Choosing the best business insurance can be challenging, especially when deciding: Do I need general liability or professional liability (or both)? Small businesses often encounter common risks like accidents, including slips or falling objects, and lawsuits from dissatisfied customers. Business insurance is essential to protect you from significant legal expenses. In many cases, businesses require both types of liability coverage to safeguard against physical damages and financial risks.

Key Takeaways

General liability insurance helps your business if accidents happen. It also helps if things get broken, like when someone slips or something breaks. Professional liability insurance helps if you make a mistake at work. It also helps if you give bad advice that costs someone money.

Many businesses need both types of insurance to stay safe. This is important if you meet with clients or give advice. It is also needed if you work on projects for others. Both insurances help protect you from different problems.

Picking the right insurance means you must know your business risks. You should check if contracts or laws say you need certain insurance. You can also look at bundle options to save money. Bundling can make your insurance easier to manage.

General Liability Insurance

What Is General Liability

You might ask what general liability insurance does for your business. This insurance helps protect you from many daily risks. If someone slips and falls in your store, it can help. If you break something that belongs to a client, it can help too. You do not have to be an expert to see why this is important. General liability helps pay for claims that could cost a lot. Many business owners pick this insurance because it covers many things. You can think of it as a safety net for your business.

What Does It Cover

General liability insurance covers more than just accidents. Here is what a normal policy can help with:

Bodily injury: Pays for doctor bills and legal costs if someone gets hurt at your business.

Property damage: Pays for fixing or replacing things if you break someone else’s property.

Personal injury and advertising injury: Helps if someone says you hurt their reputation.

Legal fees and settlements: Pays for lawyer costs, court fees, and settlements up to your policy limit.

Premises and operations: Covers things that happen at your business place.

Products and completed operations: Helps if someone makes a claim after you finish a job or sell something.

Tip: General liability insurance does not cover everything. It will not help with professional mistakes or if your workers get hurt. You may need other insurance for those problems.

Professional Liability Insurance

What Is Professional Liability

You may ask what professional liability insurance does for your business. This insurance helps if someone says you made a mistake at work. Many people call it errors and omissions insurance. If you give advice or offer a service, you have risks that general liability does not cover. Professional liability insurance helps when a client says you did not do your job right or missed something important.

Here’s what big insurance regulators say about professional liability insurance:

It protects you from claims of negligence, errors, or not doing your job.

It covers money lost from mistakes or missing steps in your services.

It pays for lawyer fees, court settlements, and arbitration costs.

It is important for anyone who gives advice or special services, like IT consultants, architects, or financial advisors.

Rules for coverage, policy limits, and what counts as professional services are set by regulatory bodies.

Note: Small business professional liability insurance is needed if you give advice or handle big projects for clients. It covers risks that general liability insurance does not cover.

What Does It Cover

Professional liability insurance covers many things that can happen at work. If a client says you gave bad advice or made a mistake, this insurance helps pay for your defense and any money you owe. Here are some common claims:

Misrepresentation, even if it was not on purpose

Wrong advice

Errors and omissions

Malpractice, especially in healthcare

Professional misconduct

Professional liability insurance pays for lawyer fees, court costs, settlements, and judgments. It covers money lost from mistakes or missing something in your work. It does not cover injuries or property damage. That is why you need both general liability and professional liability insurance for full protection.

General vs Professional Liability

Key Differences

General liability and professional liability help your business in different ways. General liability helps if someone gets hurt at your business. It also helps if you break someone’s things. Professional liability helps if a client says you made a mistake. It also helps if your advice costs them money. You may want to know how these insurances are not the same. The table below shows the main differences between them:

Feature | General Liability Insurance | Professional Liability Insurance |

|---|---|---|

Purpose | Covers physical injury, property damage, personal injury | Covers errors, omissions, or negligence in your work |

Who Needs It | Businesses with a physical location or client interaction | Anyone giving advice or specialized services |

Claims Covered | Slip-and-fall, property damage, false advertising | Bad advice, missed deadlines, malpractice |

Contract Requirements | Sometimes required by partners or vendors | Often required by clients or by law |

Combined Use | Often paired with professional liability for full protection | Often paired with general liability for full protection |

Tip: You get better protection if you have both types of insurance. This way, you cover both physical and money risks.

Typical Claims

You might want to know what real claims look like. Here are some examples:

A customer slips and falls in your store. This is a general liability claim.

You break a client’s laptop during a meeting. General liability covers this.

A client says your advice made them lose money. This is a professional liability claim.

You miss a deadline, and your client gets a fine. Professional liability helps here.

Someone sues you for a privacy problem after you handle their data. Professional liability covers this.

These examples show why both types of insurance are important. General liability helps with injuries or broken things. Professional liability helps with money lost from mistakes. Knowing the difference helps you pick the right insurance for your business.

Do I Need General Liability or Professional Liability (or Both)?

Picking the right business insurance can be tricky. You might wonder, “do I need general liability or professional liability (or both)?” The answer depends on your daily work, who you help, and what could go wrong. Let’s look at what fits your business best.

Who Needs General Liability

You need general liability insurance if you have a business space, meet clients, or use other people’s things. This insurance helps if someone gets hurt at your office or you break a client’s laptop. Many businesses need this, even if you work from home. Homeowners’ insurance does not cover business accidents.

Some reasons you might need general liability insurance are:

You work at client sites or use their things.

You advertise your business or do marketing.

You sign contracts that ask for general liability insurance.

General liability insurance covers things like:

Third-party bodily injury (like a customer slipping in your store)

Third-party property damage (like breaking something at a client’s office)

Advertising injury (like copyright issues or false advertising)

Reputational harm (like libel or slander)

Damage to rental property

Note: Even if you work from home, you still need general liability insurance. Homeowners’ insurance does not cover business claims.

Who Needs Professional Liability

You need professional liability insurance if you give advice, offer services, or help clients decide things. This insurance helps if someone says you made a mistake, gave bad advice, or missed a deadline. Some jobs must have this insurance by law or contract.

You should think about professional liability insurance if you:

Need proof of insurance to get hired.

Must follow state rules for your job.

Want protection from lawsuits about mistakes or bad advice.

Here are some jobs and why they need professional liability insurance:

Profession | Common Risk Scenario / Reason for Insurance Coverage |

|---|---|

Misdiagnosis causing delayed treatment and costly malpractice settlements | |

Legal professionals | Missing filing deadlines resulting in loss of client settlements |

Financial advisors | Recommending unsuitable investments causing significant client financial loss |

Architects/Engineers | Design errors causing expensive reconstruction and delays |

Accountants | Filing incorrect tax returns triggering penalties and audits |

Consultants | Poor strategic advice leading to failed product launches and lost revenue |

IT professionals | Software bugs causing system crashes and revenue loss |

Real estate agents | Failing to disclose property issues resulting in repair costs and value loss |

Professional liability insurance protects you from claims about negligence, misrepresentation, or not doing your job right. For example, if you are a tech company and your software makes a client lose money, this insurance helps pay the costs.

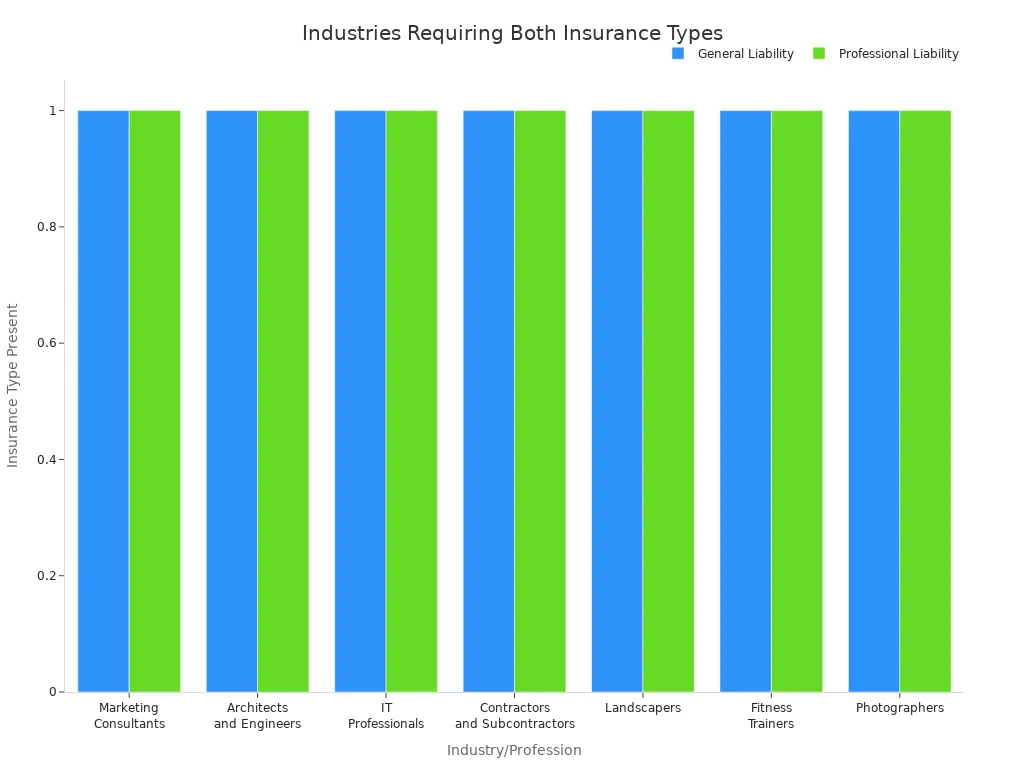

When Both Are Needed

Sometimes, you need both kinds of insurance. Many businesses face risks that need both general liability and professional liability insurance. If you visit clients, work on their things, and give advice or services, you need both for full protection.

Here are some times when both are needed:

You are a consultant who visits client offices and gives advice.

You are a contractor who builds things and also designs projects.

You are an IT professional who installs equipment and writes software.

You are a personal trainer who works with clients in gyms and gives fitness advice.

Having both types of insurance means you are covered for accidents and for mistakes in your work. This is important if you want to protect your business from all kinds of claims.

Simple Checklist: Do I Need General Liability or Professional Liability (or Both)?

Ask yourself these questions to help you decide:

Do clients or vendors come to my business place?

Do I work at client sites or use their things?

Do I advertise my business or use marketing?

Do contracts ask for general liability insurance?

Do I give advice, offer services, or help clients decide things?

Does my state or job need professional liability insurance?

Do clients ask for proof of professional liability insurance before hiring me?

Have I ever worried about being sued for a mistake or bad advice?

Do I want to protect my business from both physical and money risks?

Tip: If you said “yes” to questions about both physical risks and professional services, you probably need both types of insurance.

Real-World Scenarios

Let’s see some examples to make this clear:

Consultant: You visit a client’s office and spill coffee on their computer (general liability). Later, your advice leads to a failed project (professional liability).

Contractor: You damage a wall while working at a client’s house (general liability). Your design has a flaw that causes extra costs (professional liability).

Healthcare Professional: You treat patients in your clinic (general liability). A patient says you made a mistake in their care (professional liability).

IT Professional: You install new computers at a client’s office and damage their floor (general liability). Your software update makes their system crash (professional liability).

Personal Trainer: You train clients in a gym and someone trips over your equipment (general liability). A client says your fitness plan hurt them (professional liability). Personal trainer insurance combines both to keep you safe.

No matter what you do, asking “do I need general liability or professional liability (or both)?” helps you find the right business insurance. Many businesses, including those needing personal trainer insurance, do better with both. This way, you protect yourself from accidents and from claims about your work.

Choosing the Right Coverage

Decision Guide

You want to pick the best insurance for your business. First, think about what you do each day and what could go wrong. Use the checklist and examples from before to help you. Ask yourself if you worry more about accidents or about making mistakes at work.

Here are some steps you can follow:

Look at what each type of liability insurance covers.

Write down what your business does and where you work.

Think about risks like giving advice or missing a deadline.

Remember any past problems or close calls you had.

See if your contracts or leases ask for certain insurance.

Talk to an insurance agent if you are not sure.

Many businesses need both types of insurance to be safe.

Check your insurance every year as your business changes.

Tip: Do not just look at the cost. Make sure you know what your insurance covers and what it does not cover. Some people pick the cheapest plan and miss important protection.

Legal and Client Requirements

Some states have rules about liability insurance. Other states only want you to tell clients if you do not have enough insurance. Here is a quick look at what some states want:

State | Requirement Summary |

|---|---|

Idaho | Must have at least $100,000 per incident and $300,000 total. |

Oregon | Must have $300,000 per claim and $300,000 total through a state fund. |

West Virginia | PLLCs need $1 million in coverage; status is public. |

California | No set amount, but you must tell clients if you do not have coverage. |

Nebraska | Malpractice insurance required, but no set minimum. |

Clients might want to see proof of your insurance before they sign a contract. Some clients want to be added to your policy as an “additional insured.” Others want a waiver of subrogation or a notice before you cancel your insurance. Always read your contracts and talk to your agent so you meet these needs.

Cost and Bundling Options

What Affects Cost

You may wonder why insurance costs are not the same for every business. Many things can change the price you pay. Your industry is very important. For example, a restaurant pays more than a photographer. Where your business is located also changes the cost. Some states have higher prices than others.

The size of your business matters too. If you have more workers or have made claims before, you will pay more. The kind of work you do also changes the price. For example, personal trainer insurance is often cheaper than insurance for a busy restaurant.

Professional liability insurance costs also change based on your job and risk.

Bundling with GSP Insurance Group

Bundling your insurance can help you save money. It also makes things easier to manage. When you bundle, you get one bill and one company to call if you need help. Many people save 10% to 30% by bundling their insurance. This is good for personal trainers who need both general and professional liability insurance.

Here are some reasons to bundle:

You pay less for your insurance.

You only need to keep track of one account.

It is easier to handle claims.

You do not miss any important coverage.

Tip: Always check if bundling is the best choice for you. Sometimes, having separate policies is better. Ask GSP Insurance Group what works best for your business.

You want to keep your business safe and strong. Without the right coverage, you risk lawsuits, lost income, and damage to your reputation.

Out-of-pocket costs and downtime can drain your savings.

Review your risks and talk with GSP Insurance Group. Get advice that fits your needs and protect your future. Ready to feel confident? Reach out for a quote or speak with an expert today.

FAQ

What happens if I only have general liability insurance?

You are safe from accidents and property damage. But you are not covered if you make a mistake at work or give wrong advice.

Can I buy both types of insurance together?

Yes! You can get both general liability and professional liability. Buying them together can save you money. It also makes your insurance easier to handle.

Does professional liability insurance cover employee injuries?

No, it does not. You need workers’ compensation insurance for injuries to workers. Professional liability only helps with claims about your work or advice.