Picture this: You’re at a bustling Shelter Cove event, laughter in the air, the sun shining—until a sudden storm rolls in. Maybe you’re hosting a wedding under ancient oaks, or selling handmade goods at one of Bluffton’s lively festivals. What happens if a guest slips, or a vendor’s tent blows over? Event insurance steps in, turning chaos into calm. In the Lowcountry, it’s not just smart—it’s often required for festivals, markets, and weddings. You protect your plans, your money, and your peace of mind.

Key Takeaways

Event insurance keeps your plans safe from problems like accidents or bad weather. It helps you not lose money if something goes wrong.

Most places in the Lowcountry ask for proof of event insurance. This makes sure everyone is safe and follows local rules before your event.

Having liability and cancellation coverage helps you feel calm. It protects your guests, your money, and your event from surprises.

Weather in the Lowcountry can change fast. Event insurance helps you get ready for storms, hurricanes, and other local problems.

Getting event insurance is fast and simple. You can often get proof of coverage the same day you buy your policy.

Event Insurance Basics

What It Covers

Event insurance helps keep your event safe from surprises. If you plan a wedding, festival, or market in Hilton Head, Bluffton, or Beaufort, you want to avoid losing money if things go wrong. This insurance can help if there are accidents, injuries, or bad weather that makes you cancel or move your event.

Here are some things event insurance can help with:

General liability covers accidents or injuries at your event.

Cancellation coverage helps if you must cancel or move your event.

Rain insurance helps if storms or heavy rain cause losses.

Property damage covers if you or guests break something at the venue.

Liquor liability helps if someone gets hurt after drinking alcohol.

These protections help your event go smoothly, even if problems happen.

Coverage Type | Description |

|---|---|

Short-term General Liability | Pays for property damage or injury claims during your event. |

Cancellation Coverage | Gives money back for lost deposits or costs if you cancel or move your event. |

Property Damage Liability | Helps pay if you damage someone else’s property. |

Liquor Liability | Protects you if someone gets hurt because of alcohol. |

How It Works

You buy event insurance for a certain date and place. You pick the coverage you want, like liability or cancellation. If something happens, like a storm in Hilton Head or a guest falling at your Bluffton wedding, you file a claim. The insurance company checks your claim and pays you for covered losses. This means you do not have to pay big bills yourself.

Most venues in the Lowcountry want you to show proof of event insurance before your event. This makes everyone feel safe and ready.

Mini Takeaway

Having both liability and cancellation coverage helps you worry less. You protect your event, your money, and your guests, no matter what happens in the Lowcountry.

Why You Need Event Insurance

Local Risks

The Lowcountry has pretty places for events. But the weather can change fast. Imagine a sunny wedding at Coligny Beach. Suddenly, a storm comes in. Or a Bluffton market closes early because of a hurricane warning. These things happen more than you think.

Here are some big risks when you plan festivals or gatherings in Hilton Head and Bluffton:

Risk Type | Description |

|---|---|

Hurricanes | Coastal storms can force last-minute changes or cancellations. |

Tornadoes | Quick, severe storms can pop up with little warning. |

Earthquakes | Rare, but still part of local emergency plans. |

Tsunamis | Unlikely, but included in safety planning for coastal events. |

Winter Storms | Sometimes, cold snaps or ice can disrupt outdoor plans. |

Evacuations | Past hurricanes have led to full-area evacuations, like during Matthew. |

You want your event to go well. But you also need a backup plan. Event insurance helps you deal with these risks. You do not have to lose your money if something goes wrong.

Venue & Vendor Rules

Most venues and vendors in the Lowcountry have strict rules. Over 80% of wedding and event venues in Hilton Head want you to get your own insurance. They ask for proof before you set up your booth or walk down the aisle.

Here’s what you usually need:

General liability coverage for property damage or injuries.

Cancellation coverage if your event gets postponed or a vendor cancels.

Host liquor liability if you serve alcohol.

If you skip these steps, you might not get to hold your event. Even small markets or pop-up festivals often want these protections.

Tip: Always check with your venue and vendors early. Ask what insurance they need so you can plan ahead.

Mini Takeaway

The Lowcountry is beautiful, but it has special risks. Event insurance helps you feel safe, follow the rules, and protect your plans—no matter what happens with the weather or venue.

Who Needs Event Insurance

Weddings & Rehearsals

Weddings in Hilton Head, Bluffton, and Beaufort are special. You spend a lot of time planning your wedding. You pick the best place and choose good wedding professionals. But sometimes, things do not go as planned. A storm can come fast. A guest might get hurt. A vendor could make a mistake. These problems can ruin your big day. Wedding insurance helps you feel calm. It pays for accidents, cancellations, and problems with wedding professionals. Many venues and wedding vendors want to see your wedding insurance before your ceremony or rehearsal. If you want your wedding to go well, put event insurance on your list.

Markets & Vendors

Pop-up markets and vendor booths make Bluffton and Hilton Head lively. If you sell things or run a booth, you have some risks. Someone could get hurt at your booth. Your tent might blow over. Market vendor insurance Bluffton helps if these things happen. Many markets want to see your event insurance before you set up. This insurance lets you focus on your business, not on worries.

Festivals & Nonprofits

Festivals bring people together in the Lowcountry. If you plan a food festival, concert, or fundraiser, you must think about safety. Event insurance pays for injuries, property damage, and cancellations. Nonprofits that host events need this protection too. You want your festival to be fun, not full of stress. Event insurance helps you handle surprises.

Private Parties

You might plan a birthday, graduation, or reunion at home or a rented place. Homeowners insurance usually does not cover event risks. It often does not pay for alcohol problems, big groups, or damage when you rent your home. Many states have social host liability laws. If a guest drinks too much and causes harm, you could be blamed. For private parties, think about event liability insurance and host liquor liability. If you host at home, know what is covered and what is not.

Here are some events in the Lowcountry that often need event insurance:

Weddings and rehearsals

Company cookouts and holiday parties

Business conferences and trade shows

Concerts and speaking events

Book signings

Birthdays, graduations, and reunions

Religious celebrations

Mini Takeaway

If you bring people together, spend money, or serve alcohol, you should get event insurance. It keeps your wedding, market, or festival safe. Then you can enjoy making memories.

Event Insurance Coverage Options

If you plan a festival, wedding, or market in the Lowcountry, you need to know what your event insurance covers. Let’s look at the main choices so you can pick what works best for your event.

Liability Protection

Liability protection is very important for event insurance. It helps if someone gets hurt or something gets broken at your event. If a guest trips on a tent stake, or a vendor’s booth scratches the floor, this coverage helps pay for it.

Here’s what liability protection usually covers:

Coverage Type | Details |

|---|---|

General Liability Coverage | Pays up to $2,000,000 for injuries or damage at your event. |

Legal Defense | Pays for a lawyer if someone sues you after an accident. |

Venue Damage Coverage | Pays for repairs if you break something at the venue. |

Additional Insured Certificates | Lets you add venues or vendors to your policy for free. |

Liquor Liability | Optional coverage for events with alcohol. |

You should ask your venue what they need. Many places in Hilton Head and Bluffton want you to have $1 million in liability coverage before you can book.

Property & Equipment

Your event might use rented gear, decorations, or special equipment. Property and equipment coverage protects these things if they get lost, stolen, or broken.

Here’s what you can cover:

Type of Property/Equipment | Description |

|---|---|

Event Equipment | Sound systems, lights, and stages. |

Decorations | Flowers, banners, and other decorations. |

Rented Gear | Anything you rent for your event, like tents. |

You can also add coverage for fine art, drones, or special booths. If you run a festival with many vendors, this coverage keeps your stuff safe.

Cancellation & Postponement

Sometimes you have to cancel or move your event. Maybe a hurricane comes, or a vendor cancels at the last minute. Cancellation and postponement coverage helps you get back money you already paid.

Protects your budget if weather, sickness, or emergencies mess up your plans.

Pays for lost deposits for venues, food, or entertainment.

Helps if a vendor does not show up, so you do not lose money.

This coverage is very important for outdoor festivals and weddings in the Lowcountry, where weather can change fast.

Liquor Liability

If you serve alcohol, you need liquor liability coverage. This helps if a guest drinks too much and causes harm or breaks something.

Pays for claims about alcohol service.

Most venues want this if you serve beer, wine, or cocktails.

Helps you follow South Carolina laws and venue rules.

Liquor liability helps you feel safe, especially at weddings and festivals with drinks.

Certificates of Insurance

Venues and vendors often want a certificate of insurance (COI) before your event. This paper shows you have the right coverage.

Shows your coverage limits and dates.

Lets you add venues or vendors as “additional insured” for free.

Needed for most event contracts in Hilton Head, Bluffton, and Beaufort.

You can usually get a COI the same day you buy your policy. This makes planning easier and keeps everyone happy.

💡 Tip: Want to save money on event insurance or other coverage? Check out these ways locals save on related coverage.

Mini Takeaway

Good event insurance helps you feel confident. You protect your guests, your stuff, and your money. You keep your event running well, even if something unexpected happens at a festival or wedding in the Lowcountry.

Coastal Weather & Local Factors

Weather Risks

Living in the Lowcountry is nice because of the views and ocean air. But there are also big weather problems you need to think about. Coastal South Carolina can have sudden storms, heavy rain, and flooding. If you want to have an outdoor event, you should plan for bad weather.

Here are the main weather problems for events in Hilton Head, Bluffton, and Beaufort:

Weather Risk | Description |

|---|---|

Flooding | Storm surge and high tides can make water rise fast, especially in low places. |

Drought | Long dry times can hurt water supply and outdoor fun. |

Severe Storms | Strong winds and heavy rain can break tents and equipment. |

The land near the coast is low, so water can rise quickly.

South Carolina is the 4th most at risk for coastal flooding.

Heavy rain can cause runoff and hurt local seafood.

Want to know more about how weather affects events? Check out these coastal weather and flood facts.

Seasonality

The time of year is important when you plan an event here. Hurricane season is from June to November. You need an emergency plan during these months. Hilton Head Island is in evacuation zone ‘A’, so it gets orders to leave first if a storm comes.

Always know your way out if you need to leave.

Keep emergency phone numbers close.

The Chamber of Commerce watches visitor numbers during hurricane season to help keep people safe.

Seasonality means more than just storms. Summer can be very hot, which makes outdoor events hard. Sometimes winter brings cold weather that surprises people.

Local Regulations

You must follow local rules when you plan an event. Hilton Head, Bluffton, and Beaufort have special rules to keep people safe.

Most hotels and venues want to see proof of liability insurance.

Even if you do not serve alcohol, you might need liquor liability because of social host laws.

If your event is on business property, you need a special event permit.

Outdoor events with more than 250 people always need a permit.

You must turn in your permit application at least 30 days before your event.

Vendors need a local business license.

For each event, you must give a site plan with tent and stage sizes.

If you have a party at home, you may not need a permit. But you still need to think about safety and insurance.

Mini Takeaway

Coastal weather can change your plans very fast. Local rules help keep everyone safe, but you need to get ready early. Event insurance helps protect your event from surprises, no matter the weather.

Event Insurance Costs

Typical Ranges

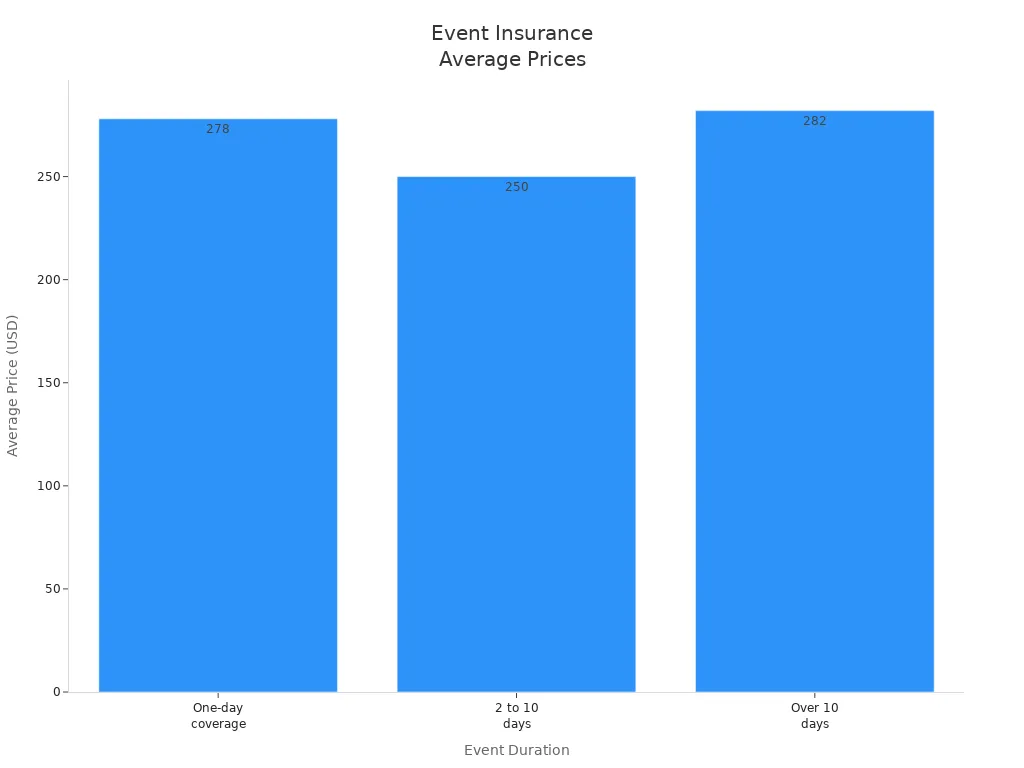

You might want to know how much event insurance costs in Hilton Head, Bluffton, or Beaufort. Most short-term policies cost from $75 to $350 for one day. The price changes based on your event’s size and what you need. Here is a quick look at local prices:

Coverage Type | Starting Price | Minimum DRP |

|---|---|---|

$1M/$2M (occurrence/aggregate) | $75 | $250,000 |

$1M/$2M (occurrence/aggregate) | $160 | $300,000 |

Average for one-day coverage | $278 | N/A |

Average for 2 to 10 days | $250 | N/A |

Average for events over 10 days | $282 | N/A |

What Affects Price

Many things can change the cost of your event insurance. Here are the main things that matter:

Type of event: Concerts or festivals usually cost more than small meetings.

Event duration: Longer events cost more money.

Number of attendees: More guests mean higher risk and higher price.

Venue and location: Outdoor events in the Lowcountry have more weather risks.

Coverage types and limits: Adding cancellation or liquor liability makes it cost more.

Alcohol service: Serving drinks means you need extra protection.

Comparing Costs to Risks

Paying $75 to $350 for event insurance may seem like a lot, but it can save you thousands. If a storm ruins your tent or a guest gets hurt, you could owe a lot of money. Small events can get basic coverage for a low price. Big festivals or weddings with many guests cost more, but the protection is worth it. Many venues now want to see proof of insurance before your event. Without it, you could lose your deposit or pay for damages yourself.

💡 Think of event insurance as a safety net. It helps keep your plans safe and protects your money if something bad happens.

Mini Takeaway

Spending a little on event insurance can save you from big problems. You get peace of mind and follow local rules, so you can enjoy your Lowcountry event.

Get Covered Fast

What You Need

You want to get event insurance quickly. You should have some details ready before you start. Here is what you need:

Required Information | Description |

|---|---|

Event Type | What kind of event? (wedding, festival, market, etc.) |

Event Duration | How many days will it last? (1-10 days) |

Location | Where is your event? (venue name and address) |

Number of Attendees | How many people do you expect? |

Coverage Needs | What do you want covered? (liability, cancellation, etc.) |

You might also want to know if you need coverage for things like injuries or damage. Some policies protect you for up to $2 million. If you buy more than one policy together, you can save up to 15%.

Tip: The more information you have, the faster you get a quote.

Same-Day Certificates

You do not have to wait long for proof of event insurance. Most companies in Hilton Head and Bluffton send you a certificate the same day you buy your policy. This paper shows your venue or vendors that you have coverage. It lists your coverage limits and event dates. Many venues want to see this before you set up or start your event.

Need coverage fast?

Get a fast event quote for your Lowcountry gathering.

Add Additional Insureds

Venues often want to be added as “additional insureds” on your policy. This means your event insurance protects them too if something happens. You can usually add a venue or vendor for free when you buy your policy. Just tell your agent who needs to be listed. Always check with your insurance agent to make sure everyone is covered for your event.

You can add the venue or its owner as an additional insured.

Ask your agent if you have questions about coverage for your event.

Planning a festival, wedding, or market?

Get your event covered today—quotes are quick and easy.

Mini Takeaway

You can get event insurance in the Lowcountry fast and easy. Local experts help you get the right coverage, same-day certificates, and all the papers your venue needs. You spend less time worrying and more time enjoying your event.

North Carolina Event Insurance vs. South Carolina

Regional Differences

When you plan an event in the Carolinas, you will see some rule changes. North Carolina event insurance covers the basics like liability, property, and cancellation. You can get this insurance for weddings, markets, and festivals. Most venues want to see proof of insurance, and the rules are usually the same everywhere in the state. South Carolina, especially the Lowcountry, has more rules. The weather there brings extra risks like hurricanes and flooding. This makes insurance even more important. Some venues in Hilton Head and Bluffton might want higher coverage amounts. You may also need liquor liability coverage if you serve alcohol at your event.

Local Requirements

The Lowcountry is different because it has strict liquor liability laws. In 2017, South Carolina made a law for bars, restaurants, and venues with liquor licenses. They must have at least $1 million in liquor liability insurance. This rule affects many event spaces and vendors in Hilton Head, Bluffton, and Beaufort. Here is what makes the Lowcountry special:

Venues with liquor licenses must have $1 million in liquor liability coverage.

This law can make insurance cost more for local businesses and event hosts.

Many venues will not let you book without proof of this coverage.

Local business owners keep asking lawmakers to look at these rules again.

If you want to serve alcohol at your event, check these rules early. You do not want any surprises at the last minute.

Mini Takeaway

Each state has its own event insurance rules, but the Lowcountry’s are some of the strictest. Always check local laws and venue needs before you buy insurance. The right coverage keeps your event safe and helps you worry less, no matter which state you choose.

You want your weddings, markets, and festivals in the Lowcountry to go off without a hitch. Event insurance gives you peace of mind, covers surprises, and keeps you in line with local rules. Add it to your event checklist so you can focus on celebrating. Ready to protect your big day? Talk to a local expert or get a fast quote today!

FAQ

What types of events need insurance in Hilton Head or Bluffton?

You should get event insurance for weddings, festivals, markets, fundraisers, and private parties. Most places in the Lowcountry want you to show proof before your event starts.

Can I get event insurance if my event is outdoors?

Yes! You can buy insurance for outdoor events. It helps protect you from weather, accidents, and damage. Many venues ask for insurance, especially for outdoor events.

How fast can I get proof of insurance?

You can get a certificate the same day you buy your policy. Have your event details ready. Most venues want this paper before you set up.

Does event insurance cover bad weather or cancellations?

Event cancellation insurance helps if storms or emergencies make you cancel or move your event. You can get back deposits and some costs if you add this coverage.

Who do I contact if I have questions about my event insurance?

Talk to a local agent who knows Hilton Head, Bluffton, and Beaufort.

Get a fast event quote or ask a local expert.