Imagine your family feeling sad and also needing money for a funeral. Many people try to get help from crowdfunding, but it is not always reliable. Life insurance helps your family worry less. You show you care when you include funeral plans in your money plans. Don’t Make Your Family Crowdfund Your Funeral: Why Life Insurance Matters. Get Life Quote Now.

Key Takeaways

Funerals can cost a lot of money, sometimes more than $8,000. This can make things hard for your family when they are already sad. – Asking people online for money to pay for a funeral does not always work. It can take a long time and may not raise enough money. This can make your family feel worried and owe money. – Life insurance gives your family money that is not taxed. This money can help pay for the funeral, bills, and things your family needs every day. It helps your family feel safe and less stressed about money.

Funeral Costs & Crowdfunding

The True Price of Saying Goodbye

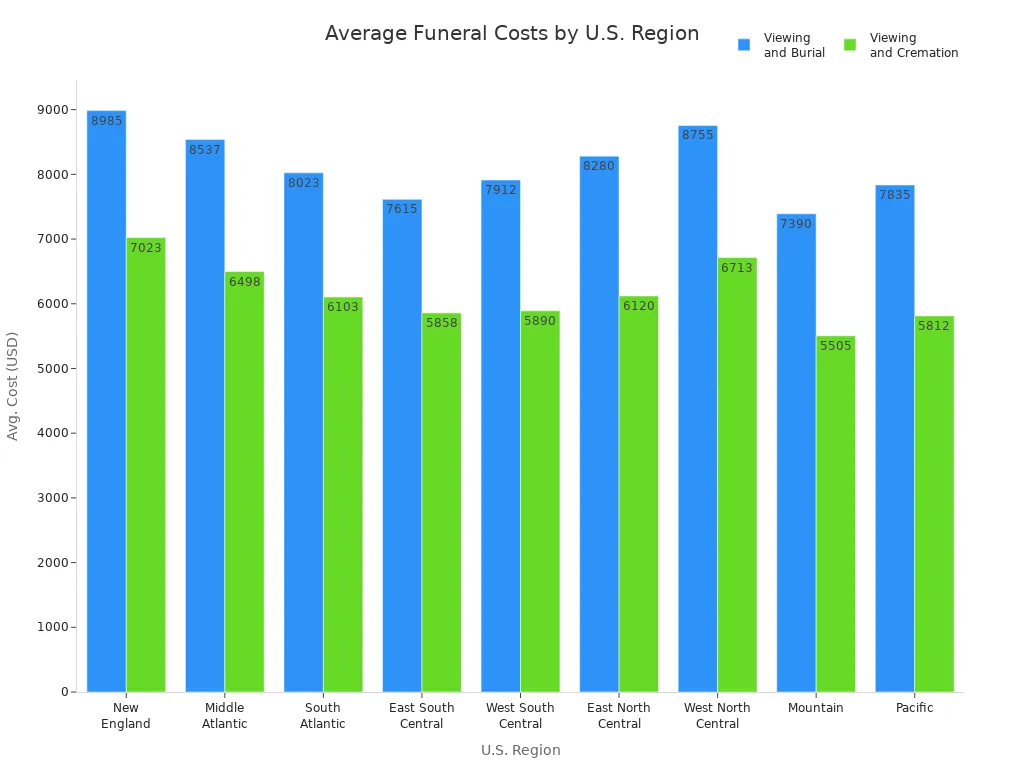

You might not realize how much funeral expenses can add up. The average cost of a funeral in the United States is now over $8,000, and it can reach $10,000 with cemetery fees. These costs include everything from the casket to the burial plot and even the flowers. Take a look at how prices vary by region:

Region | Avg. Cost of Funeral with Viewing and Burial | Avg. Cost of Funeral with Viewing and Cremation |

|---|---|---|

New England | $8,985 | $7,023 |

Middle Atlantic | $8,537 | $6,498 |

South Atlantic | $8,023 | $6,103 |

East South Central | $7,615 | $5,858 |

West South Central | $7,912 | $5,890 |

East North Central | $8,280 | $6,120 |

West North Central | $8,755 | $6,713 |

Mountain | $7,390 | $5,505 |

Pacific | $7,835 | $5,812 |

You face these expenses at a time when you least want to think about money. Funeral expenses can quickly become a heavy financial burden for your family.

Why Crowdfunding Falls Short

Many families turn to crowdfunding sites like GoFundMe for help. In fact, over 400,000 funeral requests have raised more than $1 billion. But crowdfunding is not a sure thing. You cannot predict if people will donate enough or donate in time. Sometimes, families wait weeks or months for enough support. You do not want your loved ones to worry about money while they grieve. Instead, you can protect them with life insurance. Get your Back9 Life Quote now and plan ahead.

The Emotional and Financial Toll

Asking for help online can feel embarrassing and stressful. Your family may feel exposed sharing personal stories just to cover funeral expenses. If donations fall short, they may need to use credit cards, take out loans, or even settle for less than you deserve. Without life insurance, your family could face debt and tough choices. You can spare them this pain. Show you care by planning ahead. Get your Back9 Life Quote today and give your family peace of mind.

Life Insurance: A Reliable Solution

How Life Insurance Works

Life insurance gives your family money when you die. Your loved ones get a payment called a death benefit. This money helps pay for your funeral and other bills. It also helps them keep their lives normal. Here is how it works:

Your beneficiary tells the insurance company you have died. They send in a death certificate.

The insurance company checks the claim. If everything is right, they pay in 30 to 60 days.

Your family gets the money right away. They do not have to wait for court or legal steps.

You can pick from different types of life insurance:

Term life insurance covers you for a set number of years. If you die during this time, your family gets the money.

Whole life insurance lasts your whole life. It also builds cash value as time goes on.

Final expense insurance is a kind of whole life insurance. It pays less money and is made to cover funeral costs. It is easy to get and may not need a medical exam.

Some people get both regular life insurance and final expense insurance. This covers both big needs and smaller costs like funerals. Life insurance gives your family safety and peace. Want to help your loved ones? Get your Life Quote now.

Benefits for Your Family

Life insurance does more than pay for funerals. It gives your family money and keeps them out of debt. Here are some main benefits:

Benefit Area | Explanation |

|---|---|

Debt Repayment | Life insurance pays off loans and credit cards. Your family does not get stuck with extra bills. |

Replacing Lost Income | The money replaces your income. Your family can pay for daily things and keep their life the same. |

Covering Funeral Expenses | Life insurance pays for funerals and end-of-life costs. Your family does not have to worry about these bills. |

Funding Education and Future Goals | The money can help pay for your kids’ school or other big plans. |

Estate Planning and Wealth Transfer | Life insurance helps you give assets to your family and protect their future. |

You also get these good things:

The death benefit is usually tax-free. Your family keeps all the money.

Permanent life insurance can build cash value. You can borrow from it if you need to.

Life insurance helps stay-at-home spouses by paying for child care and home costs.

Life insurance gives your family the help and safety they need. Do not let them struggle with bills or debt. Get your Life Quote today.

Myths About Life Insurance

Some people believe things about life insurance that are not true. Let’s clear up some common myths:

Myth: Life insurance costs too much.

Truth: Almost half of Americans think it costs more than it does. A healthy 30-year-old can get $250,000 in term life insurance for about $15 a month.

Myth: Employer life insurance is enough.

Truth: Employer plans often only cover one or two times your pay. They may end if you leave your job. Your own life insurance gives you better coverage.

Myth: You cannot get life insurance if you are sick.

Truth: Many companies offer plans for people with health problems. Some plans cost more or do not need a medical exam.

Myth: Only older people need life insurance.

Truth: Life insurance is important at any age. It is needed after big life changes like marriage or having kids.

Myth: The application takes too long.

Truth: Many companies now have fast online forms. They only take a few minutes.

Metric | Value |

|---|---|

Americans who overestimate term life insurance cost | |

Americans unsure about cost | 41% |

Respondents accurately estimating cost | 11% |

Actual monthly cost for healthy 30-year-old (20-year term, $250,000 coverage) |

Most people can afford life insurance. Do not let myths stop you from helping your family. Get your Back9 Life Quote now.

Getting Started with Planning

You can take easy steps to find the right life insurance. Here is how to start:

Write down your debts, mortgage, and daily costs. This shows how much your family will need.

Figure out how much money your family needs to live. Experts say you should get 10 to 15 times your yearly pay.

Look at your savings, investments, and any work life insurance. See what you already have.

Check your needs after big life events like marriage, a new baby, or a new job.

Use online tools to see how much coverage you need.

Talk to a money expert for advice.

Change your policy as your life changes.

You can also make it easier to talk about life insurance with your family:

Start with simple questions about saving and money.

Share your own stories to make it less scary.

Use games or apps to make it fun.

Keep talking about money and life insurance over time.

Ask a money expert to help with the talk.

Tip: The best time to get life insurance is now. If you are younger and healthy, your payments will be lower. Do not wait until it is too late.

You show you care when you plan ahead. Life insurance gives your family money and peace. Take action now. Get your Life Quote now and protect your loved ones.

Don’t Make Your Family Crowdfund Your Funeral: Why Life Insurance Matters

Planning Ahead Shows You Care

You want your family to remember you with love, not worry. When you plan ahead with life insurance and funeral planning, you give them comfort and security. You help them avoid delays, confusion, and legal problems like frozen bank accounts or court battles. Keeping your documents and beneficiary lists up to date makes everything easier for your loved ones. They will not have to search for papers or argue about your wishes.

Planning ahead with life insurance means your family gets help fast. They do not face extra stress during a hard time. You show real care by making funeral planning part of your financial security plan.

If you wait, your family could face missed deadlines, legal fees, or even family fights. You can avoid all this. Take action now. Get your Life Quote today.

Protecting Loved Ones from Debt

Don’t make your family crowdfund your funeral: why life insurance matters. Most Americans die with debt. Without life insurance, your family may need to pay for credit cards, medical bills, or even a mortgage. Sometimes, they must use their own money or take out loans.

Credit card balances

Medical bills

Personal loans

Mortgages and car loans

Life insurance gives your family a tax-free payment. This money covers funeral planning, debts, and daily costs. Your loved ones do not need to worry about losing their home or car. They get protection and peace of mind. Don’t make your family crowdfund your funeral: why life insurance matters. Act now to lock in lower rates and better coverage. Get your Life Quote now.

Don’t wait. Don’t make your family crowdfund your funeral: why life insurance matters. Secure their future and give them the support they deserve.

You protect your family from stress when you choose life insurance. It covers funeral costs, replaces lost income, and gives peace of mind. Start talking with your loved ones about your wishes today. Show you care—plan ahead and secure your family’s future. Get your Life Quote now.

FAQ

How much life insurance do you need?

You should aim for 10 to 15 times your yearly income. This covers funeral costs, debts, and daily needs. Get your Life Quote now.

Can you get life insurance if you have health issues?

Yes! Many plans accept people with health problems. You can still protect your family. Check your options with a Life Quote.

Does work life insurance cover enough?

Work policies often end if you leave your job. Individual life insurance stays with you. Secure your family’s future. Get your Life Quote today.