Picture this: Your car insurance renews in Bluffton, and the rate jumps. You wonder how often to shop car insurance. We recommend reviewing every 3–5 years or sooner if you add a teen driver or move to Hilton Head. Regular checkups help you avoid overpaying. Shopping for quotes is easy with a local expert—try it now here.

Key Takeaways

Check your car insurance each year. This helps you know your coverage and rates.

Look for new quotes every 3 to 5 years. You might find better rates. You can keep your loyalty discounts.

Big life changes mean you should check your insurance right away. Adding a teen driver or moving are examples.

How Often to Shop Car Insurance

The 3–5 Year Sweet Spot

You might wonder how often to shop car insurance. In our experience here in Bluffton and Hilton Head, the sweet spot is every 3–5 years. This timing gives you the best chance to catch savings without losing out on loyalty perks. Most drivers who review their policies every few years find better rates or improved coverage.

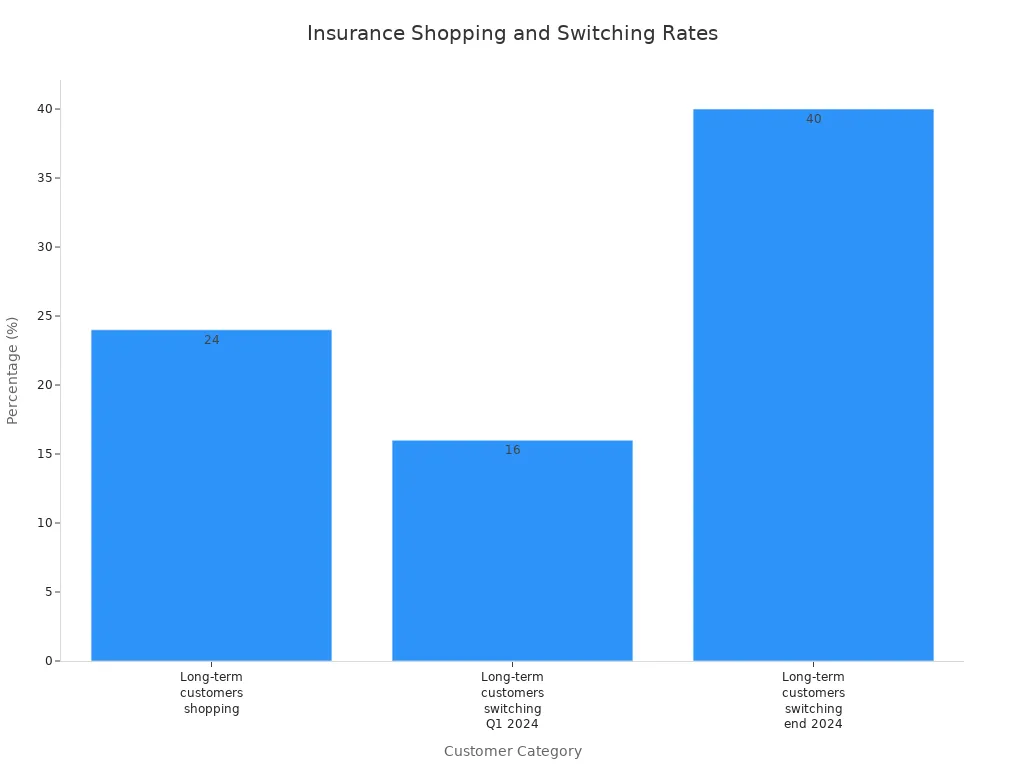

Let’s look at what happens when drivers shop or switch:

Category | Percentage |

|---|---|

Long-term customers shopping | 24% |

Long-term customers switching (Q1 2024) | 16% |

Long-term customers switching (end of 2024) | 40% |

You can see that more people are shopping and switching than ever before. If you wait too long, you might miss out on savings. If you shop too often, you could lose discounts or hurt your insurance score. We see that every 3–5 years hits the balance. You get the benefits of loyalty, but you also keep your options open.

Here’s a quick checklist for the 3–5 year review:

Ask yourself: Has my rate jumped for no reason?

Check if your coverage still fits your needs.

Compare quotes from local agencies.

Look for new discounts or policy features.

If you notice a big rate increase, even without any claims, it’s smart to review sooner. You can learn more about why your insurance increased without any claims by visiting our detailed explanation.

Annual Reviews and Local Factors

You don’t have to switch every year, but you should review your policy annually. In Bluffton, Hilton Head, and Okatie, local trends can change your rates. For example, rising home values in our area can push up insurance costs. When your home insurance goes up, you might want to save on your car insurance to balance your budget.

We see more people moving to the Lowcountry each year. This growth means more cars on the road and more competition among insurance companies. Sometimes, new companies enter the market and offer better deals. Other times, rates go up because of more claims in the area.

Here’s what you should do during your annual review:

Look at your current premium and coverage.

Ask your agent about any new discounts.

Check if your driving habits or car have changed.

Make sure your policy matches your life today.

Tip: You don’t have to do this alone. A local agent can help you review your policy and spot savings. At GSP Insurance Group, we do this for you every year.

Remember, knowing how often to shop car insurance helps you stay ahead. You don’t want to overpay, but you also don’t want to lose out on valuable discounts. Stick to the 3–5 year sweet spot, but always review your policy each year—especially if you live in a fast-growing place like Bluffton or Hilton Head.

When to Review Your Car Insurance

Life Changes (New Car, Teen Driver, Move)

Big changes in your life often mean it’s time to review your car insurance. In Bluffton and Hilton Head, we see this all the time. Maybe you just bought a new car, added a teen driver, or moved to a new neighborhood. Each of these can have a big impact on your rates.

Adding a teen driver? Your premium could jump by 152% on average. For families with teenage boys, the increase is even higher—up to 176%. Teenage girls see a 129% rise.

Insurance companies see teen drivers as high risk because they get into accidents more often.

If you add a new car, your rate may change based on the car’s value and safety features.

Moving to a different ZIP code can also affect your premium, especially if you move to a busier area.

Tip: Always shop around for quotes and ask about discounts when you have a major life change.

Big Rate Increases

If you open your renewal and see a big jump in your car insurance bill, don’t ignore it. Sometimes rates go up even if you haven’t had any claims. This can happen because of local trends or changes in the insurance market. When you see a big increase, it’s smart to compare your options and see if you can save.

Policy Updates

Policy updates can also trigger changes in your premium. We see this in the Lowcountry as costs rise:

Vehicle repair costs have gone up, leading to a 20% increase in premiums for many drivers.

Medical and litigation costs are higher now, which can push your rates up.

More accidents in the area mean insurers may adjust your rates, even if you haven’t had a claim.

If you make any changes to your coverage, always review your car insurance to make sure you’re still getting the best value.

Risks of Switching Too Often

Insurance Score Impact

You might think changing companies every year saves money. But switching too much can hurt your insurance score. Insurers in Bluffton and Hilton Head check your history when you apply. If you change companies more than once a year, they may see you as risky. This can make your premiums go up.

Your insurance score is like a credit score. It shows if you are a good customer. If you keep changing companies, you cannot build a strong record. Insurers want to see that you stay with one company. If you jump around, they may worry about gaps or claim problems.

Want to learn more about how your insurance score affects your rates? Read our guide on insurance scores explained for Bluffton and Hilton Head drivers.

Here’s what we notice in our area:

Switching a lot can mean higher premiums.

Insurers may think you only care about price.

Staying with a company for a short time can hurt your score.

Losing Discounts

If you stay with one insurer for a few years, you can get good discounts. Many companies give loyalty perks to customers who stay. If you switch too often, you miss these savings.

Here’s a checklist of discounts you might lose if you switch too much:

Multi-policy discounts (bundling home and auto)

Safe driver rewards

Accident-free bonuses

Renewal loyalty credits

Insurers in Bluffton and Hilton Head like customers who stay. If you keep switching, you start over with discounts each time. You could also have gaps in coverage, which makes claims harder.

Tip: Before you switch, ask your agent about the discounts you might lose. Sometimes, staying with your company saves you more money.

How to Save on Car Insurance

What to Compare

If you shop for car insurance in Bluffton, Hilton Head, or Okatie, you want good value. The lowest price is not always the best choice. Use this checklist to compare your current policy with new ones:

Coverage types: Do you have enough liability, collision, and comprehensive?

Limits: Are your coverage limits high enough to protect your assets?

Deductibles: Can you afford your deductible if you need to file a claim?

Discounts: Are you getting all the savings you qualify for?

Local service: Will you get help from someone who knows the Lowcountry?

Price: Does the premium fit your budget?

Service quality: How easy is it to reach your agent or file a claim?

You need to balance your monthly payment with what you pay after an accident. In Bluffton, Hilton Head, and Okatie, lower premiums often mean higher deductibles. If you want a lower deductible, your monthly cost may go up. Having a local agent is important. A friendly agent can help you when you need it.

Tip: Check your coverage every year. Remove extras you do not need. Raise your deductible if you can. Ask about bundling policies to save more.

Local Discounts

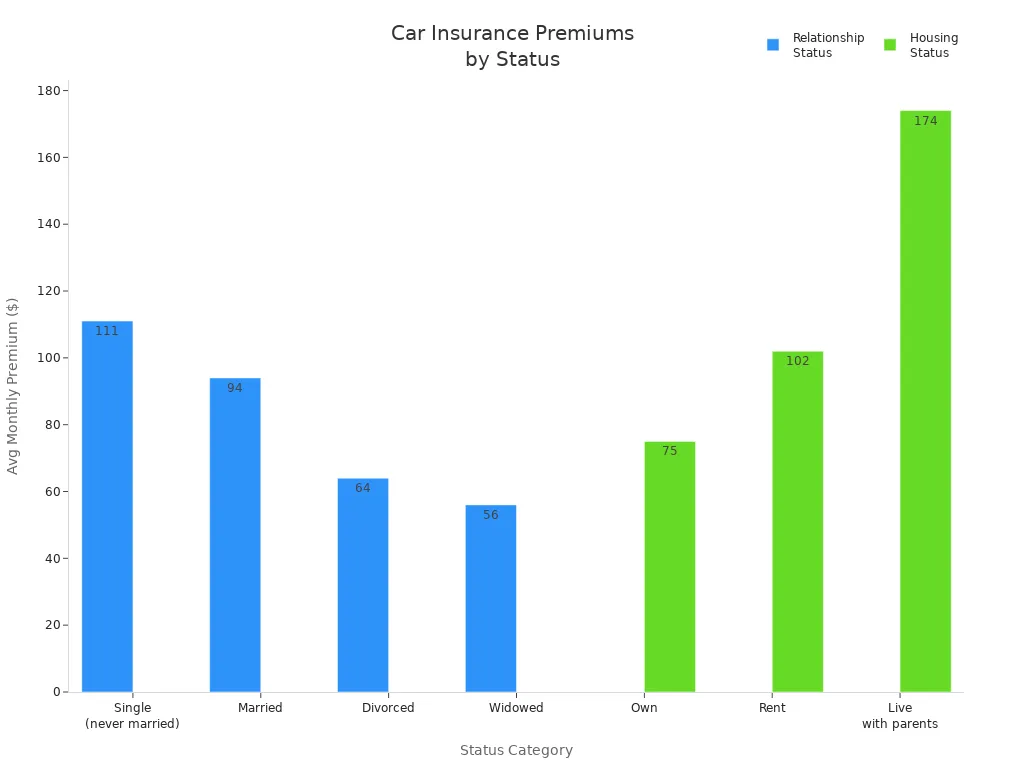

You can save money on car insurance by using local discounts. In Bluffton and Hilton Head, your relationship and housing can change your premium. Look at these average monthly premiums:

Relationship | Average Monthly Premium |

|---|---|

Single (never married) | $111 |

Married | $94 |

Divorced | $64 |

Widowed | $56 |

Housing Status | Average Monthly Premium |

|---|---|

Own | $75 |

Rent | $102 |

Live with parents | $174 |

Many drivers miss easy ways to save. Want to see if you can get more discounts? Check out the top 5 discounts Bluffton residents miss. You might find a discount you did not know about.

Why Buy Auto Insurance with GSP

Local Support

When you buy auto insurance, you want help from people who know Bluffton, Hilton Head, and Okatie. At GSP Insurance Group, you get real people who live and work nearby. We understand what drivers in the Lowcountry need. You can visit our office, call us, or send an email. You always talk to a real person, not a machine.

Take a look at how local independent agencies like GSP compare to national providers:

Feature | Independent Agencies (e.g., GSP) | National Providers |

|---|---|---|

Personalized Service | Yes | Limited |

Community Ties | Strong | Weak |

Commitment to Customer Satisfaction | High | Variable |

Claims Advocacy | Hands-on | Less personal |

Human Interaction | Always available | Often automated |

Flexibility in Coverage | High | Limited |

Proactive Coverage Review | Yes | Rarely |

Customer Treatment | Individual focus | Number focus |

We give you yearly reviews without you asking. You do not have to look for new insurance every year. We check your policy for you and tell you if you should make a change.

Easy Quotes

Buying auto insurance should not be hard. With GSP, you get quick and simple quotes from local experts. We check many companies for you. You do not have to fill out the same forms again and again. We help you find car insurance that fits your needs and your budget.

Wondering about the average cost in our area? Here is what we see:

Area | Average Monthly Rate |

|---|---|

Hilton Head Island, SC | $131.33 |

South Carolina | $147.28 |

National | $169.67 |

You can see local rates are often lower than the national average. Want more details? Check out our guide on how much auto insurance costs in Bluffton.

Ready to buy auto insurance or just want to see your choices? Ask for a quote today at GSP Insurance Group. We make it easy to buy auto insurance and feel sure about your choice.

You deserve peace of mind on Bluffton and Hilton Head roads. Regular reviews help you save money, find better coverage, and avoid costly gaps. Local experts at GSP Insurance Group know what matters here.

At GSP Insurance Group, we’re proud to be your Partner for the Journey. Ready to review your policy? Request a quote today.

FAQ

How often should you review your car insurance in Bluffton or Hilton Head?

You should review your car insurance every year. Shop around every 3–5 years or after big life changes.

What life events mean you need to shop for new car insurance?

You need to shop if you move, buy a new car, add a teen driver, or see a big rate increase.

Can switching car insurance companies too often hurt you?

Yes, switching too much can lower your insurance score and make you lose loyalty discounts.