How Your Credit Score Impacts Home and Auto Insurance Rates

Credit score insurance rates reflect your credit history; higher scores often mean lower home and auto premiums, while poor scores can raise costs.

Credit score insurance rates reflect your credit history; higher scores often mean lower home and auto premiums, while poor scores can raise costs.

Attractive nuisance insurance helps Bluffton & Hilton Head homeowners cover liability for pools, trampolines, and more. See what protection you need.

Insurance scores explained: how they impact your home & auto rates in Bluffton & Hilton Head, including what affects your premiums and ways to save.

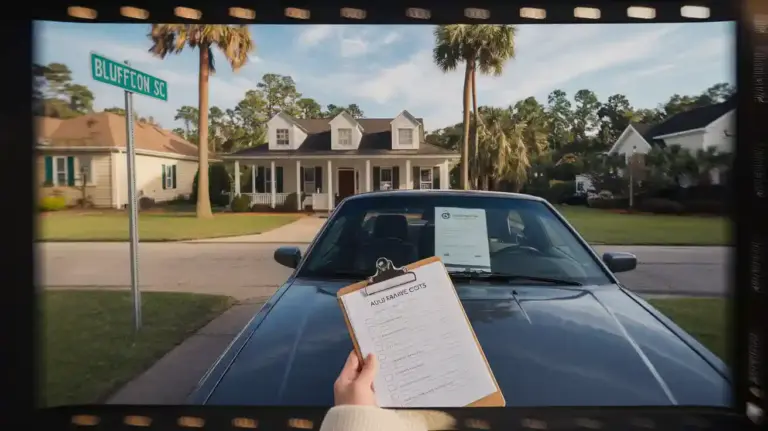

Home insurance Bluffton SC: Find coverage for coastal risks, flood, and HOA rules. Compare 2025 rates, discounts, and tips for protecting your home.

Agreed Value vs. Stated Value vs. ACV: How to Insure Your Classic the Right Way and ensure your collector car is covered for its true value, not just market price.

What Is Umbrella Insurance? Bluffton’s 2025 Guide to Extra Protection explains how extra liability coverage protects your assets when regular policies fall short.

Top 5 Discounts Bluffton Residents Miss on Auto & Home Insurance—see which savings you may be missing and how to lower your insurance costs today.

Homeowners Insurance Hilton Head: Coastal Coverage Guide explains how to protect your home from wind, flood, and salt air with the right coverage.

Auto insurance in Bluffton SC typically costs $1,250–$1,650 per year. Rates vary by age, driving record, and coverage. See what impacts your price.

Street-legal or neighborhood only? The golf-cart coverage rules no one explains—find out what insurance and legal steps you need for full protection.