You live in Bluffton or Hilton Head. You might wonder, “How Much Does Auto Insurance Cost in Bluffton SC?” Car insurance here usually costs between $1,250 and $1,650 each year. This is a little more than the South Carolina average. It is less than what many people pay in other states. Your auto insurance bill depends on more than your driving. It also looks at coastal risks and hurricane dangers. The area has lots of golf carts and tourists. These things affect your price too. The numbers come from the South Carolina Insurance Department and local market averages. We are licensed independent agents. We help you compare car insurance choices from different companies.

Key Takeaways

Auto insurance in Bluffton costs from $1,250 to $1,650 each year. This is more than the average in South Carolina. But it is less than in many other states.

Things like your driving record and age can change your rates. Local risks like hurricanes and tourist traffic also matter a lot.

Picking higher coverage limits is smart. State minimums might not pay for everything after an accident. This helps protect your savings.

You can save money by bundling your policies. You can also raise your deductibles. Ask about discounts for safe driving or good grades.

A local insurance agent gives you advice that fits you. They help you get the best coverage for what you need.

How Much Does Auto Insurance Cost in Bluffton SC?

Average Car Insurance Cost in Bluffton and Hilton Head

Car insurance costs vary depending on where you live, your driving record, and your vehicle. In Bluffton and Hilton Head, liability-only insurance typically falls between $150–$175 per month, while higher liability with comprehensive and collision coverage usually ranges from $185–$225 per month.

Hilton Head drivers tend to see slightly lower premiums compared to Bluffton, but both areas are above the South Carolina state average due to local factors like coastal risks, golf carts on the road, and seasonal traffic.

Here’s a simple chart showing estimated monthly car insurance costs for both cities:

City | Average Monthly Liability-Only Quote | Average Monthly Full-Coverage Quote |

|---|---|---|

Hilton Head Island | $145-$165 | $180-$200 |

Bluffton | $160-$175 | $195-$225 |

These are average ranges. Your exact premium will vary depending on your age, driving history, vehicle, and chosen coverage limits.

Car insurance prices have gone up in South Carolina. The average yearly price for full coverage went up by over 29% from 2023 to 2024. You might see your bill is higher than last year. This is happening all across the country.

Tip: Want to know your own rate? You can compare quotes with a local agent who understands Bluffton and Hilton Head.

Bluffton vs. South Carolina and National Averages

How much does auto insurance cost in Bluffton SC? Bluffton’s prices are higher than the South Carolina average. They are still lower than what many people pay in other states. The average cost for full coverage in South Carolina is about $1,650 per year. Bluffton’s yearly price is closer to $2,532. Hilton Head is a little lower.

Why are insurance prices in Bluffton higher? Bluffton is close to the coast. Hurricanes and flooding are real risks here. Repairs cost more because shops charge extra in tourist areas. Golf carts are everywhere, and sometimes they crash into cars. Tourists bring more traffic, which means more claims.

Here are some things to remember:

Bluffton’s average price is shaped by local risks.

Hilton Head is a bit cheaper, but still above the state average.

National prices are even higher, so you’re not paying the most.

Mini Takeaway: Your car insurance bill in Bluffton shows coastal living, busy roads, and local repair costs.

Local Minimum Liability Limits vs. the True Cost of an Accident

South Carolina requires a minimum level of liability coverage, but those limits are often far too low compared to the real costs of accidents in Bluffton and Hilton Head. Here’s a look at how coverage levels compare:

Coverage Type | Estimated Annual Range | Estimated Monthly Range |

|---|---|---|

State Minimum Liability (25/50/25 BI/PD) | $400-$600 | $35-$50 |

Higher Liability Only (50/100/50 BI/PD) | $500-$750 | $40-$65 |

Higher Liability + Comp/Collision | $1,500-$2,200 | $125-$185 |

The average cost of an accident in Bluffton can be much higher than the minimum coverage. Medical bills and repairs often go past the state minimum. If you drive a family car or have a golf cart, you should think about real risks. You want enough coverage to protect your money.

Note: The minimum coverage keeps you legal, but it may not pay for everything after a big accident.

Want to see how much does auto insurance cost in Bluffton SC for you?

Find out more about car insurance choices for Bluffton drivers.

Request a Quote:

Compare your car insurance prices with a Bluffton expert today.

Factors That Affect Auto Insurance Rates

Driving Record and Age

Your driving record is very important for your insurance premiums. If you have no tickets or accidents, you pay less. If you get a ticket or crash, your price goes up. Age also matters a lot. Young drivers like Jeffrey pay more for insurance. Insurance companies think young people take more risks. Older drivers like Richard and Susan can pay less if they drive safely.

Vehicle Type and Coverage

The car you drive changes your insurance premiums. New SUVs or cars with special safety features cost more to fix. Jordan drives a family SUV, so he might pay more than someone with an old sedan. The coverage you pick also changes your price. Full coverage costs more than liability-only. If you add extras like roadside help, your insurance premiums go up.

Location and Local Risks (flood zones, golf carts, tourism traffic)

Where you live in Bluffton or Hilton Head changes your insurance rates. Living near a flood zone or busy tourist area can make your price higher. Golf carts are everywhere here. Sometimes they crash into cars. More tourists mean more cars and more claims. If you live in a quiet place, you might pay less.

Tip: Check if your home is in a flood zone. This can change your insurance premiums even if you drive well.

Coastal Exposure (hurricanes and storm damage claims)

Bluffton and Hilton Head are close to the coast. Hurricanes and storms are real dangers here. Insurance companies look at these risks when setting your insurance premiums. If your area has lots of storm damage, your price may be higher. Richard and Susan live near the water, so they might pay more after a big storm.

Mini Takeaway: Your insurance premiums depend on many things. Your driving, your car, and where you live all matter. Local risks and your choices both change your price. Knowing what affects car insurance rates helps you make smart choices.

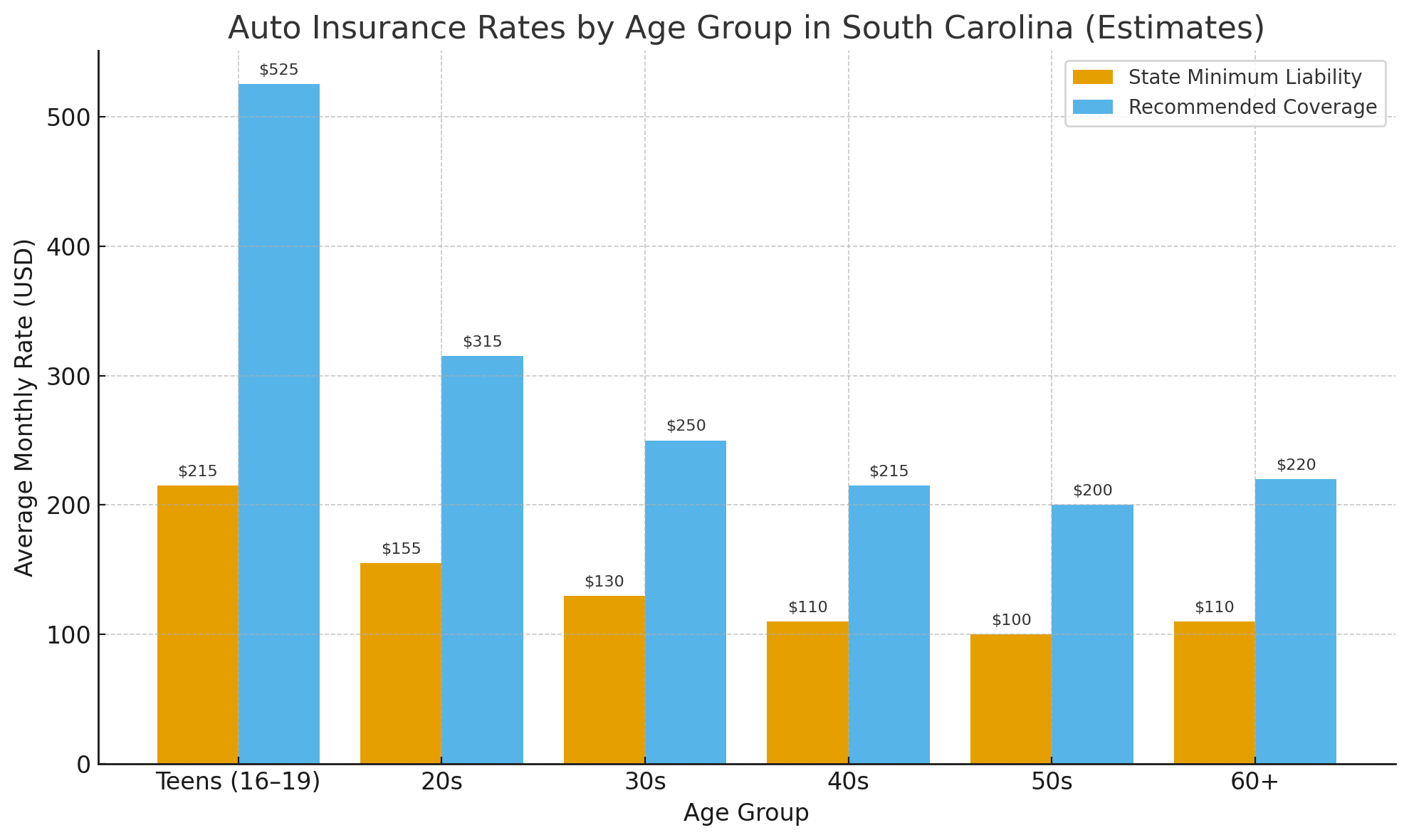

Sample Rates and Savings Tips

Sample Rates by Driver Profile

You might want to know what car insurance costs for people like you in Bluffton. The price changes if you are older or younger. It also changes if you have tickets or accidents. Here is a chart that shows average monthly rates for different ages:

Age Group | State Minimum Liability | Recommended Coverage |

|---|---|---|

Teens (16-19) | $120-$250/mo | $400-$700+/mo |

20s | $80-$140/mo | $250-400/mo |

30s | $65-$110/mo | $10-$250/mo |

40s | $60-$100/mo | $170-$220/mo |

50s | $55-$95/mo | $150-$210/mo |

60+ | $60-$105/mo | $160-$230/mo |

How to Save on Car Insurance

You can pay less for car insurance and still get good coverage. Try these easy tips:

Bundle Your Policies: Put your auto, home, or renters insurance with one company. You might get a discount for having more than one policy.

Raise Your Deductible: If you can pay more out of pocket, pick a higher deductible. This can make your monthly bill lower.

Ask About Discounts: Are you a safe driver, a good student, or do you drive less? Many companies give discounts for these things. Always ask your agent about discounts.

Drive Safely: If you have no tickets or accidents, you can get better rates.

Work With a Local Agent: Local agents know Bluffton’s risks. They can help you find the best car insurance for you.

Mini Takeaway: You have choices. If you make smart choices, you can save money and still get good protection.

CTA Box: “Compare your rates with a Bluffton insurance expert today — Request Your Quote.”

Compare your options today — Request Your Quote.

Why Choose a Local Auto Insurance Agent

Local Expertise and Claims Support

You want someone who knows Bluffton and Hilton Head. Local agents live here. They understand the roads, the weather, and the way people drive. When a hurricane hits or a golf cart bumps into your car, you want help from someone who has seen it before. National carriers may not know about the busy tourist traffic or the flood zones near your home.

If you need to file a claim, a local agent can guide you step by step. You get answers fast. You get support from someone who cares about your community. You do not have to wait on hold for hours. You get real help when you need it most.

Tip: Local agents know which car insurance companies handle claims best in Bluffton. You get advice that fits your life.

Personalized Coverage for Bluffton Residents

Your needs are not the same as everyone else’s. Maybe you drive a family SUV like Jordan. Maybe you have a golf cart like Richard and Susan. A local agent helps you pick auto insurance that matches your lifestyle. You get coverage for hurricanes, floods, and even golf cart accidents.

Here’s what a Bluffton agent can do for you:

Review your driving habits and risks

Suggest car insurance options for your budget

Explain coverage for local hazards

Help you update your policy as your life changes

You get a plan that fits you, not just a one-size-fits-all policy.

CTA Box: “Get coverage tailored to your lowcountry lifestyle-Request Your Quote”

Get coverage tailored to your Lowcountry lifestyle — Request Your Quote.

Mini Takeaway: Local agents understand Bluffton’s unique needs. You get better service, smarter coverage, and peace of mind.

You can see that your auto insurance cost in Bluffton or Hilton Head changes based on your choices and where you live. Picking the right plan helps you save money and keeps you protected. Here are ways you can stay in charge:

Your commute, credit, and claims history all affect your price.

You can look at different deductibles, ask about discounts, and talk to a local agent.

Comparing plans can help you save real money.

Coverage Type | What It Covers |

|---|---|

Collision | Damage from a crash with another vehicle |

Comprehensive | Non-collision events like theft or fire |

Rental | Rental car while yours is in the shop |

Rideshare | Protection for rideshare drivers |

New Driver Coverage | Extra help for new drivers |

Business Travelers | Coverage for work-related driving |

You have many options. You can protect your car and save money. Request your Bluffton auto insurance quote today.

FAQ

How much is car insurance in Bluffton, SC?

You can expect to pay between $1,250 and $1,650 per year for car insurance in Bluffton. Your rate depends on your age, driving record, and the type of coverage you choose.

What affects my car insurance rate the most?

Your driving record, age, and the car you drive matter most. Local risks like hurricanes, golf carts, and tourist traffic also play a big role in Bluffton and Hilton Head.

Tip: Safe driving and bundling policies can help you save money.

Do I need more than the state minimum coverage?

Yes, you should consider higher limits. The state minimum may not cover all costs after an accident. More coverage protects your savings and gives you peace of mind.

Can I get discounts on my auto insurance?

Yes! You can get discounts for safe driving, bundling home and auto, being a good student, or driving less. Ask your local agent about all available discounts.

Why should I use a local Bluffton insurance agent?

A local agent knows Bluffton’s unique risks. You get personal advice, faster claims help, and coverage that fits your Lowcountry lifestyle. Local experts make insurance easier for you.