Imagine you own a busy restaurant in Bluffton or Hilton Head. One day, a past worker makes a claim you did not expect. Now you have to pay for lawyers and other costs you did not plan for. You might have to pay things like:

Lawyer fees that can go up to $250,000 if you go to court

Early deals that usually cost about $75,000

More money for the other person’s lawyer if they win

EPLI insurance South Carolina helps you handle these problems. This way, you can keep working on your business. You will find out how EPLI keeps you safe from claims you did not see coming.

Key Takeaways

EPLI insurance helps your business with sudden employee claims, like wrongful termination and discrimination. It is important to know what EPLI covers. This helps you get ready for legal problems and avoid big costs. You should check your EPLI policy often with an advisor. This makes sure it fits your business and covers new risks. Make clear workplace rules and give training to your team. This lowers the chance of claims and keeps everyone safer at work. If you get a claim, act fast to lower legal costs and handle things the right way.

EPLI Insurance South Carolina: Coverage Basics

What EPLI Covers

You want your business to be safe from surprises. epli insurance south carolina helps you with this. This insurance helps when workers say you treated them badly. Many restaurants, contractors, hotels, and offices in Bluffton, Hilton Head, Beaufort, Okatie, and Savannah use it.

Here is a simple table that shows the main claims epli insurance south carolina covers:

Claim Type | Description |

|---|---|

Wrongful Termination | Helps if workers say you fired them unfairly for different reasons. |

Discrimination | Covers claims about unfair treatment because of protected traits. |

Sexual Harassment | Helps with claims about bad behavior at work, like unwanted actions. |

Retaliation Claims | Covers claims from workers who say you punished them after they spoke up. |

If you own a restaurant, you have extra risks. Workers come and go often, and busy times can cause problems. EPLI insurance South Carolina can add special coverage for restaurants. It covers wrongful termination, discrimination, and harassment. Contractors and hotel owners also need protection, but their risks are not the same. Offices in Savannah and Beaufort often see claims about discrimination or retaliation, especially when teams get bigger fast.

Tip: If you want to see how this insurance works for your business, ask our team for a business insurance quote.

When EPLI Responds

You should know when EPLI insurance South Carolina helps you. The insurance works when you get a formal claim about work issues. Here are some common things that start a claim:

You get a letter from a worker’s lawyer.

You get a Charge of Discrimination from the EEOC.

A worker files a complaint with a state or federal office.

If any of these happen, tell your insurance company right away. EPLI insurance in South Carolina helps pay for lawyers, settlements, and other costs. Georgia businesses must follow state and federal rules, so having EPLI helps you worry less.

If you want to check your policy or learn how EPLI insurance South Carolina can help your team, ask for a business insurance quote today.

Employment Practices Liability Insurance: Unexpected Claims

You might think you do everything right at work. Still, some claims can surprise you. Employment practices liability insurance protects you from more than just the usual problems. Many business owners in Bluffton, Hilton Head, Beaufort, Okatie, and Savannah get claims they did not expect. Let’s see what surprises happen most often.

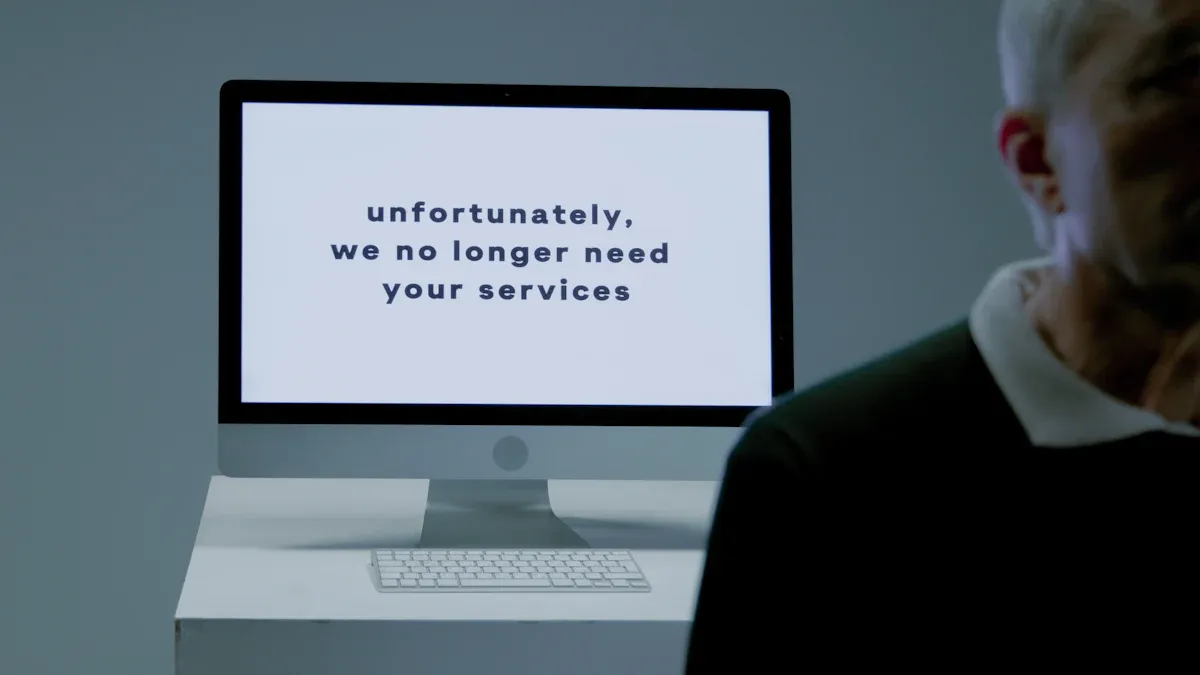

Wrongful Termination

You may believe you have a good reason to fire someone. Sometimes, a worker does not agree and files a claim. Maybe you had to let people go after a slow season in Hilton Head. The worker says you fired them because of their age or health. Even if you followed the rules, you still must defend yourself. Employment practices liability insurance helps pay for lawyers and settlements.

Note: In our area, wrongful termination claims often happen after busy seasons or when new managers start.

Discrimination & Harassment

Discrimination and harassment can happen at any job. You might not know there is a problem until someone complains. In South Carolina and Georgia, the most common claims are:

Race or color discrimination

Sexual harassment

Age discrimination

Disability discrimination

A server in Bluffton may feel left out because of their age. A contractor in Beaufort might hear unwanted comments at work. These claims often come from protected groups like gender, race, age, or disability. Harassment can be words or actions. If it makes work feel unsafe, you could be responsible—even if you did not know right away.

In Georgia, workers have 180 days to file a harassment claim with the EEOC. The process can include interviews and meetings to solve the problem. Employment practices liability insurance helps you handle these cases and keeps your business running.

Retaliation & ADA Issues

Retaliation claims happen when a worker says you punished them for speaking up. Maybe someone in your Savannah office reports unsafe work. Later, you change their schedule or job. They may think this is payback and file a claim. These cases are hard to see coming.

ADA issues are also common. The Americans with Disabilities Act protects workers with disabilities. If you do not make changes for a worker, you could get a claim. For example, a hotel in Okatie may not change a job for a worker with a back injury. Employment practices liability insurance covers these claims and helps you through the steps.

Third-Party & Emerging Risks

Not all claims come from your workers. Sometimes, a customer or vendor files a claim against your business. This is called a third-party claim. For example, a guest at a Hilton Head restaurant may say a worker harassed them. Or a delivery driver in Beaufort may claim discrimination while visiting your business.

New risks are also important. Social media posts can cause claims if someone feels hurt or embarrassed. The pandemic brought new problems, like claims about safety rules or sick leave. EPLI helps protect you as new risks show up.

Tip: Even good teams can get surprise claims. Check your employment practices liability insurance policy every year. If you want help, ask our local team for a business insurance quote.

EPLI vs. General Liability vs. Professional Liability

Key Differences

You want your business to be safe. Different insurance policies protect you in different ways. Look at this table to see what each one covers:

Insurance Type | What It Covers |

|---|---|

General Liability | Customer injuries, property damage, and advertising injuries |

Professional Liability | Mistakes in your work, missed deadlines, poor advice, and negligence claims |

Employment Practices Liability (EPLI) | Employee claims like harassment, discrimination, wrongful termination, and retaliation |

General liability helps if a customer gets hurt in your Bluffton restaurant. It also helps if you break something while working in a Savannah office. Professional liability helps when a client says your advice or work caused them money problems. Contractors and consultants in Hilton Head and Okatie often need this.

EPLI is not the same. It helps when an employee says you treated them unfairly. This includes claims about discrimination, sexual harassment, or wrongful termination. These claims can happen even if you try to do everything right.

Note: If you want to learn more about general liability and professional liability, read our guide: GL vs. professional liability explained.

Why EPLI Matters

General liability does not cover employee lawsuits. EPLI fills this gap for you. In Bluffton, Hilton Head, and Savannah, small businesses sometimes get claims they did not expect. Even a small problem can turn into a big legal fight.

EPLI pays for lawyer costs, settlements, and judgments for employee claims. Without EPLI, you might have to pay a lot of money yourself. Many local businesses add EPLI to their insurance to feel safe.

If you want to check your insurance or see if EPLI fits your business, request a business insurance quote. Our team can help you choose the best protection.

Covered vs. Not Covered

Common Misconceptions

A lot of business owners in Bluffton, Hilton Head, Beaufort, Okatie, and Savannah think their insurance protects them from every problem at work. This is not true. You should know what your policy covers and what it does not. This helps you get ready for claims from workers or other people.

Here is a table that shows what EPLI covers and what it does not:

Covered by EPLI | Not Covered by EPLI |

|---|---|

Discrimination | Wage and hour disputes |

Sexual harassment | Criminal acts |

Retaliation | Bodily injury |

Wrongful termination | Workers’ compensation |

Some third-party claims | Unemployment claims |

Tip: Talk to a local advisor and check your policy. Some policies have extra choices or limits.

You may think EPLI pays for every problem at work. It does not pay for wage and hour problems, like missed breaks or overtime. It does not cover crimes or injuries at work. You need other insurance for those things.

If you want to see what your insurance covers, ask for a review. Our team can help you find gaps and make sure you are protected. Request a business insurance quote to begin.

Graphic suggestion: Make a simple graphic with two columns. One side says “Covered” and has icons for handshake, gavel, and shield. The other side says “Not Covered” and has icons for a clock, police badge, and bandage.

Even good teams can get claims they did not expect. Knowing what your policy covers helps you plan and keep your business safe.

Local Risks for Small Employers

Small businesses in Bluffton, Hilton Head, Beaufort, Okatie, and Savannah have risks that big companies might not have. Local jobs like restaurants, contractors, hotels, and offices face special problems. These problems can cause surprise employment claims, even if you try your best to run things well.

Seasonal & High Turnover

Many businesses here need extra workers during busy times. You might hire more people for summer or holidays. This is normal for restaurants and hotels. In North Charleston, restaurants can lose up to 75% of their workers each year. Staffing shortages happen here about 12% more than in other places.

When you hire fast or get new workers often, you might notice:

Not enough time to train new workers

More chances for mistakes or confusion

Workers who do not feel part of your team

Hiring for busy seasons and losing workers fast can make employees unhappy. This can make claims about wrongful termination, discrimination, or harassment more likely. Even good teams can have these problems. To learn more, check out our restaurant risk insights.

Limited HR Resources

Small businesses usually do not have a big HR team. You might do the hiring, training, and rule-following by yourself. This makes it hard to keep up with new laws and best ways to do things.

Some common problems are:

Following all the rules from the government

Handling worker problems when you are busy

It can be hard to know new rules or fix problems between workers. Mistakes can mean fines or legal trouble. Contractors and builders here have these problems too. For a helpful list, see our contractor coverage checklist.

Tip: Check your insurance and HR rules every year. This helps you find problems before they get big. If you want help, request a business insurance quote. Our local team is ready to help you.

Protect Your Business: Next Steps

Owning a business in Bluffton, Hilton Head, Beaufort, Okatie, or Savannah brings special risks. You want your team to be safe. You also want your business to stay protected. Here are some easy things you can do now.

Policy Review

Begin by checking your EPLI policy with your insurance advisor. This helps you find problems before they happen. Use this checklist to help you:

Think about your business risks and talk with your agent.

Change your employee handbook to have clear rules for attendance and discipline.

Write down job duties for every role.

Do regular reviews and keep notes.

Use a good hiring process to pick the best people.

Make sure your job application has an equal opportunity statement and at-will clause.

Do background checks for all new workers.

Set a rule that does not allow discrimination or harassment.

Keep an open-door rule so staff can share problems safely.

Write down all worker issues and how you fix them.

Tip: Check your policy every year to stay ready for new risks. Request a business insurance quote to begin.

Incident Protocols

You need simple steps for handling problems at work. When something happens, act fast and follow your steps. This can stop claims from getting worse. Make sure you:

Answer complaints quickly.

Look into all reports fairly.

Keep notes about what happened and what you did.

Change your rules when needed.

Staff Training

Teach your team about workplace rules and how to treat others. Use easy words and real-life examples. Talk about:

Stopping harassment and discrimination

How to report problems safely

What is expected at work

Good training helps everyone know what to do.

Get a Quote

Protecting your business starts with the right insurance. Your price depends on things like claims history, number of workers, location, and type of work. Here is what insurance companies look at:

Factor | What It Means for You |

|---|---|

Claims History | Fewer claims can make your price lower. |

Number of Employees | More workers can mean higher costs. |

Business Location | Your city or town can change your rate. |

Employee Turnover | Losing workers often can raise your price. |

Industry Type | Some jobs have more risk than others. |

Ready to keep your team and business safe? Request a business insurance quote from our local experts today.

You can have risks that surprise even strong teams. It is important to check your EPLI coverage because:

Claim costs have gone up 211% since 2015.

Legal fees to stop claims can be $50,000.

Policy retentions can change your profits.

Benefit of Knowing Claims | Why It Helps You |

|---|---|

The right coverage protects you | You do not lose lots of money from surprise claims |

Knowing risks helps you get ready | You pick the best protection for your business |

Spend time looking at your policy and teach your team new rules. Be ready for claims you did not expect. Request a business insurance quote to keep your business safe.

GSP Insurance Group is proud to be your Partner for the Journey.

FAQ

What does EPLI insurance cover for my business?

EPLI helps with claims like wrongful termination, discrimination, harassment, and retaliation. It pays for lawyer costs and settlements. This protection works for restaurants, contractors, hotels, and offices in Bluffton, Hilton Head, Beaufort, Okatie, and Savannah.

Want to check your coverage? Request a business insurance quote.

Can EPLI help if a customer files a claim?

Yes, some EPLI policies cover third-party claims. If a customer or vendor says there was harassment or discrimination, your policy might help. Ask your advisor to look at your choices.

How much does EPLI cost for small businesses?

Your price depends on how many workers you have, your claims history, and your type of business. Restaurants and hotels with lots of new workers may pay more. You can get a special quote from our local team.

Request a business insurance quote for your business.

Do I need EPLI if I already have general liability insurance?

General liability does not pay for employee lawsuits. EPLI covers this gap. You need EPLI to protect against claims from your workers, like discrimination or wrongful termination.

What steps should I take if I get an employment claim?

Act quickly. Call your insurance advisor. Collect papers and follow your steps for handling problems. Answer complaints fast and be fair. EPLI helps you with costs and legal steps.

Need help with a claim? Request a business insurance quote.

See Also

Unveiling The $8,000 Secret: The Importance Of Gap Insurance