You walk into your basement and see water everywhere. You call your insurance company, only to hear your claim is denied. Why? Water is the real risk: water-backup vs. seepage vs. flood (what’s actually covered?) can leave you confused. Water is the real risk: water-backup vs. seepage vs. flood (what’s actually covered?) matters to every homeowner. Water is the real risk: water-backup vs. seepage vs. flood (what’s actually covered?) causes headaches, and insurance claims for water are common. Water is the real risk: water-backup vs. seepage vs. flood (what’s actually covered?) leads to 1 in 60 homes filing a claim each year. Water is the real risk: water-backup vs. seepage vs. flood (what’s actually covered?)—don’t let exclusions surprise you.

Water damage claims have a denial rate of 9-10%.

Policy exclusions account for about 33% of all claim denials.

Statistic Description | Value |

|---|---|

Annual water damage claims per insured homes | 1 in 60 |

Percentage of all home insurance claims due to water damage | 27.6% |

Key Takeaways

Water backup coverage is essential. It protects against damage from water coming up through drains or sump pumps, which standard homeowners insurance usually does not cover.

Seepage is often excluded from homeowners insurance. Regular maintenance is crucial to prevent slow leaks and avoid denied claims.

Flood insurance is a separate policy. Standard homeowners insurance does not cover flood damage from rising water, hurricanes, or overflowing rivers.

Water Damage: What’s Actually Covered?

Water damage can sneak up on you in all sorts of ways. You might see water in your basement after a storm, or maybe your washing machine decides to go rogue and flood the laundry room. Not all water damage is created equal, and not all of it is covered by your homeowners insurance. Let’s break down the three main types—water-backup, seepage, and flood—so you know what’s actually protected and what needs extra coverage.

Water Backup Coverage

Water backup coverage is like a safety net for those “uh-oh” moments when water comes up from places it shouldn’t. Imagine you’re relaxing on a rainy Saturday, and suddenly your sump pump fails. Water starts backing up into your basement, soaking your carpet and boxes of family photos. Standard homeowners insurance usually doesn’t cover this kind of damage. That’s where water backup insurance steps in.

Water backup coverage is an optional add-on for your homeowners policy. It helps pay for damage caused by water backing up through sewers, drains, or sump pumps. This coverage is especially important if you live in areas with older plumbing or frequent storms—like Bluffton, Hilton Head, or anywhere in the Lowcountry.

Here’s what water backup insurance typically covers:

Sewer backups into your home’s drains or toilets

Sump pump overflows during heavy rain

Internal plumbing backups that force water up through fixtures

You might see coverage for sudden plumbing leaks from burst pipes, accidental overflows from appliances, and water damage from firefighting efforts. These are usually covered by standard homeowners insurance, but water backup insurance fills the gap for those messy, unexpected backups.

Mini-Takeaway: Water backup coverage protects you from damage caused by water coming up through drains, sewers, or sump pumps. Standard homeowners insurance doesn’t cover this, so adding water backup insurance is a smart move.

Worried about water backup? Get a quote for water backup coverage today! Protect your home with GSP Insurance Group.

Seepage Exclusion

Seepage sounds harmless, but it can cause big headaches. Insurance companies see seepage as a slow, sneaky problem—water that seeps through your foundation, walls, or roof over time. They usually call this a maintenance issue, not a sudden accident. That means standard homeowners insurance won’t cover damage from seepage.

Let’s say you notice a damp spot in your basement that keeps getting bigger. You find out groundwater has been slowly seeping through the concrete for months. Unfortunately, this kind of water damage insurance claim will likely get denied. Insurers expect you to keep up with home maintenance and repairs.

Here’s a quick look at what’s excluded under seepage clauses:

Exclusion Type | Description |

|---|---|

Flood and Surface Water | Tidal waves, overflow from lakes or rivers, spray from these sources |

Sewer Backup | Water that backs up through sewers or drains |

Sump Pump Overflow | Water discharged from sump pumps or related equipment |

Groundwater | Water below the surface that seeps or flows through structures |

Waterborne Material | Material carried by the aforementioned types of water |

Water Penetration | Damage from water penetrating roofs or walls unless caused by a covered peril |

Insurance companies will look at the source of the water damage. If it’s sudden and accidental, you’re usually covered. If it’s gradual, like seepage, it’s considered a maintenance issue.

Mini-Takeaway: Seepage is usually excluded from homeowners insurance. Regular maintenance is key to preventing these slow leaks and avoiding denied claims.

Not sure what’s covered? Schedule a free policy review with GSP Insurance Group and get peace of mind. Book your review now!

Flood Insurance

Flooding is a whole different ballgame. Standard homeowners insurance does not cover flood damage. The National Flood Insurance Program (NFIP) defines a flood as water covering two or more properties or acres of normally dry land. Causes include overflowing rivers, tidal surges, flash flooding, mudflows, and land collapse due to heavy waves or currents.

Let’s picture a hurricane rolling through Hilton Head. Water rises, rivers overflow, and your home ends up underwater. Without flood insurance, you’re on your own for repairs. Flood insurance is a separate policy that covers damage from hurricanes, storm surges, overflowing lakes and rivers, groundwater seepage, and flash flooding.

Here’s a quick table showing what flood insurance covers vs. homeowners insurance:

Type of Water Damage | Covered by Flood Insurance | Covered by Homeowners Insurance |

|---|---|---|

Hurricanes and Storm Surges | Yes | No |

Overflowing Rivers and Lakes | Yes | No |

Groundwater Seepage | Yes | No |

Flash Flooding | Yes | No |

Most homeowners think their regular insurance covers flood damage, but that’s a common misconception. According to FEMA, only 4% of homeowners nationwide have flood insurance, even though flooding is a risk for almost everyone.

Mini-Takeaway: Flood insurance is a separate policy. Standard homeowners insurance does not cover flood damage from rising water, hurricanes, or overflowing rivers.

Live in a flood-prone area? Protect your home and savings with flood insurance. Get your flood insurance quote from GSP Insurance Group.

What’s Actually Covered by Standard Homeowners Insurance?

Here’s a quick list of water damage scenarios usually covered by standard homeowners insurance:

Wind-driven rain

Damage from a tree falling on your roof

Accidental discharge or overflow of water or steam

Damage from snow and ice dams

Damage from putting out a fire

Mold and mildew (when caused by covered water damage)

Malicious activity or vandalism

But remember, insurance companies often deny claims for pre-existing damage, lack of documentation, or policy exclusions. Always report water damage quickly and keep good records.

Tip: Review your policy and talk to your agent about adding water backup coverage or flood insurance. It’s the best way to avoid surprises and keep your home protected.

Understanding Your Coverage and Local Risks

Local Risk Factors

Living in the Lowcountry means you face unique challenges when it comes to water damage. Bluffton, Hilton Head, and surrounding areas deal with heavy rain, tidal flooding, and aging infrastructure. Coastal marshlands and rising sea levels add to the risk. Take a look at how these factors stack up:

Local Risk Factors for Water Damage | Description |

|---|---|

Coastal marshlands | Contributes to high humidity and flooding risks. |

Tidal flooding | Increases the likelihood of water damage during high tides. |

Rising sea levels | Leads to more frequent and severe flooding events. |

Low-lying areas | Particularly vulnerable during hurricanes or king tides. |

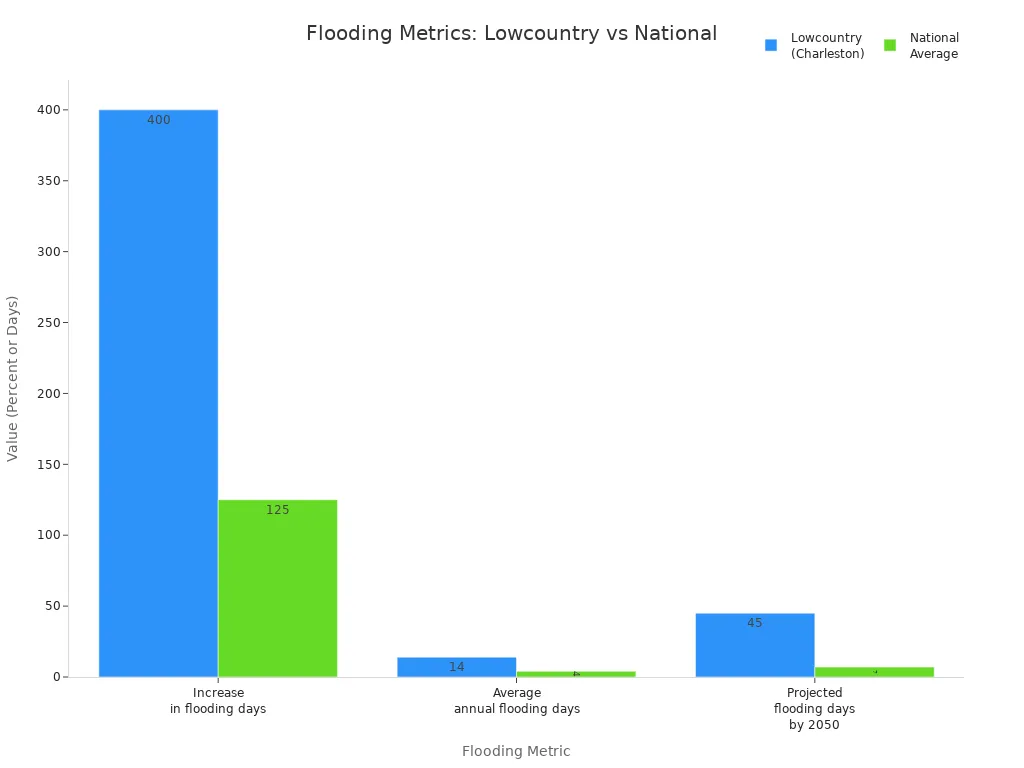

Flooding days in the Lowcountry far exceed the national average. Check out this comparison:

Metric | Lowcountry (Charleston) | National Average (2020) |

|---|---|---|

Increase in flooding days | 400% | 100-150% |

Average annual flooding days | 14 days | 4 days |

Projected flooding days by 2050 | 45-85 days | 7-15 days |

Protecting Your Home

You can prevent water backups and reduce the risk of damage with a few smart moves. Regular maintenance goes a long way. Try these tips:

Clean gutters often to keep water flowing away from your home.

Inspect pipes for cracks and leaks.

Schedule plumbing inspections to catch problems early.

The best protection against water damage is prevention. Stay vigilant for ongoing problems and set a regular maintenance schedule for cleaning gutters, inspecting pipes for cracks and leaks, and getting plumbing inspections to prevent future water damage repairs.

Thinking about extra coverage? Here’s how you can add water-backup or flood insurance:

Contact an independent insurance agency like GSP Insurance Group to discuss options.

Decide on coverage based on your home’s risks and budget.

The agency prepares the endorsement form for your policy.

Watch for waiting periods before coverage starts.

Review your policy documents to understand your coverage and exclusions.

Ready to protect your home? Get a quote for water-backup or flood insurance with GSP Insurance Group. Start here.

Reviewing Your Policy

Understanding your coverage means knowing what’s excluded and where gaps might exist. Many homeowners discover that flood damage, sewer backups, and mold remediation need extra endorsements. You should review your policy at least once a year, especially after renovations or changes in your home’s value. Consulting with an insurance professional helps you avoid costly surprises and ensures you have the right protection.

Review your policy annually.

Ask about exclusions and coverage gaps.

Get expert advice from GSP Insurance Group.

Not sure if you’re covered for water damage? Schedule a free policy review with GSP Insurance Group. Book your review now!

You want to avoid costly surprises from basement seepage or sudden and accidental water damage. Reviewing homeowner insurance policies helps you understand what insurance coverage protects and what exclusions leave you exposed. Take action now—don’t let denied claims or uncovered damage drain your savings.

A Partner for Your Journey: GSP Insurance Group helps you navigate water damage policies, flood policy options, and basement seepage risks. Get expert advice and peace of mind. Request your coverage review today!

Financial Consequence | |

|---|---|

Lack of Maintenance | Claims likely denied, leading to out-of-pocket repair costs |

Gradual Leaks | Considered maintenance issues, resulting in significant expenses |

Homeowner Responsibility | Neglect leads to non-coverage, increasing financial burden |

FAQ

What is the difference between water backup and flood damage?

Water backup happens when water comes up through drains or sump pumps. Flood damage comes from rising water outside, like heavy rain or overflowing rivers.

Does homeowners insurance cover all types of water damage?

No, homeowners insurance covers sudden and accidental water damage, like burst pipes. It does not cover flood damage or slow seepage. You need extra coverage for those.

How can I make sure my home is fully protected from water damage?

Review your insurance policy every year. Add water backup and flood insurance if needed. Talk to an agent for advice on your specific risks.

Want peace of mind? Get a free water damage coverage review with GSP Insurance Group. Book yours now!

See Also

Uncovering The $8,000 Secret: The Importance Of Gap Insurance