You pull out your old Pokémon cards from a shoebox under your bed at home. Suddenly, you realize these collectibles could buy a car. But what if your home faces fire, water, or theft? Standard insurance rarely covers the true value. Insuring the priceless means real protection for your home and your memories at home. You want your home to be safe. Your insurance should protect every card at home, not just the walls. Keep your home, your collection, and your peace of mind secure with the right insurance at home.

Key Takeaways

Collectibles like Pokémon cards can be very valuable. Some are worth thousands or even millions. Protecting them is as important as protecting your house. – If you keep your collection in a shoebox, it is not safe. Damp places can also hurt your cards. Fire, water, mold, and heat can damage them. This can make them lose their value. – Special insurance gives real help. It covers what your collection is really worth. If something bad happens, you can get the right amount of money.

The Value of Collectibles

How Value Grows

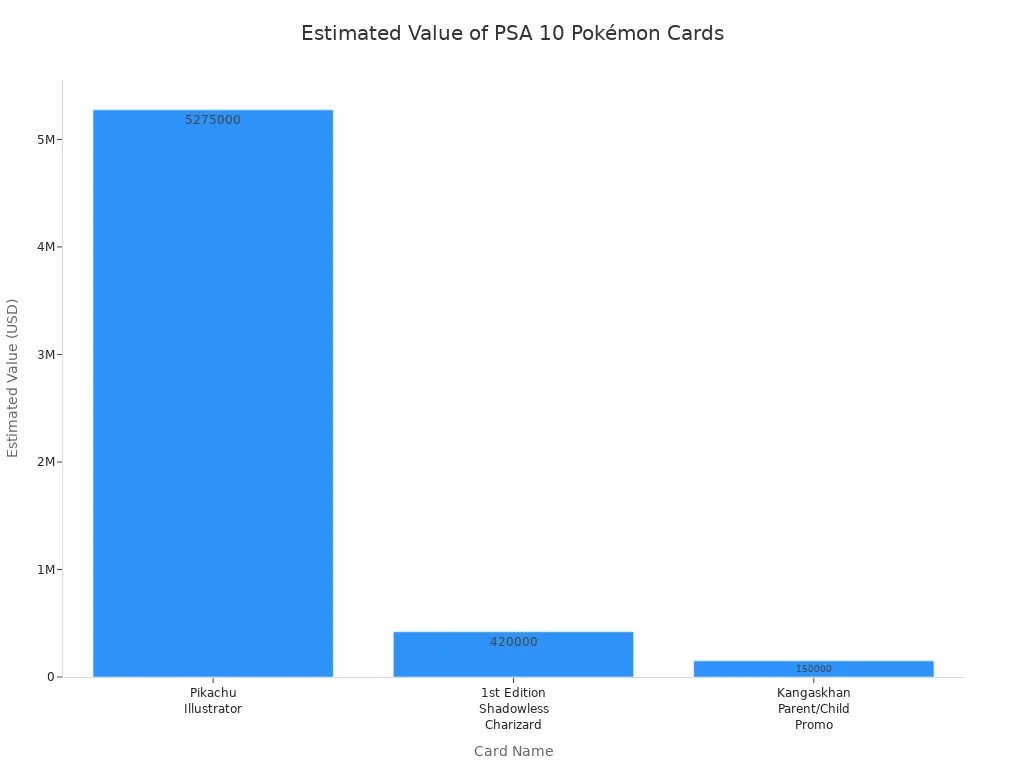

You might think your collection just sits at home, but its value can surprise you. Some Pokémon cards, comics, and vintage toys have seen their prices skyrocket. Take a look at these recent market values for iconic cards:

Card Name | Year | Grade | Estimated Value (USD) | Notes |

|---|---|---|---|---|

Pikachu Illustrator | 1998 | PSA 10 | $5,275,000 | Record auction (2022) |

1st Edition Shadowless Charizard | 1999 | PSA 10 | $420,000 | Highly sought after |

Trophy Pikachu (No. 1 Trainer) | 1997 | PSA 9 | $250,000+ | Tournament prize |

Presentation Blastoise (Prototype) | 1998 | CGC 8.5 | $360,000 | Prototype card |

Kangaskhan Parent/Child Promo | 1998 | PSA 10 | $150,000 | Tournament exclusive |

Comics and toys also keep climbing. A rare Spiderman comic sold for $707,000. Vintage toys like a 1954 Futuramic Spaceship can reach $13,000. Shows like Pawn Stars and Stranger Things have made collectibles even more popular, pushing prices higher.

Real-World Losses

Imagine you keep your cards or comics in a shoebox at home. One day, a pipe bursts or a fire breaks out. You lose not just memories, but real money. One collector lost a PSA 10 Charizard to water damage at home, wiping out years of value. Another saw a vintage Batman playset ruined by mold in a damp basement. These stories show why insuring the priceless is more than just a smart move—it’s a must. Standard insurance often misses the mark for collectibles, so you need coverage that truly protects what you love at home.

Risks of Poor Storage

Physical Threats

Your collection faces more threats at home than you might think. Fire, water, and theft are just the start. When you keep your cards or comics in a shoebox at home, you expose them to temperature swings, humidity, and moisture. These conditions can cause paper items to wrinkle, stick together, curl, or even grow mold and mildew. Extreme heat in your home can warp or melt materials. Cold can crack or break glass and metal. Moisture brings mold, mildew, and even bugs. Without climate control at home, your collectibles face a much higher risk of total loss.

Cold can crack, rust, or break glass and metal at home.

Humidity and moisture can cause mold, mildew, and insect damage at home.

Lack of climate control at home puts antiques, artwork, books, and collectibles at risk.

Loss of Value

Improper storage at home does more than just damage your collectibles. It can destroy their value. When cards or comics get wrinkled, faded, or moldy, their condition drops fast. Collectors and buyers want items in top shape. Even a small crease or spot of mold can cut the value in half. Shoeboxes and damp basements at home are not safe places for your treasures. Standard insurance policies often do not cover these risks for collectibles at home. That is why insuring the priceless means more than just putting your collection in a safe spot at home. You need the right insurance and storage to keep your collection’s value strong at home.

Insuring the Priceless

What Standard Insurance Misses

You may think your homeowners or renters insurance covers everything. But that is not always true for collectibles. Most standard policies have low limits for expensive items. If you lose your cards, comics, or toys in a fire or theft, you might not get enough money back. Many policies do not cover collectibles, jewelry, art, or antiques unless you pay for extra coverage. You should check your policy to see what it really covers.

Standard policies often do not cover high-value collectibles.

You need to buy extra endorsements or separate policies for full protection.

Claim payouts might not match the appraised value of your items.

Items without appraisals may not be covered at all.

Regular appraisals and good records help keep your coverage up to date.

If you do not have the right insurance, you could lose the value of your collection. The cost of premiums is small compared to what you could lose if something happens. Insuring the priceless means you protect your collection from surprises.

Specialized Collectibles Coverage

Specialized collectibles insurance gives you protection that standard policies miss. This insurance is made for valuable and rare items like trading cards, vintage toys, comics, and art. It covers your collection if it is lost, stolen, or damaged, even if you take it out of your home.

You can pick different types of coverage:

Scheduled policies: List each item with its appraised value for exact payment.

Blanket policies: Cover your whole collection as one group, making it easier to manage.

Agreed value policies: Set the value at the start, so you know what you will get if you file a claim.

Specialized insurance from GSP Insurance Group matches your collection’s real value. You get coverage for items at home, on the go, or at events. This insurance keeps up with rising values, so you do not have to worry about being underinsured. You also get peace of mind, knowing your collection is safe wherever you keep it.

Collectors who use specialized insurance see many benefits:

You get financial protection against theft, damage, or loss.

You can enjoy your collection without worrying about losing its value.

Coverage matches both current and future value, which is important for items that grow in worth.

You protect the emotional and sentimental value of your collection.

You can change your coverage as your collection grows or changes.

How to Document and Appraise

To make sure your insurance works, you must document your collection the right way. Insurance companies want proof that you own your items and know their value. Good records help you get the right payout if you ever file a claim.

Here is what you should keep for each item:

Documentation Type | Description | Why It Matters for Insurance |

|---|---|---|

Narrative (Full) Appraisal | Detailed report with photos, description, history, condition, and value | Proves you own the item and its value |

Appraisal Summary | Short overview of value | Quick value check for insurance |

Certified Appraisal Report | Official, certified report | Needed for taxes and some insurance claims |

Condition Report | Details about the item’s condition | Helps set the right value for insurance |

Photographs | Clear pictures of all sides, markings, and condition | Shows you own the item and what shape it is in |

Provenance Records | History of the item, including past owners and origin | Shows it is real and adds value |

Tip: Use a checklist to keep your records neat and organized. Update your appraisals every few years, especially if your collection grows or prices change.

Many collectors make mistakes when keeping records. They forget to update coverage limits, use old appraisals, or miss details like who owns the policy. These mistakes can cause problems if you need to file a claim. Always double-check your paperwork and keep your contact information up to date.

Insuring the priceless is not just about buying a policy. You need to care for your collection, keep good records, and work with experts who know about collectibles. GSP Insurance Group can help you find the right coverage and guide you through the process. Protect your collection, your home, and your peace of mind. Get a quote or talk to an agent who understands what your collection means to you.

You spend time building your collection at home. Protecting it matters just as much. Your home holds memories, but your home also faces risks. Keep your home safe by storing your collection right at home. Specialized insurance helps your home stay secure. Contact GSP Insurance Group to protect your home and collection today.

FAQ

How does collectibles insurance protect my collection at home?

Collectibles insurance covers your items at home from fire, theft, water, and accidents. You get peace of mind knowing your treasures stay safe at home.

Can I insure my collection if I keep it at home?

Yes! You can insure your collection even if you store everything at home. Just make sure you document each item and keep records at home.

What should I do if my collection grows at home?

Update your policy when your collection grows at home. Take new photos, get appraisals, and let your agent know about changes at home.