You want to keep your business safe from the beginning. Focus on these five insurance policies: general liability, workers’ compensation, professional liability, commercial property, and business income. State laws and your business needs may not be the same. Insurance helps you follow the law and avoid money problems.

Business insurance claims reached $965.6 billion in 2024. There are many types of business insurance. Getting the right coverage can help your business do well.

Key Takeaways

General liability and workers’ compensation insurance help protect your business. They keep you safe from common risks and legal costs. These policies help you follow the law.

Professional liability, commercial property, and business income insurance cover special risks. They help if there are mistakes, property damage, or lost income. These policies help your business stay strong after problems.

Look at your business risks carefully. Talk to insurance experts to pick the right policies. Make sure they fit your needs and budget. This helps keep your business safe for a long time and gives you peace of mind.

1. General Liability Insurance

Coverage

General liability insurance is very important for businesses. It helps protect your business from claims about injuries or damage. If someone gets hurt in your store, this insurance can help. It also helps if you break something that belongs to a client. The insurance pays for doctor bills, lawyer fees, and fixing things. It also covers problems like slander or mistakes in ads. Other business insurance does not always cover these things. General liability insurance fills this big gap.

Importance

You may ask why this insurance is first on the list. Experts say it is the most suggested policy for new businesses. Lawsuits and medical bills are getting higher every year. Even a small accident can cost a lot of money. Without insurance, you might have to pay yourself. This can hurt your business or make you close it. General liability insurance helps you worry less and focus on growing your business.

Claims for damage can happen if you break something at work.

This insurance pays for lawyers, settlements, and doctor bills.

It also helps with claims about stress or hurt feelings.

Many clients and landlords want you to have this insurance before working with you.

Who Needs

Almost all businesses need general liability insurance. If you see customers, work at someone’s place, or show ads, you have risks. This insurance is often part of a business owners’ policy. It is a base for other business insurance. No matter if you have a store, give services, or work from home, this insurance helps protect you from common and expensive claims.

2. Workers’ Compensation Insurance

Coverage

Workers’ compensation insurance helps if someone on your team gets hurt or sick at work. This policy pays for doctor bills and lost pay. It can also help if someone dies because of work. You do not have to pay these costs yourself. The average cost for an injury claim is about $41,353. This is a lot of money for any business. Most small businesses pay about $45 each month for this insurance. Workers’ compensation is a main type of business insurance. It protects you and your workers.

Importance

You may think accidents will not happen, but they do. Workplace injuries are more common than you might think. Every year, there are thousands of claims and even deaths at work. In California, insurers paid $12 billion for medical and wage losses in one year. Across the country, about 3.1 claims are filed for every 100 full-time workers. These numbers show why this insurance is important. Workers’ compensation helps your workers get better. It also helps your business keep running.

Tip: Workers’ compensation is not just a good idea. It is the law in almost every state. If you do not have it, you could get big fines or stop-work orders. You could even face criminal charges.

Who Needs

If you have workers, you almost always need workers’ compensation insurance. Most states make you get it when you hire your first worker. Some states have special rules or let some people skip it. But not having this insurance can put your business in danger. This is one of the most important types of business insurance. It is needed for any business that wants to follow the law and protect its team.

3. Professional Liability Insurance

Coverage

Professional liability insurance helps if a client says you made a mistake. It also helps if they say you gave bad advice. This insurance pays for lawyer fees and settlements. It covers damages if your work causes harm to someone. This insurance is not like other business insurance. It focuses on mistakes, missed deadlines, or advice that causes loss. People in healthcare, finance, or law have more risk. Even small mistakes can cause big problems.

Service businesses are seeing more claims and bigger claims.

Clients want more, so claims happen more now.

New risks like cyber issues and privacy make things harder.

When the economy changes, more people sue to get money back.

Importance

You need this insurance if you give advice or services. Many claims come from simple mistakes or confusion. Most negligence cases do not become claims, but some do. When they do, they can cost a lot of money. Hospitals and clinics can lose money or face fines after mistakes. They can even lose patients. Professional liability insurance helps you handle these risks. It keeps your business open.

Note: This insurance cannot stop all claims. But it helps pay for them. It is very important for service businesses.

Who Needs

If you run a service business, you need this insurance. Here are some jobs that need it:

Consultants, accountants, and lawyers

Healthcare workers and therapists

IT professionals and designers

AI risk tools show you have high money risk without this insurance. These tools show how mistakes or missed work can cost a lot. Out of all business insurance, this one is a must if you give advice or services.

Sector | Claim Frequency Increase (2024 Forecast) |

|---|---|

Senior Living | |

Long-Term Care | 0.3% |

You can see claims are going up in many service jobs. This makes professional liability insurance a smart choice for your business.

4. Commercial Property Insurance

Coverage

Commercial property insurance helps protect your business from big losses. It gives help if your building, equipment, or inventory gets damaged or lost. This policy covers things like fire, storms, theft, and some water damage. If you own or rent a space, this insurance can pay to fix or replace what you lose. It is one of the main types of business insurance you should have. Many business owners add this to their business owners’ policy for better coverage.

A survey in 2020 found that 26.5% of small businesses had property damage from fire or natural disasters. Employee theft causes about 42% of inventory losses in the US. These numbers show these problems happen a lot to business owners.

Importance

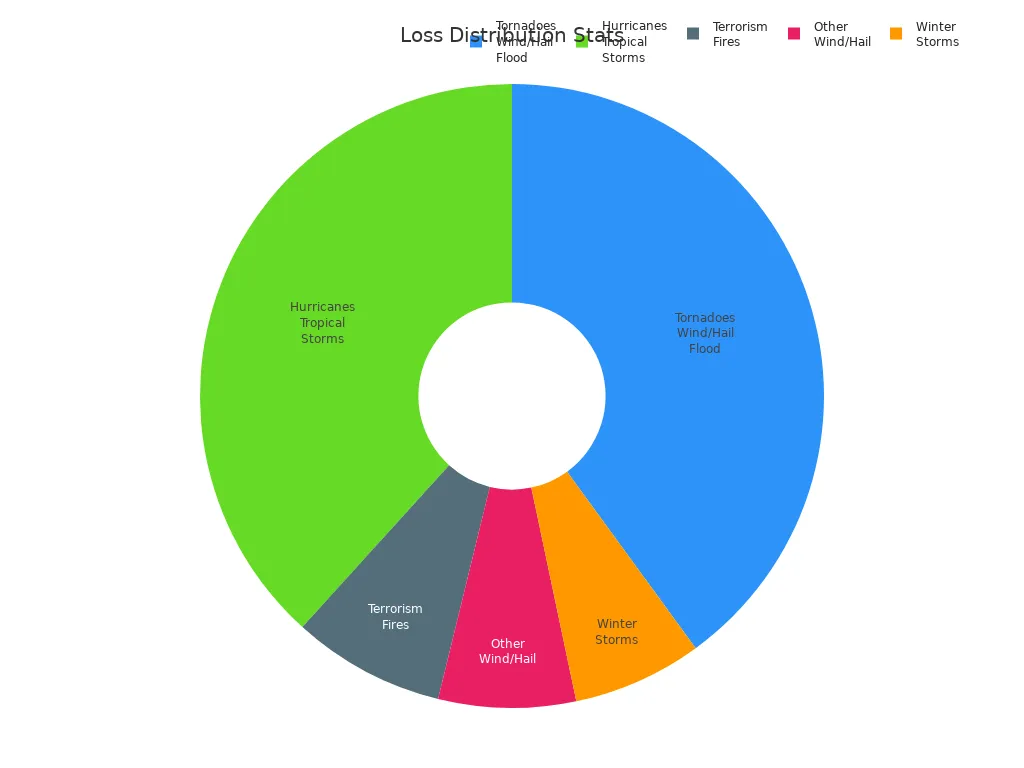

You cannot know when a disaster will happen. Tornadoes, hurricanes, and fires can ruin your property very fast. Look at the chart below to see how much damage these events cause:

Event Type / Statistic | Description / Data |

|---|---|

Tornadoes, wind, hail, flood | 39.9% of insured losses |

Hurricanes, tropical storms | 38.2% |

Other wind/hail/flood | 7.1% |

Winter storms | 6.7% |

Terrorism, fires, wildfires | 7.9% combined |

Big storms like Hurricane Katrina caused over $41 billion in insured losses. Half of that money went to businesses. Catastrophe losses are expected to double every ten years. If you do not have the right business insurance, you could lose everything.

Who Needs

You need commercial property insurance if you own or rent a space, use equipment, or keep inventory. This is true for shops, offices, and even home-based businesses. Here are some reasons why you should have this insurance:

You need coverage that matches what your property is worth.

Inflation and business interruption can make losses worse.

Insurance contracts should help you avoid missing coverage.

Insurers use data to check your risks. They look at your building, what you do, and how you protect your things. This helps set the right price and coverage. Adding commercial property insurance to your business owners’ policy is a smart idea. It is one of the most important types of business insurance for any company that wants to stay open after a loss.

5. Business Income Insurance

Coverage

Business income insurance helps if your business must close. It pays you when a covered event stops your work. This policy gives money for lost income and pays your workers. It also helps with bills like rent and utilities. If a fire or storm shuts you down, this insurance helps. You can keep paying your team and cover your main costs. Many owners add this to their business insurance or get it in a business owner’s policy (BOP).

Pays for lost income if you must close

Covers wages and regular bills

Helps with extra costs if you move or rent space

Supports you if suppliers or utilities stop working

Importance

You work hard to make your business grow. But what if you have to close for weeks or months? Business income insurance keeps you from losing all your profits. For example, if your store makes $10,000 each month and a flood closes you for three months, you could lose $30,000. This insurance helps you get that money back. It also pays your rent and salaries, so you do not fall behind. Most business insurance does not pay for lost income, but this one does. That is why it is important for small businesses and helps you stay open after a disaster.

Who Needs

You need business income insurance if you run a shop, restaurant, or any business that needs steady sales. Small businesses and startups can lose a lot if they stop making money, even for a short time. This insurance is one of the most important types for new owners. If you have a store or use equipment, you should add this to your insurance plan. Most business insurance covers property or liability, but business income insurance protects your cash flow. You can keep your team and pay your bills, even when things go wrong.

Choosing Startup Insurance

Assess Risks

When you start a business, you need to know what could go wrong. Many startups use risk assessment tools like SWOT analysis to spot dangers and chances. You can also try scenario planning. This helps you think about what might happen if things go well or badly. Here’s how you can assess your risks:

List all the things that could hurt your business.

Think about how likely each risk is and how much damage it could cause.

Focus on the biggest risks first.

Choose insurance policies that match your top risks.

Work with your team and partners to get a full picture.

Use InsurTech tools for data-driven choices.

Review your plan often as your startup grows.

Advanced data and AI can help you see risks you might miss. These tools let you pick business insurance that fits your needs and budget.

Legal Needs

You must follow the law when you pick insurance for startups. Each state has its own rules. Some types of business insurance, like workers’ comp, are required. Almost 40% of US companies face lawsuits about jobs within five years. Many startups get sued by customers or workers. These lawsuits can cost over $50,000 each. Repeat founders often buy insurance early because they know the risks. You should check what your state and industry require. Some businesses need extra coverage, like commercial auto insurance or data protection.

Lawsuits can come from customers, workers, or even competitors.

Insurance for startups can protect you from big legal bills.

Always check your legal needs before you buy a policy.

Consult Experts

Choosing the right insurance for startups can feel hard. You do not have to do it alone. Insurance experts can help you understand your risks and legal needs. They use data to see where you might lose money. Experts also check if your partners and vendors follow the rules. They look at things like audits, agent performance, and data safety. With their help, you can pick the best startup insurance for your business. They also help you keep up with new laws and risks, like cyber threats or climate events.

Tip: Talk to an insurance expert before you decide. They can help you find the right types of business insurance and make sure you stay safe and legal.

You want to protect your business and follow the law.

Choosing the right insurance policies helps you avoid big losses and keeps your company strong.

Cost-benefit studies show that smart insurance choices give you more value over time.

Return (USD) | |

|---|---|

Health and productivity programs | $2.03 |

Talk with an agent to find the best fit for your needs.

FAQ

What insurance do I need to start a business?

Most new businesses need general liability and workers’ compensation. Some companies might need extra insurance. You should check your state’s rules. Ask GSP Insurance Group if you are not sure.

How much does business insurance cost?

The price depends on what your business does and how big it is. It also depends on your risks. Most small businesses pay $500 to $3,000 each year. You can get a quote to know your cost.

Can I bundle insurance policies?

Yes! You can put different policies together in a Business Owner’s Policy (BOP). Bundling can help you save money. It also makes your insurance easier to handle.