You’re sitting at your kitchen table in Bluffton, reviewing your renewal papers. You notice that your home or auto premium has changed again. In South Carolina, insurers consider more than just your driving record or the age of your roof. They also look at a credit-based insurance score, which is different from your regular credit score. Both scores can influence your credit score insurance rates. Typically, individuals with good credit pay less for insurance, while those with average or poor credit may face higher premiums. The state categorizes credit scores into “good,” “average,” or “bad” groups to determine rates.

Mini-takeaway: Your credit score isn’t just for loans; it can significantly impact your insurance costs. Explore simple tips and CTAs to help you save.

Key Takeaways

Your credit score changes your insurance rates. Good credit can help you pay less for home and auto insurance.

Credit-based insurance scores are not the same as regular credit scores. Insurance companies use them to see risk and guess if you will make claims.

Paying bills on time helps your credit-based insurance score. Using less credit can also help. This may make your insurance cost less.

Local things like crime and natural disasters can change insurance prices. Knowing about these can help you control your costs.

Check your credit report often for mistakes. Fixing errors can make your credit score better and lower your insurance costs.

Credit Score vs. Credit-Based Insurance Score

What Is a Credit Score?

Your credit score helps you get loans or credit cards. This number tells lenders if you pay bills on time. Most scores go from 300 to 850. If you pay late or owe a lot, your score drops. If you pay on time and owe less, your score rises. You can check your score online or at your bank.

What Is a Credit-Based Insurance Score?

A credit-based insurance score is not the same. Insurers use it to guess if you might file a claim. It uses some of the same info as your credit score. But it looks at insurance risk, not just money habits. LexisNexis uses a range from 200 to 997. You usually cannot see this score on your credit report. You may need to ask your insurance agent for details.

Here’s a quick look at the differences:

Aspect | Credit Score | Credit-Based Insurance Score |

|---|---|---|

Purpose | Shows if you might miss a bill payment | Shows if you might file claims that cause loss |

Score Range | Usually from 300 to 850 | Can be 200 to 997 for LexisNexis Attract score |

Usage by Insurers | Can deny you based on your score | Cannot deny you just because of this score |

Accessibility | Easy to check with credit reports | Harder to get; you may need to ask your agent |

Want to learn more? Check out Insurance Score 101 for more details.

Factors Insurers Consider

Insurers in South Carolina look at many things to set your rates. They use your credit-based insurance score to see how risky you are. Here are the main things they check:

Outstanding debt: How much you owe right now.

Bankruptcies: If you have ever filed for bankruptcy.

Length of credit history: How long you have had credit.

Collections: If you have missed payments sent to collections.

New applications for credit: If you have asked for new credit lately.

Number of credit accounts in use: How many accounts you use now.

Timeliness of debt repayment: If you pay bills on time.

South Carolina lets insurers use these scores for rates. Some states, like California or Massachusetts, do not allow this. If you have good credit, you may pay less. If your credit is bad, you may pay more.

Mini-takeaway: Your credit-based insurance score is about risk, not just money. In Bluffton and Hilton Head, good credit can help you save on insurance.

Credit Score Insurance Rates: How It Works

Auto Insurance Impact

Your credit-based insurance score is important for auto coverage costs in South Carolina. Insurers use this score to guess if you might file a claim. If your score is high, you usually pay less. If your score goes down, your rates can go up a lot.

Let’s see how credit score insurance rates change for auto policies:

Credit Score Level | Average Premium |

|---|---|

Excellent | $1,300 |

Good | $1,520 |

Poor | $3,339 |

Drivers with poor credit can pay more than twice as much as those with excellent credit. This happens because insurers think lower scores mean more risk. They believe drivers with low scores will file more claims.

South Carolina makes all drivers have at least 25/50/25 liability coverage. This is the starting point for everyone. Your credit score can make your price go up or down from there. Even if you drive safely, your credit score insurance rates can rise if your score drops.

Tip: Want to see how your credit changes your auto rates in Bluffton? Check out How Much Does Auto Insurance Cost in Bluffton?

Home Insurance Impact

Your credit-based insurance score also changes your homeowners’ premiums. Insurers use this score to decide how risky you are as a policyholder. If your score is strong, you can get better rates. If your score is average or poor, you may pay more, even if you never filed a claim.

In the Lowcountry, things like roof age, hurricane risk, and claims history matter too. Still, credit score insurance rates can change your price a lot. For example, two homes on the same street in Hilton Head could have very different premiums if the owners have different credit scores.

Bundling homes and auto policies can sometimes help lower your rates. Some lenders want you to escrow your homeowners’ premiums. If your credit changes, your monthly mortgage payment can change too.

If you want to learn more about local home insurance, visit Home Insurance Bluffton SC: 2025 Buyer’s Guide.

Other Rating Factors

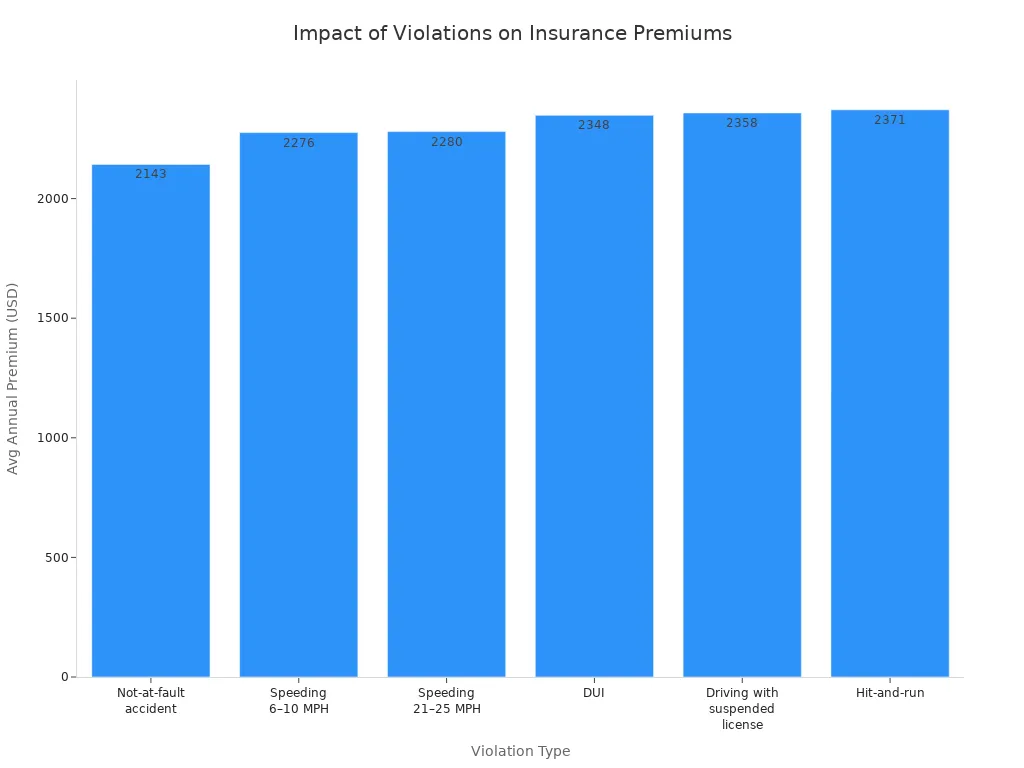

Credit scoring matters, but it is not the only thing that sets your insurance rates. Insurers look at other things to decide your premiums. For auto insurance, your driving record is very important. Even a small speeding ticket can make your rates go up.

Here’s how different violations can change your yearly premium in South Carolina:

Violation | Average Annual Premium After Violation | Percent Increase Over Clean Record |

|---|---|---|

Not-at-fault accident | $2,143 | +6% |

Speeding ticket (6–10 MPH over limit) | $2,276 | +13% |

Speeding ticket (21–25 MPH over limit) | $2,280 | +14% |

DUI | $2,348 | +21% |

Driving with suspended license | $2,358 | +22% |

Hit-and-run | $2,371 | +23% |

For homeowners’ insurance, things like roof age, claims history, and even local laws can change your price. In places like Charleston, lots of lawsuits can make premiums go up for everyone.

Mini-takeaway: Your credit-based insurance score is a big part of your price, but it is not the only thing. Safe driving, taking care of your home, and bundling can all help you manage your insurance rates.

South Carolina & Lowcountry Realities

Local Risk Factors

If you live in Bluffton or Hilton Head, insurance can be tricky. Your address can change your insurance price. Insurers check crime, traffic, and how close you are to the ocean. Hurricanes and storms often hit the Lowcountry. Strong winds, flooding, and heavy rain can hurt homes and cars. These dangers make insurance cost more for everyone.

Here’s a quick look at the most common local risk factors:

Factor | Description |

|---|---|

Location | Areas with more accidents or higher theft rates usually pay more for insurance. |

Driving History | Bad driving records can make your rates go up, no matter where you live. |

Vehicle Type | Some cars cost more to insure because of safety or theft. |

Local Crime Rates | If your neighborhood has more crime, insurance costs can rise. |

Address | Insurers look at crime and traffic near your home to set your price. |

Natural Disasters | Places with hurricanes or storms often have higher insurance costs. |

Every hurricane season, these risks show up. Homes on Hilton Head Island can get damaged by wind or water. Insurance companies raise prices after big storms. This makes it harder for everyone, not just people who file claims. Want to know how these risks change your auto rates? Check out How Much Does Auto Insurance Cost in Bluffton?.

Mini-takeaway: Where you live in the Lowcountry matters. Hurricanes, crime, and traffic all play a part in your insurance price.

Why Good Credit Matters

Good credit can help keep your insurance price steady, even when local risks go up. Insurers use your credit-based insurance score to guess if you might file a claim. In South Carolina, people file more claims than in nearby states. The average claim costs more each year. When storms hit, everyone’s insurance price can go up, even if you do not file a claim.

You can see this in Bluffton and Hilton Head. After a hurricane, prices rise for all homeowners. If you have good credit, your price may not go up as much. Good credit tells insurers you handle risk well. This can help you get better prices, even when things get tough.

Here’s what happens when storms and claims hit the Lowcountry:

Home insurance prices go up after hurricanes and storms.

Homes near the ocean face more risk from wind and water.

Fewer companies offer insurance, and prices get higher.

South Carolina has more claims than other states, so costs rise.

Want tips to keep your home insurance price low? Visit Home Insurance Bluffton SC: 2025 Buyer’s Guide. Wonder why your price went up even with no claim? See Why Your Insurance Increased (No Claims).

Mini-takeaway: Good credit helps you save money. It can keep your insurance price lower in Bluffton and Hilton Head, even when storms and claims make things harder.

Improve Your Credit-Based Insurance Score

If you make your credit-based insurance score better, you can save money. You might get lower prices on your insurance policy. There are easy things you can do in Bluffton or Hilton Head.

Payment History

Your payment history is very important. Insurance companies check how you pay bills. If you pay on time, they think you are responsible. This can help lower your insurance premium.

Pay each bill before it is due.

Use automatic payments so you do not forget.

Even one late payment can make your insurance cost more.

Tip: If you always pay bills on time, you look safe to insurance companies. This can help you get lower prices.

Credit Utilization

Credit utilization means how much credit you use. Insurance companies look at this when they check your credit. Using less credit is better for your insurance policy.

Utilization Level | Impact on Credit Score |

|---|---|

0-10% | Excellent |

11-30% | Good |

31-50% | Okay |

Above 50% | High risk |

Try to use less than 30% of your credit. If you can, use under 10%. This helps when insurance companies check your credit for your policy.

Disputing Errors

Mistakes on your credit report can hurt your score. You can fix these mistakes. Here is what you should do:

Get free credit reports from Equifax, Experian, and TransUnion.

Write down any mistakes you see.

Send a letter to the credit bureau with proof, like receipts or ID.

The bureau must check and answer you in 30 days.

The Fair Credit Reporting Act protects you. If you find mistakes, fix them fast. Fixing errors can help your credit-based insurance score.

Insurance-Specific Tips

You can do other things to help your insurance in the Lowcountry:

Do not open lots of new credit accounts at once.

Try not to file small claims on your insurance policy.

Bundle home and auto insurance to get discounts. See Top 5 Discounts Bluffton Residents Miss.

Check your credit and insurance file every year.

Ask your insurance company to check your score again after you improve it. Many will lower your insurance premium if your score goes up.

Keep your roof and home in good shape. This helps your credit and your insurance rates. For more tips, visit Home Insurance Bluffton SC: 2025 Buyer’s Guide.

Mini-takeaway: Small things—like paying bills on time and using less credit—can help lower your insurance premium.

Want to see your options? Get a custom quote from GSP Insurance Group.

Request a Quote → https://www.gspins.com/quotes/

You can control your insurance credit score in many ways. This helps you manage what you pay for insurance. Your insurance credit score is important when companies decide your price. You can also save money by driving safely. Making smart upgrades to your home helps too. Insurance companies check your insurance credit score. They also look at how you drive and how safe your home is. Each thing can help you save money:

Factor | Impact on Insurance Costs |

|---|---|

Good Credit | Higher credit scores may qualify for lower premiums. |

Safe Driving | Can lead to discounts on premiums. |

Home Upgrades | Safety features can result in further savings on premiums. |

Insurance companies might raise your rates for different reasons. This can happen even if you did not file a claim. Some reasons are natural disasters, higher building costs, or changes in your insurance credit score. Here are some common reasons:

Reason for Rate Increase | Description |

|---|---|

Major losses from natural disasters | Increased payouts from natural disasters lead to higher premiums the following year. |

Increase in construction costs | Rising costs of materials and inflation increase the replacement value of homes, raising premiums. |

Home structure needs work | Inspections revealing necessary repairs can lead to premium increases due to higher claim likelihood. |

Risky additions to the property | Features like pools and trampolines increase injury risk, prompting higher premiums. |

Decline in credit score | A significant drop in credit score may indicate payment risk, leading to increased premiums. |

Decline in insurance score | A lower insurance score, which considers credit and claim history, results in higher premiums. |

Insurance companies want you to know about your insurance credit score. Local agents can help explain how your score affects your price. They show you how to check your credit. They remind you that many things change your insurance price.

You can do things to help yourself. Keep your insurance credit score high. Drive safely and make your home safer. Insurance companies give rewards for these steps. If you need help, GSP Insurance Group can check your insurance credit score. They can show you ways to lower your price.

Want a quick review of your coverage? We can tell you what makes your price go up. We can help you find ways to lower it. Start Your Review → https://www.gspins.com/quotes/

FAQ

How does my credit-based insurance score affect my insurance rates in Bluffton?

Your credit-based insurance score shows how risky you are to insurers. If your score is high, you often pay less for home or auto insurance. In Bluffton, a good score can really help, especially after storms or claims.

Tip: If your credit history gets better, ask your agent to check your score.

Can I see my credit-based insurance score?

You cannot find your credit-based insurance score on a normal credit report. You have to ask your insurance agent to get this information. Some companies will tell you your score if you ask them.

Note: Your credit history changes this score, but it is not the same as your loan score.

What factors go into my credit-based insurance score?

Insurers look at if you pay bills on time, how much debt you have, and how long you have had credit. They also check for bankruptcies and new credit accounts. Your credit history is very important.

Payment history

Debt amount

Length of credit history

New credit accounts

Do credit checks related to insurance hurt my credit score?

No, credit checks for insurance are called “soft” inquiries. These do not make your credit score go down. Insurers use these checks to figure out your credit-based insurance score, not to give you a loan.

Mini-takeaway: You can look for insurance without your credit score dropping.

Can improving my credit-based insurance score lower my premiums?

Yes! If you pay your bills on time and use less credit, your credit-based insurance score can get higher. Many insurers will lower your premium if your score goes up.

Want to see your choices? Request a Quote from GSP Insurance Group.