medical bills, but they work in different ways. Med pay only covers injuries from car accidents. Health insurance covers a wide range of medical needs, not just accidents. PIP goes further by paying for lost wages and rehab.

Here’s a table to help you see the differences:

Feature | MedPay | Health Insurance / PIP |

|---|---|---|

Coverage Type | Medical expenses from auto accidents only | Broader medical needs; PIP covers lost wages, rehab, more |

Fault Requirement | No-fault: pays no matter who caused the accident | May depend on fault; PIP is no-fault in some states |

Claims Process | Pays first for accident medical bills, then health insurance steps in | Health insurance claims can be complex, with cost-sharing |

Optional vs. Mandatory | Usually optional, not in every state | PIP mandatory in some states; health insurance required for care |

Coverage Limits | Lower limits, affordable premiums | Higher limits, broader coverage, often more expensive |

Med pay works fast and pays your bills right away. You do not need to worry about deductibles or copays. Health insurance often asks you to pay part of the bill before it helps. PIP can cover more, but you may not have it in your state.

When Med Pay Is Useful

You might ask, “When does med pay help me most?” Med pay steps in when your health insurance does not pay first. Some health insurance plans say med pay must pay before they do. If you have PIP, it usually pays first. In states like Massachusetts, PIP pays up to a set amount. After that, med pay can help with extra bills.

Here are times when med pay acts as your main coverage:

Your health insurance has rules that make med pay pay first.

PIP benefits run out or are not available.

Your health insurance denies your claim because of coordination of benefits.

You get hurt in a car accident and need help with deductibles or copays.

Med pay fills gaps left by health insurance and PIP. You get quick help with bills, and you do not need to wait for a long claims process. If you want peace of mind after an accident, med pay can be a smart choice.

🚗 Tip: Always check your insurance policy. See how med pay, health insurance, and PIP work together in your state.

Cost of Med Pay

Premiums

You may ask how much MedPay costs each month. Most drivers pay between $6 and $15 for MedPay. The price depends on your insurance company and where you live. Here is a table showing what some companies charge:

Insurance Company Example | Monthly MedPay Premium |

|---|---|

USAA | $6 |

Other Insurers | $7 – $14 |

Liberty Mutual | $15 |

MedPay is usually cheap to add to your car insurance. You pay a small amount for extra protection. Medical expense coverage is not expensive for most families.

Many things can change your premium. Here are the main reasons:

The state you live in changes the price. Some states make you buy medical payments coverage, but others let you choose.

Your insurance company decides its own prices.

The coverage limit you pick changes your monthly cost.

Your driving record and car type matter.

If you file lots of claims or cause accidents, your insurance may cost more.

Tip: Filing a MedPay claim by itself does not usually raise your premium, but accidents or many claims might.

Coverage Amounts

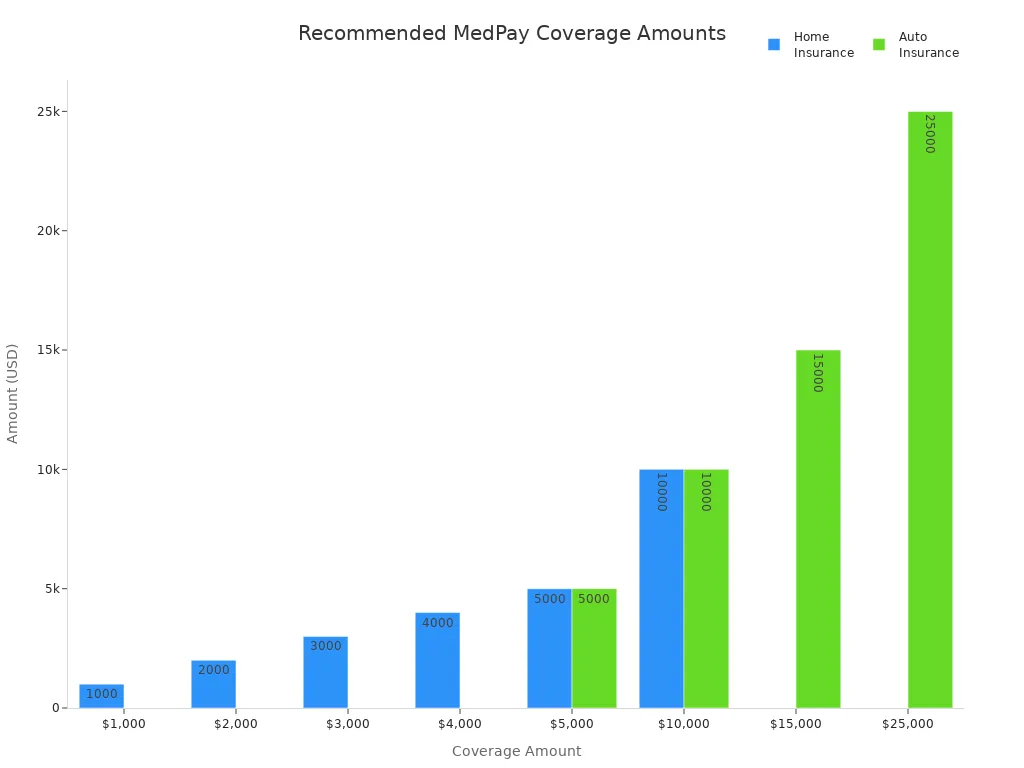

You get to pick how much medical payments coverage you want. Most insurance companies offer limits from $1,000 up to $25,000. Some companies offer even higher limits. Experts say you should pick an amount that fits your budget and health insurance needs. Even if you have good health insurance, MedPay can help pay extra costs.

Insurance Type | |

|---|---|

Home Insurance | $1,000, $2,000, $3,000, $4,000, $5,000, $10,000 |

Auto Insurance | $5,000, $10,000, $15,000, $25,000 (some up to $100,000) |

Common coverage limits are $1,000, $2,000, $5,000, $10,000, $25,000, $50,000, and $100,000. Each person in your car gets coverage up to the limit you pick. If you want to know how much coverage you need, think about your health plan, your budget, and how many people ride with you. Many drivers find medical payments coverage is a smart way to get more protection.

Not sure how much medical payments coverage you need? Ask your insurance agent to help you choose the best amount for you.

How to Add Med Pay

Steps to Add

If you want to add MedPay to your car insurance, you can call your insurance agent or go online. Most companies let you add this coverage easily. You just ask for Medical Payments coverage and pick a limit that works for you.

Here is how you can add MedPay:

Call your insurance company or agent.

Ask about Medical Payments coverage choices.

Pick a coverage limit that fits your budget and health needs.

Look over the details before you sign up.

Make sure MedPay is now on your car insurance.

Choosing the right coverage limit matters. If you pick a low limit, you might have to pay more if your medical bills are high. Many people make this mistake and get bills they did not expect. Think about your health insurance deductible and how much you want MedPay to help.

💡 Tip: Take your time when picking your coverage limit. Ask your agent for help if you are not sure.

Check Existing Coverage

Before you add MedPay, check your current car insurance policy. You might already have Medical Payments coverage and not know it. Look at your policy papers or call your insurance company to ask. Some plans include MedPay automatically, while others let you choose it.

Many people do not know what their MedPay covers. They might not know the difference between MedPay and PIP, or they think they do not need it if they have health insurance. This can cause mistakes like not updating coverage when life changes or missing out on benefits.

One common mistake is not working with both your health insurance and your Medical Payments insurance. If you let MedPay pay everything first, you could lose some health insurance benefits.

Skipping MedPay because you think it is not helpful.

Not checking or changing your coverage as your needs change.

Thinking MedPay is the same as PIP or health insurance.

If you ever file a claim, knowing your coverage helps you avoid surprises. Check your car insurance policy every year to make sure you have the right protection.

MedPay gives you quick help with medical bills after a car accident. You get coverage for ambulance rides, doctor visits, and even deductibles. The cost stays low, but coverage limits might not be enough for big emergencies. Some people skip MedPay to save money, but that can leave you with high bills.

– Review your health insurance and state rules.

Think about your driving habits and risks.

Talk with an insurance expert to pick the right coverage.

Take a few minutes to check your auto policy. You might find MedPay is the extra protection you need.

FAQ

What happens if I already have health insurance?

You can still use MedPay. It helps pay your deductibles and copays. MedPay covers costs your health insurance does not pay. You get extra help with bills after a car accident.

Does MedPay cover me if I am walking or biking?

Yes! MedPay protects you if a car hits you while you walk or ride a bike. You get coverage for your medical bills, even if you are not driving.

Can I choose my own doctor with MedPay?

You can pick any doctor or hospital you want. MedPay does not limit you to a network. You get freedom to choose the best care for you.

Will MedPay pay for lost wages if I miss work?

No, MedPay does not cover lost wages. It only pays for medical and funeral costs. If you want help with lost income, look at Personal Injury Protection (PIP).

How do I know if MedPay is right for me?

Think about your health insurance, your budget, and your risk of accidents. Talk with your insurance agent. You can ask questions and get advice that fits your needs.