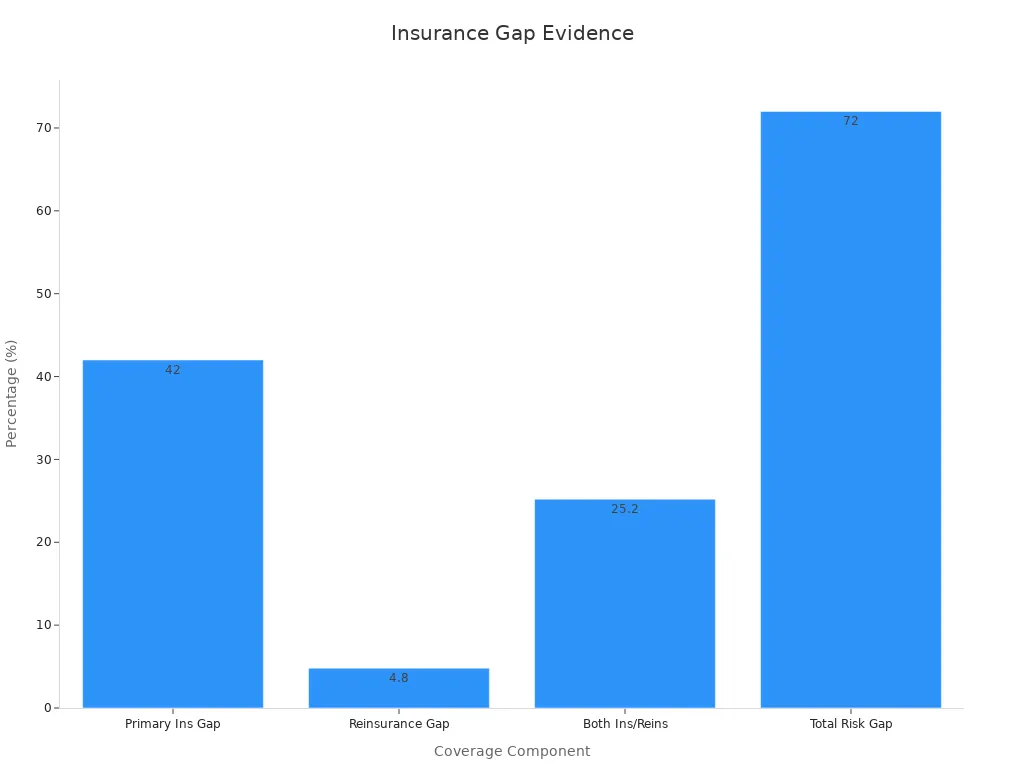

A binding moratorium is a rule that stops insurance companies from giving new policies or changing old ones for a short time. This usually happens right before or during disasters. You may not be able to buy new home insurance or change your coverage if a wildfire or hurricane is close. This means you could be at risk. For example, less than one-third of disaster losses in the world are covered by insurance. The number of people without enough coverage gets bigger every year.

Knowing about binding moratoriums helps you avoid surprise gaps. It also helps you keep your protection strong.

Key Takeaways

A binding moratorium is when insurance companies stop selling new policies for a short time. They also do not let you change your current policy during risky times like wildfires or hurricanes.

Moratoriums help keep insurance fair for everyone. They stop people from only buying insurance right before a disaster. But they can make it hard to get or change insurance when you really need it.

You cannot buy new insurance or add more coverage during a moratorium. But you can usually renew your current policy. You can also still file claims if you need to.

You should plan ahead by checking your insurance policy before disaster season starts. Protect your home and keep up with news about any moratoriums in your area.

If there is a moratorium, focus on keeping your property safe. Make sure you understand your coverage so you do not get surprised later.

What Are Binding Moratoriums?

Definition

A binding moratorium is a short-term rule. It stops insurance companies from selling new policies or making changes to old ones. Some people call it an insurance moratorium. Companies use this rule when a big risk, like a wildfire or hurricane, is close by. The main goal is to protect you and the insurance company from big losses.

Most of the time, the insurance company starts the moratorium. Sometimes, the government or a regulator can order it instead. For example, in February 2024, the Texas FAIR Plan Association made a binding moratorium. They stopped giving new insurance in some Texas Panhandle counties because wildfires were spreading. This helped lower risk during a dangerous time.

Moratoriums are not just for insurance. In 2016, the governor of Puerto Rico made a moratorium. It stopped people from taking money out of the Government Development Bank. This helped protect the bank during a crisis. In insurance, a moratorium means you cannot buy new coverage or change your policy for a short time.

Note: A moratorium does not last forever. It ends when the risk goes down, like after a storm or when a fire is under control.

Key Features

You can tell a binding moratorium by these main things:

Temporary Suspension: The rule only lasts a short time. It starts when risk is high and ends when things are safer.

Limited Area: The insurance moratorium usually covers only certain places. These are often counties in the path of a wildfire or hurricane.

No New Policies: You cannot buy new insurance during the moratorium. This stops people from getting coverage only when a disaster is coming.

No Policy Changes: You cannot raise your coverage or add new things to your policy. Your current protection stays the same.

Renewals May Continue: Most companies let you renew your policy, even during a moratorium.

Legal Backing: Sometimes, a government or regulator orders the moratorium. Other times, the insurance company decides on its own.

A moratorium helps keep insurance fair. If everyone could buy new coverage right before a disaster, costs would go up for all. By using a moratorium, companies can manage risk and keep prices steady for you and others.

📝 Tip: Always check your insurance policy before disaster season. If you wait too long, a binding moratorium could stop you from getting the coverage you need.

Why and When Are They Imposed?

Common Triggers

Insurance moratoriums often happen before big disasters. Companies use them to protect themselves and you from big losses. Some common triggers are:

Hurricanes: If a hurricane is coming, companies may stop new policies in that area. This keeps people from rushing to get coverage right before the storm.

Wildfires: During wildfire season, if fires are close, insurers may start a moratorium. This pause stops new policies or changes in places where fires might spread.

Floods: If heavy rain or flooding is likely, you might see a moratorium in flood-prone areas. This helps keep things fair for everyone.

These disasters can cause lots of damage and many claims at once. A moratorium lets insurers help current policyholders and not take on too much risk.

Note: Insurance moratoriums are planned. They are not random. They help keep the insurance market steady for everyone.

Timing

When a moratorium starts is very important. Companies usually announce it right before a disaster or when they know a threat is real. For example, during hurricane season, you might see moratoriums on homeowners’ and flood insurance in coastal places. In wildfire season, insurers act fast in risky counties.

A moratorium does not last forever. It ends when the danger is gone and things are normal again. This helps insurers manage risk and pay claims. Sometimes, regulators step in after a disaster. They may stop insurers from canceling or not renewing policies. This keeps the market steady and gives you time to recover.

Insurance moratoriums are an important risk management tool. They help keep things fair and stable. They make sure you and your community can get insurance after a disaster.

Binding Moratoriums: Consumer Impact

Policy Changes

When a moratorium happens, you have strict limits on your insurance. You cannot change your policy at all. You cannot make your coverage bigger, add new things, or change your deductible. Your protection stays the same until the moratorium is over.

You can still renew your policy if it is time.

You cannot make your coverage better or add endorsements.

You cannot lower your deductible or add new property.

Tip: Always look at your policy before disaster season. If you wait until a moratorium starts, you cannot make important changes.

Many people feel upset by these limits, especially in emergencies. A LocalCircles survey showed that 43% of people who filed a health insurance claim in the last three years had problems. These problems included claim rejections, exclusions, deductions, and delays. New rules tried to help by making the moratorium period shorter, from 96 months to 60 months. The ‘no look back’ rule means insurers cannot say no to claims for pre-existing conditions after the moratorium ends. Even with these new rules, you might still have delays or pay more. These problems show how binding moratoriums can make it hard to manage your insurance when you need it most.

Studies show that moratoriums only help for a short time. For example, during COVID-19, payment holidays let people wait to pay debts, but interest still grew. The main problem did not go away. In insurance, a moratorium does not fix coverage gaps. It only stops changes for a little while. You may still feel worried if you cannot change your policy during a risky time.

New Coverage

A home insurance moratorium also stops you from getting new coverage. If you want a new policy during a disaster warning, you cannot get one. This rule helps keep insurance fair for everyone. If people could buy coverage right before a disaster, prices would go up for all policyholders.

Insurance moratoriums usually start 24 to 48 hours before a disaster and last until the risk is gone.

You cannot buy new home insurance or add coverage during this time.

The moratorium only covers certain places, usually those most at risk.

This can cause problems if you are buying or selling a home. Many home sales and loans need proof of insurance. If there is a moratorium, you may not be able to finish buying your home or get a new loan. This can slow down your plans or even stop your purchase.

Note: If you want to buy a home in a risky area, check for any moratoriums before you start. This can help you avoid last-minute problems.

You may also have coverage gaps if you wait too long to get insurance. If a disaster is coming and a moratorium starts, you cannot protect your property with a new policy. This leaves you open to loss. Insurers and government leaders decide how long a moratorium lasts based on risk and emergencies. You should get ready by making a home inventory, protecting your property, and talking to your insurance agent before disaster season.

Binding moratoriums help the insurance market, but they can leave you with fewer choices when you need them most. Planning ahead helps you avoid these problems and keeps your coverage strong.

What To Do During a Moratorium

Protecting Your Property

You can still do things to protect your property during a binding moratorium. Even if you cannot change your insurance, you can lower your risk of losing things. Many homeowners use simple steps to keep their homes safe and stop bigger problems later.

Strategy | Description | Purpose/Outcome |

|---|---|---|

Add hurricane shutters or make your roof stronger to meet local building codes | Lowers your risk and might make your insurance cost less | |

Replacement Cost and Law & Ordinance Coverage | Make sure your policy pays for new building code costs if you must rebuild | Helps you not pay extra money after a disaster |

Some states stop insurers from canceling or not renewing policies after wildfires | Gives you more time to recover and keep your insurance | |

Insurance Support Workshops | Go to workshops to learn about claims and getting help | Helps you know your rights and what to do next |

Many states now make insurers give you more time before they cancel your policy after a disaster.

You can ask your insurer if you can get discounts for making your home safer.

Go to local workshops to learn how to file claims and protect your rights.

🛡️ Tip: Take pictures of your property and make a list of your things. This makes it easier to file claims if you have damage.

Reviewing Coverage

You should check your insurance coverage often, especially during a moratorium. This helps you avoid gaps and keeps your protection strong.

Read your policy’s moratorium clause. Know how long you must wait for coverage of pre-existing conditions.

Ask your agent what counts as a pre-existing condition.

Pick policies with shorter waiting times if you can.

Check your coverage every year to make sure it fits your needs.

Ask your insurer to explain the moratorium rules in simple words.

If your claim is denied, use the appeal process and give medical proof if needed.

Think about changing insurers if you find better coverage or shorter waiting times.

📋 Note: After a disaster, some states make insurers pause non-renewals and cancellations. This gives you more time to recover and keep your insurance.

By doing these things, you can be ready and protect your home and family, even when a moratorium limits your choices.

You have learned what binding moratoriums are and why they are important. These rules can make it harder to change your insurance during disasters. You should get ready by:

Checking your insurance policy before disaster season starts.

Looking out for news about moratoriums where you live.

Asking for help if you do not understand something.

Remember: Insurance agents can answer your questions and explain your choices. Stay up to date and make sure your home has the right protection.

FAQ

What should you do if a moratorium is announced in your area?

Look at your insurance policy right away. Check what your policy covers. Try to keep your home safe from harm. If you have questions, call your insurance agent. Watch for news or updates from your insurance company.

Can you buy new insurance during a binding moratorium?

No, you cannot get new insurance during a binding moratorium. Insurance companies stop selling new policies to lower risk. You have to wait until the moratorium is over to get new coverage.

Will your current policy still protect you during a moratorium?

Yes, your current insurance policy still works. You keep the coverage you already have. You cannot add or change anything, but your protection stays in place.

How long does a binding moratorium usually last?

A binding moratorium lasts until the danger is gone. This can be a few days or sometimes weeks. Your insurance company will let you know when it is finished.

Does a moratorium affect your ability to file a claim?

You can still file a claim if your property is damaged during a moratorium. The moratorium only stops new policies and changes. You can still ask for help if you have a loss.

See Also

Reasons Insurance Premiums Increase Without Any Claims Filed