Late or incomplete work comp audits can cost you—here’s why. You might end up paying more money, face hefty fines, or even lose your coverage. Insurance carriers don’t wait around, so it’s crucial for your business to stay protected and compliant.

Key Takeaways

Turn in your workers’ comp audit on time. Make sure your records are complete and correct. This helps you avoid paying more money and getting penalties.

Keep payroll, contractor insurance, and job details neat and tidy. Check everything twice before you send it in. This stops mistakes and delays from happening.

Plan early and answer audit requests fast. This keeps your coverage safe. It also helps you avoid fines and keeps your business protected.

Audit Process

Workers’ Compensation Coverage

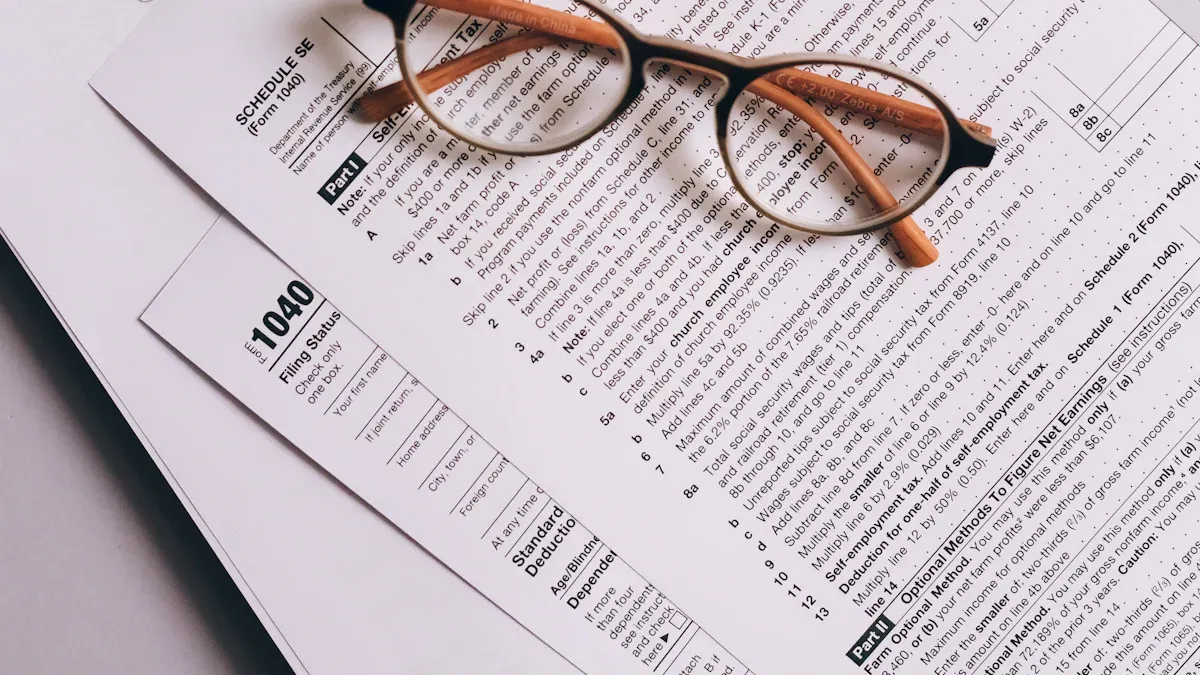

It is important to know how audits work. Each year, your insurance company asks for an audit. The audit checks your payroll and job roles. This helps make sure your coverage fits your business. You must give correct records to keep your coverage. Get your payroll, 1099s, and job descriptions ready before the audit. Good records help you avoid errors and keep coverage. Planning ahead keeps your business safe from surprises. It also shows your insurance company you care about coverage.

Late Filing and Incomplete Filing

Missing a deadline can hurt your business. Filing late often means extra costs and stress. If you wait too long, your insurance company may raise your rates. They could even cancel your policy. Filing with missing details is also risky. If you forget documents, you may lose your coverage. Plan to finish your filing on time and check every form. Make a checklist and plan each step. Filing late or missing information can cause penalties right away. You do not want to risk your coverage or pay more. Plan your filing, meet deadlines, and keep your business safe.

Costs and Penalties

Premium Increases

Some people think a late or incomplete workers’ comp audit is not a big deal. But late or incomplete work comp audits can cost you—here’s why: insurance companies often raise your premiums if you do not turn in a full audit report on time. If you miss deadlines or forget important details, your insurer may count all contractor payments as payroll. This can make your premium go way up. For example, if you pay contractors a lot and cannot show they have their own coverage, your premium could go up by $500,000 or more. Sometimes, your premium could rise by 25% to 200% because of your audit results. These extra costs can hurt your business and make it hard to plan ahead.

Tip: Always check your payroll and contractor records before sending your audit report. This helps you avoid surprise charges and keeps your workers compensation audit results correct.

Noncompliance Fees

If you do not follow the rules for your workers comp audit, you will face more than just higher premiums. Insurance companies add noncompliance fees and surcharges when you miss deadlines or send incomplete reports. These penalties can include a 20% to 100% payroll surcharge. You may also get extra fines if you do not fix mistakes fast. Some insurers charge a non-cooperative audit fee, which makes your bill even bigger. These penalties add up quickly and can drain your cash flow.

You might get these penalties if you:

Miss the audit deadline

Leave out payroll or 1099 information

Do not show proof of contractor insurance

Ignore requests for missing documents

Note: Noncompliance does not stop if you switch insurance companies. You must finish all old audit reports, or you will keep getting penalty notices and collection calls.

Policy Cancellation

Late or incomplete work comp audits can cost you—here’s why: your insurance company can cancel your policy if you do not turn in a full audit report. Many insurers send a 60-day cancellation notice if you do not answer audit requests. If your policy gets canceled, you lose coverage right away. This puts your business at risk for legal trouble and big costs if a worker gets hurt.

Losing your policy also makes it harder to get new coverage. Future insurers look at your audit history. If they see missed reports or unpaid penalties, they may not cover you. Even state-assigned workers comp insurance will not help until you fix all old audit issues and pay any fines. This can leave your business without protection for weeks or months.

Warning: Without coverage, you could face lawsuits, state fines, and business shutdowns. Always finish your audit report on time to protect your business.

How Penalties Affect Your Future

Here is what can happen if you do not finish your audit report:

Insurers may not renew your policy.

You may get surcharges and collection actions.

Your business credit can go down.

You cannot get new coverage until you fix all old audit results and pay every penalty.

You might have to pay claims yourself, which can hurt your business.

A late or incomplete audit report does not just bring one penalty. It can cause a chain reaction that hurts your business for years. Stay on top of your audit results and keep your compliance strong. This protects your business, your workers, and your future.

Avoiding Audit Mistakes

Common Errors

You want to avoid mistakes that can cost your business. Many owners make the same errors during an audit. Payroll miscalculations often happen when you do not double-check your numbers. Wrong employee classification is another big problem. If you put workers in the wrong job codes, your report will not match your real risk. Missing documentation, like payroll records or contractor insurance, can delay your audit and cause audit disputes. If you forget to include all the details in your report, you risk losing plan compliance. These errors can lead to higher costs, more stress, and even policy cancellation.

Tip: Make a plan before you start your audit. Review every report and document. This helps you catch mistakes early and keeps your plan on track.

Best Practices

You can take steps to make your audit process smooth and stress-free. Follow these best practices to keep your plan strong:

Keep payroll, tax forms, and employee records organized and up to date.

Track payroll summaries with clear employee classifications and hours worked.

Learn the audit process. Review your financial records, payroll, sales, and tax returns.

Respond quickly to requests for documents.

Prepare ahead of time. This helps you avoid surprises and keeps your plan in compliance.

If you want to avoid audit disputes or filing problems, you need a solid plan. Always check your report before you send it. Make sure your plan covers every detail, from payroll to form 5500. If you need help, GSP Insurance Group can guide you through every step. Their team knows how to prepare for a work comp audit and can help you keep your plan and form 5500 in order. Reach out to your local insurance agency in Bluffton and Buford for expert advice on plan compliance, form 5500, and your next audit report.

If you turn in your workers comp audit late or leave it unfinished, you might pay more money, get fines, or lose your insurance.

You can keep your business safe if you do things on time and make sure your records are right.

Do you need help with a workers compensation audit?

Talk to GSP Insurance Group, your trusted insurance agency in Bluffton and Buford.

Follow the rules and stop problems before they start!

FAQ

What documents do you need for a workers comp audit?

You should have payroll records, 1099s, and job descriptions ready. You also need proof that your contractors have insurance. Keeping good records helps you avoid mistakes. This makes your workers compensation audit easier.

What happens if you miss your workers comp audit deadline?

Your insurance company might make your premium go up. They could charge you extra fees or even cancel your policy. Protect your business by finishing your workers comp audit on time. GSP Insurance Group can help you with this.

How can GSP Insurance Group help you prepare for a workers comp audit?

GSP Insurance Group looks at your records and explains each step. They help you avoid expensive mistakes. You can ask them for help with Bluffton SC business insurance or Georgia workers comp insurance.