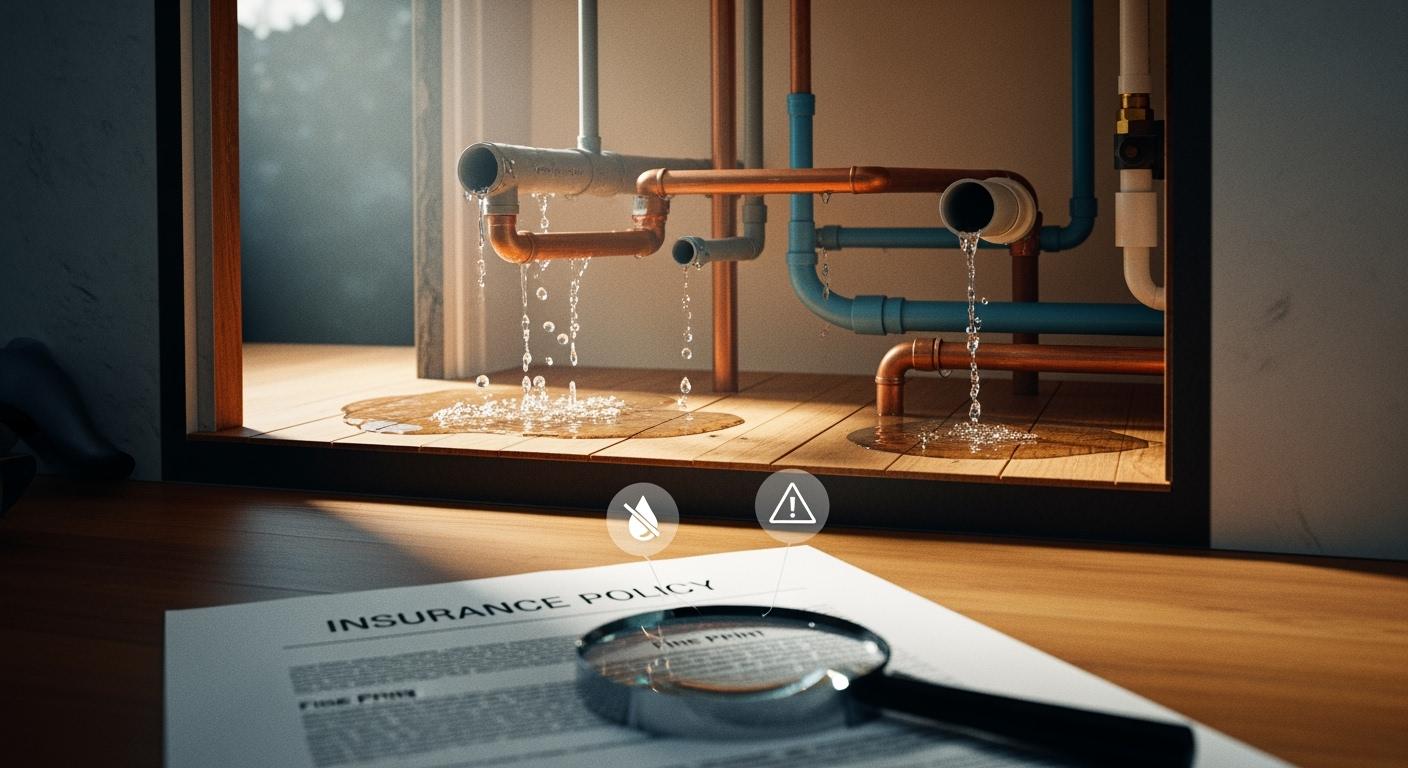

Water damage sublimits set a cap on how much your insurance will pay for certain water-related repairs. Your plumbing type can make these limits even tighter. Imagine you discover a leak under your kitchen sink in Bluffton, only to find your coverage falls short. Many homeowners face this surprise when they file a claim. You can avoid costly shocks by checking your policy and knowing your plumbing system.

If you want help reading your policy in plain English, just reach out. We’re here for you.

Key Takeaways

Water damage sublimits can lower what insurance pays for repairs. You should always check your policy to see these limits.

Some plumbing types, like polybutylene and galvanized steel, can mean less coverage. You should check your plumbing often to stop problems.

Insurance usually pays for sudden water damage. It may not pay for slow leaks. You should fix leaks fast to keep your coverage.

Mold damage is covered only if it comes from sudden water problems. You should ask your agent about mold coverage choices.

Checking your plumbing often and using water-leak sensors can stop damage. These steps may also help lower your insurance costs.

Understanding Water Damage Sublimits in Insurance

What Are Water Damage Sublimits

Water damage sublimits are the most your insurance will pay for some water problems. Many people in Bluffton, Hilton Head, and Georgia are surprised when their claim does not cover all repairs. You might think your insurance pays for everything, but sublimits can stop payments at $5,000 or $10,000. This happens even if your Coverage A dwelling limit is much higher.

Here are some important things about water damage sublimits:

The words in your policy decide what gets paid for. For example, one court said a $5,000 sublimit covered all water damage, even tear-out costs. Another court said tear-out costs were not limited. This shows you must read your policy carefully.

Sublimits can be for sudden leaks, hidden damage, or mold cleanup.

You might need extra endorsements for sewer backup or other water problems.

If you live in the Lowcountry or Coastal South, you may see these limits after a kitchen sink leak or a washing machine hose break. Many people only learn about sublimits after they file a claim.

Why Insurance Companies Use Sublimits

Insurance companies use water damage sublimits to lower risk and control costs. Water damage claims happen a lot and can cost a lot, especially with old plumbing. Insurers want to stop repeated losses, so they set strict limits and raise deductibles.

You may see these things in your policy:

Insurance companies pay a lot for water damage claims, especially those not from storms.

Insurers raise deductibles and add exclusions to protect themselves.

Homeowners with many water damage claims may have trouble getting insurance.

Some companies set deductibles as high as $50,000 for homes with old plumbing.

The age and type of your plumbing can change your coverage and make sublimits higher.

If your home has old pipes or past water damage, your insurance may have tighter sublimits or exclusions. This helps the company pay less and keeps premiums lower for everyone.

Common Triggers for Water Damage Sublimits

Some things often cause water damage sublimits in your insurance. Watch out for these common problems:

Leaks or seepage that last for weeks

Hidden water damage behind walls or under floors

Mold after water problems

Plumbing failures from old or risky pipes

Water damage in older homes without new plumbing

Here are some real examples from Bluffton, Hilton Head, and Georgia:

A Bluffton homeowner found a slow leak under the kitchen sink. The damage grew over weeks, so the insurance only paid $5,000 because of the sublimit.

In Hilton Head, a washing machine hose broke suddenly. The claim was paid up to the sublimit, and the homeowner paid the rest.

In Georgia, a family found mold after a hidden pipe leak. Their policy had a $5,000 mold sublimit, so they paid extra for cleanup.

Here is a simple table to show the difference between limited and full coverage:

Aspect | Limited Coverage | Full Coverage |

|---|---|---|

Scope of Incidents | Covers only sudden and accidental problems | May cover more events like sewer backup |

Policy Limits | Has strict money limits | Higher limits for different problems |

Cost of Premiums | Lower premiums but more out-of-pocket costs | Higher premiums but better coverage |

Add-On Endorsements | Needs extra endorsements for some problems | Often covers more things in one policy |

If your policy has a mold sublimit of $5,000, you may pay more if damage costs more than that. Always check your policy for exclusions and sublimits before you have water damage.

You can protect yourself by reading your insurance policy, knowing your plumbing type, and asking your agent about sublimits and exclusions. This helps you avoid surprises and keeps your home safe.

Plumbing Types That Affect Your Water Damage Claim

High-Risk Plumbing Materials

The pipes in your home matter when you file a water damage claim. Some plumbing materials break faster or cause bigger problems. Insurance companies know this. They set water damage sublimits or exclusions for homes with risky pipes.

Here are the main high-risk plumbing materials you should know:

Polybutylene (PB): These pipes were used from the late 1970s to the mid-1990s. They can break after only a few years. Chlorine in city water makes them weak. This causes leaks and bursts. Many people in Bluffton and Hilton Head have paid a lot to fix polybutylene pipes under slabs or behind walls.

Galvanized Steel: Homes built before the 1970s often have these pipes. They rust inside. Rust blocks water and causes leaks. Galvanized steel pipes can last 20 to 50 years. But rust can cause slow leaks that you may not notice until there is water damage.

Cast Iron Drain Lines: Older homes may have cast iron pipes. They can last up to 100 years. But they often crack or rust much sooner. Tree roots can break into these pipes. This causes sewer backups. Most insurance policies do not cover flood damage from sewer backups unless you have a special endorsement.

Aging Copper: Copper pipes last 50 to 70 years. As they get older, they can get tiny leaks. These leaks hide behind walls. This leads to slow water damage. Your policy may not cover all the damage.

Older PEX Systems: PEX is common in newer homes. But old PEX and fittings can break, especially in attics with sunlight. Some insurance companies want proof you fixed these before giving full coverage.

Tip: If your home has any of these pipes, get a plumbing inspection every year. Finding problems early can save you money and help you avoid water damage sublimits.

How Plumbing Type Impacts Your Insurance Policy

Insurance companies check your plumbing before giving coverage. Risky pipes mean more leaks and water damage. Because of this, your policy may have lower limits or exclusions for water damage.

Homes with polybutylene, galvanized steel, cast iron, or old PEX often have water damage sublimits between $10,000 and $25,000. If you have a $30,000 water damage claim, you may only get part of that money.

Homes with pipes older than 30 years may get automatic limits on water coverage. Some companies will not give you a policy unless you replace the pipes.

Many people in Georgia learn about these limits after a claim. For example, a family in Hilton Head had a washing machine leak. Their policy only paid $10,000 because they had galvanized steel pipes.

Note: Always check your policy for exclusions and water damage sublimits. Ask your agent if your plumbing type changes your coverage.

Here is a table showing how often you should check your plumbing based on your home’s age:

Property Type | Recommended Inspection Interval |

|---|---|

Recommended (under 10 years) | Every 2 years |

Established homes (10-20 years) | Annually |

Historic properties (over 50 years) | Twice yearly |

Rental properties | Before new tenants |

Vacation homes | Spring and fall checks |

Carrier Differences in Handling Plumbing Risks

Insurance companies do not all treat plumbing risks the same. You may see big differences in water damage claims depending on your pipes.

Some companies give full coverage for sudden water damage, but limit or deny claims for slow leaks.

Many policies need extra riders for sewage backup or mold. If you have cast iron pipes, you may need a special endorsement for sewer backup coverage.

Most standard policies do not cover flood damage. You need separate flood insurance for that.

Mold coverage usually has its own sublimit. You may need an endorsement to raise this limit.

Keeping records of plumbing repairs and inspections helps your claim. If you fix your pipes, save the receipts and photos.

If you do not know how your plumbing affects your water damage coverage, ask your agent for a plain-English review. Checking now can help you avoid a big surprise later.

Sudden vs. Gradual Water Damage in Your Policy

Sudden and Accidental Water Damage

Not all water damage is treated the same way. Insurance covers sudden and accidental events, but not slow leaks. If a pipe bursts or a hose breaks, your claim is usually covered. These are called “sudden and accidental” because they happen fast and without warning.

Your insurance policy says leaks must be sudden to get coverage. If water damage happens slowly, it might not count as sudden.

Here is a simple table to show the difference:

Type of Water Damage | Coverage Status |

|---|---|

Sudden Water Damage | Usually covered by home insurance |

Gradual Water Damage | Often not covered by standard insurance |

Gradual Leaks and Hidden Damage

Hidden water damage can happen without you knowing. Slow leaks behind walls or tiny holes in old copper pipes can go unnoticed for a long time. Insurance companies see these as problems you should fix, not accidents. If you file a claim for slow leaks, it may be denied or excluded.

Common reasons for denied claims include:

Old pipes or roofs wearing out

Slow leaks, even if you find them late

Not fixing small leaks when you see them

Insurance companies check if you could have found the problem. If regular checks would have found the leak, your claim may not be paid. For example, someone in Hilton Head found a slow leak after months. Their claim was denied because the damage was not sudden.

Mold Sublimits and Water Damage Claim Denials

Mold can grow after water damage. Your policy may pay for mold if it comes from a sudden event, like a burst pipe. If mold comes from a slow leak or neglect, coverage is limited or denied. Many policies set mold sublimits, sometimes at $15,000, so you pay extra if cleanup costs more.

Mold is covered if it comes from sudden water damage.

Ongoing leaks or neglect are not covered.

You can ask your agent about mold endorsements for more coverage.

Compare quotes from different companies to get better mold protection.

If you live in Bluffton, Hilton Head, or Georgia, high humidity makes mold more likely. Always check your policy for mold sublimits and exclusions. Ask your agent about endorsements if you want extra protection.

How to Protect Your Home and Insurance Policy

Spotting Water Damage Sublimits in Your Policy

It is important to know what your insurance covers before you have water damage. Many people do not notice sublimits or rules that lower how much they get paid. You can take some easy steps to help yourself:

Read the declarations page of your policy. Check how much water damage coverage you have and if there are any sublimits.

Look at the exclusions section. Find out which water problems are not covered, like floods or sewer backup.

Check for endorsements. See if you have extra coverage for things like mold or sewer backup.

Watch for special limits. Some policies only pay up to $8,000 for water damage, even if your main coverage is higher.

Remember, most regular policies do not pay for damage from floods, rising water, or storm surges.

If you see words you do not understand, ask your insurance agent for help. A quick check now can stop surprises when you file a claim.

Preventative Steps for Homeowners

You can lower your chance of water damage and keep your insurance strong. Try these simple ideas:

Get your plumbing checked often. This helps you find leaks before they get worse.

Change old supply lines every 5 to 7 years. This stops many water problems.

Put water-leak sensors near water heaters, sinks, and washing machines. These sensors warn you early and might lower your insurance cost.

Replace old pipes. Polybutylene, galvanized steel, and old copper pipes are risky.

Use materials that resist water in your home. Keep important things in waterproof boxes.

Make sure water drains away from your house. Good landscaping helps keep water out.

Have a plan for emergencies. Know what to do if you find a leak.

Many insurance companies give discounts for leak sensors. You could save up to 8% on your insurance if you use monitored sensors.

Tip: Getting your plumbing checked every year and using leak sensors can help you avoid expensive water damage and keep your insurance strong.

What to Do If Your Water Damage Claim Is Denied

If your water damage claim is denied, you still have things you can do. Try these steps:

Collect proof. Take pictures and videos of the damage right away. Save all receipts for repairs and new items.

Read the denial letter. Find out why your claim was denied.

Compare the denial with your policy. Look for mistakes or things that do not match.

Write an appeal. Tell your insurance company why you think your claim should be paid. Include all your proof.

Keep track of all calls and emails with your insurance company.

Ask your insurance agent for help or to explain things.

If you need more help, talk to a water damage lawyer.

If you are not sure what your policy covers or if your plumbing could cause lower payouts, a quick review with GSP Insurance Group can help you avoid costly surprises.

You keep your home safe when you know about water damage sublimits and your plumbing type. Checking your insurance policy and looking at your pipes helps you avoid denied claims. Many claims get denied because pipes are old or you missed repairs. Looking at your policy and checking your plumbing often helps a lot.

Doing regular checks helps you find problems early.

Insurance companies often say no to claims if you skip repairs.

Old pipes and roof issues can make your claim get denied.

A quick talk with your agent can help you avoid big costs. You can contact GSP Insurance Group for a friendly chat with no pressure.

FAQ

What does a water damage sublimit mean for my insurance claim?

A water damage sublimit is a set money limit. Your insurance pays up to this amount for water damage. If repairs cost more, you pay the extra. Always look at your policy for these limits.

How do I know if my plumbing type affects my insurance coverage?

Your insurance agent can help you check your plumbing type. Some homes have pipes that lower insurance limits. Polybutylene, galvanized steel, and old copper are risky. Ask for a review to see if you need changes.

Why did my insurance deny my water damage claim?

Insurance companies say no to claims for slow leaks. Old pipes or missed repairs can also cause denials. If damage was not sudden, you may not get paid. Read your policy and ask your agent for help if denied.

Can I increase my insurance coverage for mold or sewer backup?

You can add endorsements for mold or sewer backup. These give you higher limits for those problems. Ask your agent about options. Many people in Bluffton and Hilton Head add these for extra safety.

What steps help me avoid water damage claim problems with insurance?

Get your plumbing checked every year.

Change risky pipes.

Put in water-leak sensors.

Check your policy for sublimits.

Ask your agent about endorsements.

Save records of repairs.

A little prevention helps keep your insurance strong and your home safe.