Even a minor accident in Bluffton, Hilton Head, or Beaufort can lead to bigger issues than you might expect. Many drivers assume their insurance will handle everything, but The True Cost of a Fender Bender: Why Your Auto Insurance Liability Limits Matter More Than You Think becomes clear when you consider the real expenses after a crash:

Medical bills, lost wages, and legal fees can quickly push settlements from $25,000 to several hundred thousand dollars.

The True Cost of a Fender Bender: Why Your Auto Insurance Liability Limits Matter More Than You Think goes far beyond just repairing your vehicle. If your liability limits are too low, even a seemingly minor accident or injury could leave you paying out of pocket.

Key Takeaways

Small accidents can still cost a lot. You might have to pay for medical bills, lost wages, and legal fees. These costs can be more than what basic insurance covers. Low liability limits mean you could pay thousands yourself. Raising your coverage helps protect your money and future. Talk to a local insurance expert to look at your policy. Think about getting higher limits. You can also add extra coverage like umbrella insurance for more protection.

The True Cost of a Fender Bender

Hidden Expenses

You might think a fender bender in Bluffton or Hilton Head is easy to fix. But the real cost of a car accident is often hidden. Many drivers in South Carolina find many surprise costs after even a small crash. Here are some things you might face:

Immediate costs: You may need emergency medical care, an ambulance, or a hospital stay. These can get expensive fast. Even if you feel okay, you might still need a checkup or X-rays.

Short-term recovery: Physical therapy and doctor visits can cost a lot. You might have to travel for care. If you live far away, you could spend more on gas and miss work.

Mid-term impact: You may need more treatments or help with child care. If you can’t work, you might lose money. This can use up your savings.

Long-term consequences: Sometimes, you need to change your home or learn a new job. You might need therapy for stress or trauma. These problems can last longer than your injuries.

Lifetime financial effects: You could earn less money or pay for pain medicine for years. Your insurance premiums might go up for a long time.

Tip: Many of these costs are not covered by your insurance policy limits. It’s important to know what your policy pays for and what it does not.

Medical bills from a small car accident can be a shock. Whiplash or soft tissue injuries may need weeks of therapy. Insurance may not pay for every doctor visit or medicine. You could have to pay some bills yourself. Legal fees can also surprise you if there is a fight about who caused the crash. You might need help with insurance claims. Even a simple settlement can get smaller after attorney fees and court costs.

Insurance Premium Increases

A fender bender can cost you money for years. In South Carolina, your insurance premiums can go up after an accident. Here is what might happen:

Time After Accident | What Happens to Your Premiums? |

|---|---|

1 to 2 years | Premiums can go up by 20–50% |

3 to 5 years | Premiums may drop a little if you have no claims |

Beyond 5 years | Premiums can go back to normal |

Accidents usually stay on your record for three to five years. If you have another crash or claim, your premiums could go even higher. Taking a defensive driving class and keeping a clean record can help. But higher insurance premiums can last longer than you think.

Out-of-Pocket Risks

If your insurance policy limits are low, you might pay much more than you expect. Many drivers in Beaufort and the Lowcountry only have the state minimum coverage. But real repair costs, medical bills, and legal fees can be much higher than those limits.

Let’s see how fast out-of-pocket costs can add up after a small accident:

Medical bills for the emergency room, doctor visits, and rehab can get high.

Prescription co-pays and ambulance fees cost money right away.

Vehicle repairs in South Carolina can cost thousands, especially for new cars. Fixing a bumper can cost up to $2,000.

If your car is being fixed, you might need a rental or pay for rides.

Legal fees, even for a small accident, come out of your settlement if you hire a lawyer. Most lawyers take a part of your compensation. That means you get less money after a settlement.

Note: If your policy limits run out, you must pay every dollar over that amount. For example, if your bodily injury liability covers $25,000 but the other driver’s medical bills are $40,000, you owe the extra $15,000. This does not include your own costs or lost wages.

Here is a quick look at how costs can add up, even for a small crash in Bluffton or Hilton Head:

Bumper repair: $1,500–$2,000

Emergency room visit: $1,200–$3,000

Physical therapy: $100 per session (often 10+ sessions)

Legal fees: 33% of your settlement or more

If you only have the minimum coverage, you could pay thousands out of pocket before your insurance helps. That’s why it’s smart to review your policy with a local expert like GSP Insurance Group. We can help you compare your limits to real accident costs and find the right coverage for you.

Want to learn more about protecting yourself? Check out our guides on umbrella insurance and deductible breakdowns for more tips.

Why Liability Limits Matter

How Insurance Works

You may think your auto insurance will pay for everything after a crash in Bluffton or Hilton Head. But do you know what your policy really covers? In South Carolina, liability insurance pays for injuries and damage you cause to others. It does not pay for your own car or your own medical bills. If you only have the minimum, you could face big bills after a fender bender.

Here’s a simple look at what liability insurance pays for and what it does not:

Coverage Type | Examples of Covered Expenses |

|---|---|

Bodily Injury Liability | Ambulance fees, hospital bills, surgery, medication, physical therapy, pain and suffering damages, lost wages |

Property Damage Liability | Damage to other people’s cars, fences, mailboxes, or property |

Medical Payments | Medical bills for injuries on your property, no matter who caused it |

Common Exclusions | Description |

|---|---|

Intentional Acts | Not covered |

Your Own Car’s Damage | Not covered by liability—needs collision or comprehensive |

Professional Services | Not covered |

Employee Injury | Not covered—needs workers’ comp |

Contractual Liability | Not covered |

Insurance companies in South Carolina decide what is covered by looking at police reports, photos, and medical records. They also check what witnesses say. They use state laws to see who caused the accident. If you are at fault, your liability insurance pays for the other person’s injuries and property damage. But it only pays up to your policy limits. If the bills are higher than your limits, you must pay the rest.

Tip: Many drivers in Beaufort and the Lowcountry think “full coverage” means everything is paid for. That is not true. Only collision and comprehensive coverage pay for your own car’s repairs.

State Minimums vs. Real Accidents

South Carolina law says you must have at least:

Coverage Type | |

|---|---|

Bodily Injury Liability | $25,000 per person / $50,000 per accident |

Property Damage Liability | $25,000 per accident |

Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

Uninsured Motorist Property Damage | $25,000 per accident |

But here is the problem: The true cost of a fender bender: why your auto insurance liability limits matter more than you think. Even a small crash in Bluffton or Hilton Head can bring medical bills, lost wages, and legal fees that are much higher than these minimums. One emergency room visit can cost $3,000. Physical therapy and follow-up care can add thousands more. If you hit more than one car or a fancy car, property damage can get very expensive.

Let’s look at a real example:

You hit another car at a stoplight in Beaufort. The other driver needs surgery and months of therapy. Their medical bills reach $60,000. Your policy only pays $25,000 per person. You now owe the extra $35,000. If you cannot pay, the other driver can sue you. You might lose money from your paycheck or even your savings.

Note: There is no minimum amount needed to file a lawsuit in South Carolina. Even a small fender bender can lead to a big court case if your insurance policy limits are too low.

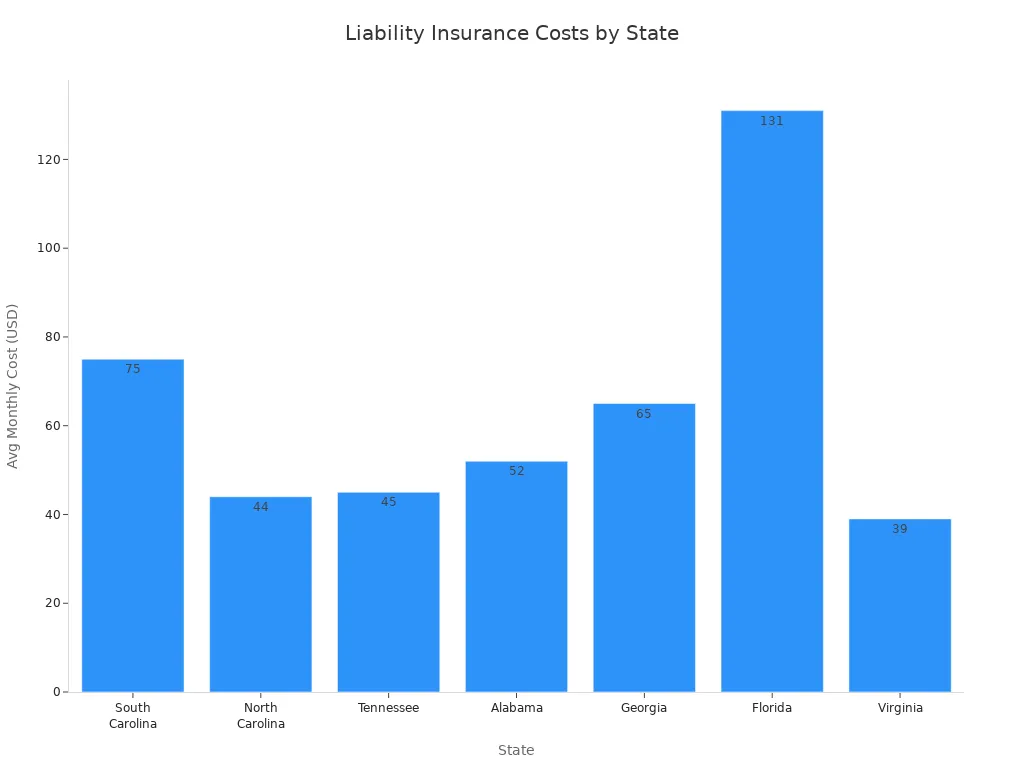

Here is how South Carolina’s average monthly liability insurance cost compares to nearby states:

You can see that South Carolina’s rates are not the highest or lowest, but the minimum limits are often not enough for real accidents. The true cost of a fender bender: why your auto insurance liability limits matter more than you think, especially when you add up medical bills, legal fees, and property damage.

Protect Yourself

You do not have to stick with the minimum. You can take steps to protect yourself, your family, and your money from the true cost of a fender bender: why your auto insurance liability limits matter more than you think. Here is what you can do:

Check your current insurance policy limits. Make sure you know what your coverage pays for.

Ask your agent about raising your liability limits. Many experts say you should have at least $300,000 in bodily injury and uninsured/underinsured motorist coverage.

Think about adding collision, comprehensive, and medical payments coverage. These help pay for your own car and medical bills after a crash.

Look into umbrella insurance. This extra policy helps when your regular policy limits are not enough. For example, if your auto insurance pays up to $100,000 but a settlement is $200,000, your umbrella policy pays the extra $100,000. This can save your house, savings, and future paychecks.

Update your policy if you move, add a new driver, or buy a new car.

See if you need extra coverage for rideshare driving or special equipment.

Make sure you have enough rental car and towing coverage.

Checklist for South Carolina Drivers:

Have you checked your policy limits in the last year?

Do your limits protect your money from lawsuits?

Are you covered for uninsured or underinsured drivers?

Do you have collision and comprehensive coverage for your own car?

Have you talked to a local expert like GSP Insurance Group about your options?

Remember, the true cost of a fender bender: why your auto insurance liability limits matter more than you think. Many drivers in Bluffton, Hilton Head, and Beaufort find out too late that their policy limits are not enough. Do not wait for a crash to learn this lesson the hard way.

If you want to avoid paying out of pocket, lawsuits, and stress, check your insurance policy limits today. GSP Insurance Group can help you compare choices, raise your coverage, and find the right protection for your life in the Lowcountry. Check out our guides on umbrella insurance and deductible breakdowns for more tips.

You may think a fender bender is not a big deal. But a car accident in Bluffton, Hilton Head, or Beaufort can cost more than you expect. Many people only have the lowest policy allowed. This is often not enough to pay for everything. Adding underinsured motorist coverage helps if the other driver’s insurance does not pay all the costs. Check your policy now so you are not caught off guard.

FAQ

What happens if my accident costs more than my insurance covers?

You pay the extra amount yourself. In Bluffton, Hilton Head, or Beaufort, this can mean thousands out of pocket. Higher limits or umbrella insurance can help protect you.

How do I know if my liability limits are enough for the Lowcountry?

Check your policy. Compare your limits to real accident costs in Bluffton, Hilton Head, and Beaufort. GSP Insurance Group can review your coverage and suggest the right amount for you.

Can raising my limits increase my premium a lot?

Not always. Many drivers in South Carolina find that higher limits only add a few dollars each month. You get much better protection for a small price. Learn more in our deductible breakdowns guide.