Picture this: your friend steps onto your porch after a Lowcountry oyster roast or maybe slips near your pool. Sometimes, an unsecured pool or a quick golf cart ride can lead to an accident. When a Friend Gets Hurt at your house, you might wonder who pays for their medical bills.

Quick Answer:

If you caused the accident, liability coverage steps in. Medical payments to others can help even if you’re not at fault. An umbrella policy gives extra protection when costs go above your regular limits.

GSP Insurance Group stands with you as your neighbor and expert, ready to help you make sense of your options.

Key Takeaways

Liability coverage helps pay medical bills if you are responsible for a friend’s injury at your house. Medical payments coverage (MedPay) pays for small injuries to guests, no matter who is at fault. This makes it easier to deal with minor accidents. Umbrella insurance gives extra protection beyond your homeowners policy. It covers bigger claims and helps protect your savings. Always take photos and get witness information if an accident happens. This helps with any future insurance claims. Check your insurance policy often to make sure it fits your needs. This is important if you have parties or risky things like pools.

Liability and Medical Payments for Injured Guests

If a friend gets hurt at your house, you may worry. You want to know what your homeowners insurance will do. Your policy has two main parts that can help. These are liability coverage and medical payments, also called MedPay. Let’s look at what each one does, how they work, and when you might use them.

What Is Liability Coverage?

Liability coverage helps if someone says you caused their injury or property damage. This is called personal liability coverage. If a guest slips on your porch after a rainy day oyster roast, or if a golf cart ride ends with a bump or bruise, liability coverage can help pay for their medical bills. It can also help with lost wages or legal costs if they sue you.

Here’s what liability coverage does for you:

It pays if you are legally responsible for someone’s injury or property damage.

It covers bodily injury, like a broken arm, and property damage, like a broken phone.

It helps pay for legal defense costs if someone sues you.

Liability coverage does not cover everything. Most policies do not cover:

Intentional acts, like hurting someone on purpose

Business or rental activities

Injuries from using motor vehicles, boats, or aircraft

Some types of personal injury, like communicable diseases

Here’s how this works in the Lowcountry. If a neighbor trips over a loose board on your dock, or a guest’s child falls by your pool, liability coverage helps if you were negligent. This means you did not fix the board or left the pool gate open.

How Medical Payments Work

Medical payments coverage, or MedPay, is a bit different. MedPay pays for small medical bills if someone gets hurt at your house, even if it was not your fault. This helps keep things friendly and easy.

For example, if a friend cuts their hand shucking oysters at your backyard roast, or a child scrapes a knee running on your pool deck, MedPay can help pay for the urgent care visit or bandages. You do not have to prove you did anything wrong.

Here’s a quick look at the differences:

Aspect | Medical Payments Coverage | Liability Coverage |

|---|---|---|

Coverage Limits | $1,000 to $5,000 | $100,000 to $500,000 |

Fault Consideration | No | Yes |

Types of Injuries Covered | Minor injuries | Major injuries |

Covers Property Damage | No | Yes |

Covers Legal Bills | No | Yes |

Typical Coverage Limits

Most homeowners policies in South Carolina have these average limits:

Coverage Type | Average Limits |

|---|---|

Personal Liability | |

Medical Payments (MedPay) | $1,000 to $5,000 |

You can pick higher limits for more protection. If you want to see how your policy compares, check out our Buyer’s Guide to Bluffton, Hilton Head, and Beaufort Home Insurance.

When Each Applies

So, when does each type of coverage help you? Here’s a simple guide:

Medical Payments: Pays for small injuries to guests, no matter who was at fault. Good for quick, small claims, like a scraped knee at your pool or a cut finger at your oyster roast.

Liability: Helps with bigger claims if you are found negligent. Think of a friend who gets badly hurt at your house, or if a golf cart accident leads to a lawsuit. Liability coverage helps with medical bills, legal fees, and damages.

Not sure what your policy would do here? Request a quick review.

Both types of coverage help protect your friendships and your money. A good policy gives you peace of mind, so you can enjoy time with friends and neighbors.

Real Scenarios When a Friend Gets Hurt

Accidents can happen very fast. This is true when you have friends over. In the Lowcountry, these things happen often. Let’s see what happens if a friend gets hurt. We will look at common situations. We will also see how your homeowners insurance helps.

Slip and Fall Injuries

A friend might slip on your porch steps after rain. Someone could trip over a rug at a holiday party. These are common ways people fall in homes:

Wet floors

Uneven walkways

Bad lighting

Loose rugs

Weather problems

If a friend gets hurt like this, personal liability coverage may help. It helps if you were careless, like not fixing a broken step. Medical payments coverage helps with small bills. It helps even if you did nothing wrong. If a tree falls and breaks a neighbor’s stuff, check our Tree/Neighbor Claims Guide.

Cuts and Minor Accidents

Oyster roasts and BBQs are fun in the Lowcountry. But sharp knives and hot grills can cause small injuries. If a friend gets a cut or burn, medical payments coverage helps. It pays for urgent care or stitches. Sometimes, insurance companies ask if the accident happened at your house. They may offer a quick, small payment. A good policy helps you feel safe. It also helps keep your friendships strong.

Child Injuries on Your Property

Kids love to run and play. If a child gets hurt at your house, medical payments coverage helps. It pays for small injuries. If the injury is bad and you were careless, liability coverage may help. Homeowners policies do not cover injuries from trampolines or risky play equipment. Always check your policy details.

Golf Cart and Community Mishaps

Golf carts are popular in the Lowcountry. But accidents can happen. Here are common golf cart claims:

Type of Claim | Description |

|---|---|

Accident Coverage | Pays for crashes with cars or things |

Weather-Related Damage | Pays for damage from storms or floods |

Theft and Vandalism | Pays if your cart is stolen or damaged |

Personal Injury Protection | Pays medical bills for people hurt in golf cart accidents |

If a golf cart accident happens at your house, personal liability coverage may help. Sometimes, a special endorsement helps with injury or damage.

Are you hosting soon? Make sure your coverage fits your needs. Get a quick review.

A good homeowners policy protects you in these real-life moments.

Homeowners Insurance Exclusions

Not every accident at your house is covered. You should know what your policy does not include. Here are some common exclusions in South Carolina.

Rental and Business Use

If you rent your home or use it for business, your regular policy may not help if a guest gets hurt. When you rent out your home, it is seen as a business. Most homeowners insurance does not cover injuries to guests during a short-term rental or business event. You might need extra or special insurance for these times.

Short-term rentals can leave you with less protection.

Business activities at home need their own insurance.

Intentional or Expected Injury

Your policy does not pay for injuries you cause on purpose. If you mean to hurt someone, or expect harm, your insurance will not pay. Courts look at what you meant and what you did. The rule is simple: insurance helps with accidents, not things you meant to do.

Both the act and the intent to harm must be shown for this exclusion.

The insurer must prove you wanted the injury to happen.

Animal and Dog Exclusions

Dog bites and animal injuries can cost a lot. Some policies cover dog bites, but not all breeds or situations. If your policy leaves out certain animals, you may have to pay if your dog hurts a guest. Always check your policy for breed rules or animal exclusions.

What to Check | Why It Matters |

|---|---|

Dog breed list | Some breeds may not be covered |

Animal history | Past bites may limit coverage |

If you have a pool, trampoline, or other things that attract kids, learn about attractive nuisance risks.

Injured Workers on Your Property

If you hire someone to work at your house, like a nanny or landscaper, your policy may not cover their injuries. Workers’ compensation insurance is the best way to protect against these claims. Some policies help with injuries to full-time staff, but not always. Ask your agent what your policy covers for paid workers.

Tip: Always ask about exclusions before you file a claim. A good policy helps you feel safe.

Other common exclusions in South Carolina:

Earth movement (earthquakes, sinkholes)

Mold from leaks or bad upkeep

Intentional loss or fraud

Pest damage (termites, rodents)

Normal wear and tear

Flood damage (needs its own policy)

Some hurricane or storm losses

Want to learn more? Check our guides on tree claims, flood insurance, and attractive nuisances for more details.

Umbrella Insurance for Injured Guests

How Umbrella Coverage Works

Sometimes, a bad accident at your house can cost a lot. Your homeowners insurance might not pay for everything. Umbrella insurance helps when your regular coverage is not enough. It gives you more protection if your personal liability limit is reached. Umbrella insurance can help pay for medical bills, legal costs, or damages if a guest gets badly hurt and the claim is bigger than your main policy covers.

Here’s a simple chart to show the difference between umbrella insurance and a regular policy:

Feature | Standard Homeowners Policy | Umbrella Insurance |

|---|---|---|

Coverage Scope | Limited scenarios | Broader, includes personal injury |

Coverage Limits | Lower limits | $1 million or more |

Global Protection | No | Yes |

Umbrella insurance gives you at least $1 million in extra coverage. It even protects you in other countries. It also covers things like slander or libel, which most homeowners policies do not. Want to know more? Check out our Umbrella Insurance Guide.

Thinking about umbrella insurance? Ask GSP.

Example of a Large Claim

Let’s say you have a family reunion at your house. A guest falls on your porch and gets badly hurt. The total claim is $600,000. Your homeowners policy pays up to $200,000. Without umbrella insurance, you would have to pay $400,000 yourself. With umbrella coverage, you do not have to worry about losing your savings or your house.

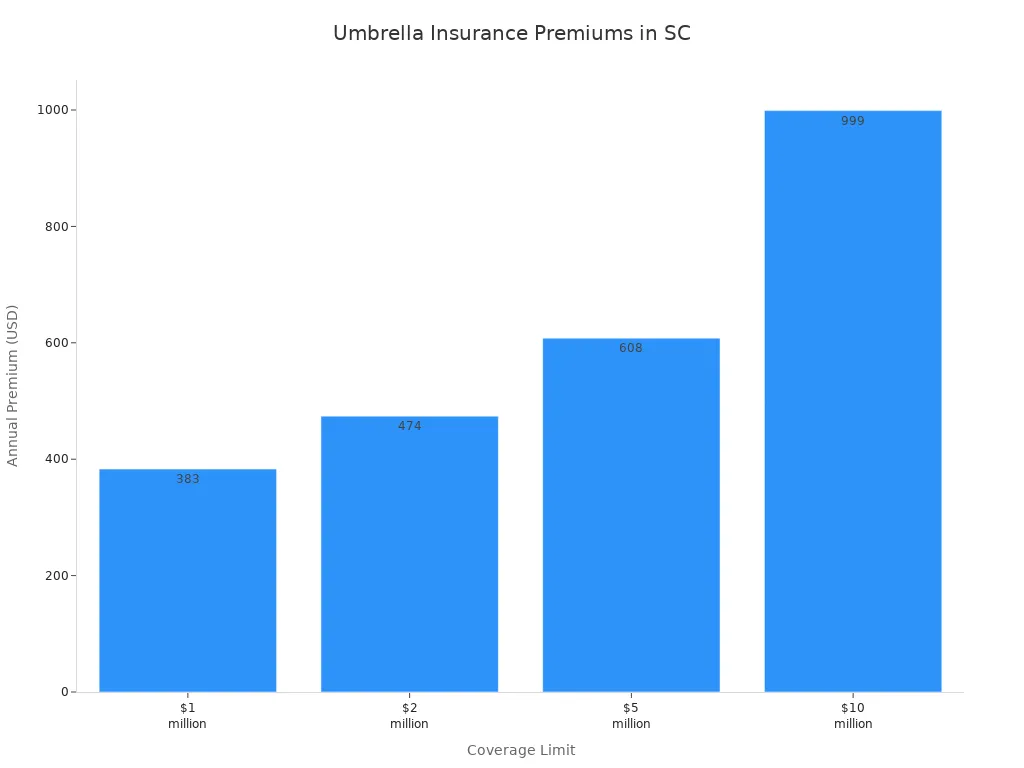

Cost and Benefits

Umbrella insurance gives you a lot of protection for a small cost. In South Carolina, $1 million in coverage costs about $383 to $563 each year. You can get higher limits if you want more protection.

Coverage Limit | Annual Premium |

|---|---|

$1 million | $383–$563 |

$2 million | $474–$713 |

$5 million | $608–$933 |

$10 million | $999–$1,578 |

Here are some reasons why people in the Lowcountry pick umbrella insurance:

Gives extra protection when you need it most

Covers more claims, like personal injury and slander

Helps keep your money and friendships safe

A good policy with umbrella insurance helps you feel ready for anything. You can spend time with friends and not worry, because you have strong protection.

What to Do If a Guest Is Injured on Your Property

Accidents can happen very quickly. A friend might slip on your porch. A neighbor could get a small cut at your oyster roast. If someone gets hurt at your house, you should stay calm. You need to handle things the right way. Here is a simple guide to help you protect your guests, your friendships, and your peace of mind.

Ensure Safety and Medical Care

Safety comes first. If a friend gets hurt, do not panic. Check if the area is safe for everyone. If the injury is serious, call for medical help right away. For small injuries, give first aid or help your guest get to urgent care.

Tip: Do not say you are sorry or admit fault. Just help your guest and make sure they get the care they need.

Document and Gather Evidence

Once your guest is safe, start collecting information. Good notes help if you need to file a homeowners insurance claim later.

Take clear photos of where the injury happened.

Write down the date, time, and what happened.

Ask people who saw it for their statements and contact info.

Save any security camera video that shows the accident.

Keep a written record of what happened and any talks you had.

These steps help show what happened. They also protect you if someone asks about negligence or premises liability.

Notify Your Insurance Agent

Call your insurance agent as soon as you can after the accident. Acting fast helps start the claims process. It also keeps your coverage in good shape. Your agent will tell you what to do next. They will answer questions about personal liability coverage. They will also explain what your policy covers.

Note: Report the accident quickly. Waiting too long can hurt your claim or your homeowners insurance protection.

Review Your Coverage

After an accident, look over your policy. Make sure you know your coverage limits and what your policy covers. Here is a quick table to help you know what to check:

Aspect of Coverage | Description |

|---|---|

Coverage Limits | Check if your policy covers enough—most range from $100,000 to $500,000. |

Additional Coverage | If you rent out your home, you may need extra protection for guests. |

Personal Liability Coverage | This helps pay for costs if a guest is injured, including medical bills and legal fees. |

If you see gaps or have questions, talk to your agent. They can help you change your policy for better protection.

Want a handy checklist? Download our free “Guest Injury Response Checklist” or talk with a local GSP Insurance Group agent. We want to help you keep your home, your friendships, and your money safe.

Building Comprehensive Homeowners Insurance Protection

You want your home to be safe for everyone. A good policy helps you feel calm, even if something bad happens. Here are ways to make your Lowcountry home safer.

Increase Liability and MedPay Limits

First, look at your current coverage limits. Many people pick higher limits for liability and medical payments. This helps if a big accident happens, like a bad fall or golf cart crash. Higher limits mean more help if someone gets hurt. Personal liability coverage keeps your savings and house safe if a claim costs a lot.

Confirm Endorsements for Risks

Every house is unique. You might need extra endorsements for special risks. Here are some choices for Lowcountry homeowners:

Ask your agent about endorsements for pools, golf carts, or expensive things. These add-ons help you get better protection.

Consider Umbrella Coverage

Sometimes, a big accident costs more than your main policy pays. Umbrella coverage helps when you reach your policy limit. It gives you extra safety and protects your money from large claims. Here’s what umbrella coverage does:

Gives extra protection above your home and auto policies

Handles claims that could take your savings

Offers higher limits and more protection than standard policies

Covers accidents, injuries, or damage that go past your main policy

Match Coverage to Your Lifestyle

Your life changes, so your insurance should change too. Think about your home, hobbies, and guests. Here are some tips:

Add medical payments coverage for quick help with guest injuries

Schedule valuable items to make sure they’re covered

Update your policy when you buy new things or make big changes

Review your coverage if you host parties, have a pool, or use a golf cart

High-net-worth homeowners should check their insurance every year

Want to make sure your policy fits your life? Contact GSP Insurance Group for a friendly, local review. We’ll help you protect what matters most.

Good homeowners insurance does more than save your money. It helps you stay friends with neighbors. A strong policy gives you support in many ways:

Loss of use coverage pays for your living costs if your house needs fixing.

Personal liability coverage protects you from big bills if someone gets hurt.

Medical payments coverage helps pay for guest injuries and keeps things friendly.

Service Type | What It Does |

|---|---|

Homeowner’s Policy | Covers your home and guest injuries |

Umbrella Policy | Gives extra help for big claims |

In the Lowcountry, neighbors always help each other. Make sure your policy does the same. Want a fast, local review? Connect with GSP Insurance Group.

FAQ

What should you do first if a guest gets hurt at your house?

Stay calm. Make sure your guest is safe. Call for medical help if needed. Give first aid if you can. Do not admit fault. Focus on helping your guest feel comfortable.

Does your homeowners insurance cover injuries from golf cart accidents?

Your policy may help if the accident happens on your property. Some golf carts need special coverage. Ask your agent if your policy includes golf cart protection for injuries or damage.

Will your insurance pay if a friend trips during a backyard oyster roast?

Yes, if you have liability or medical payments coverage. Liability helps if you were careless. Medical payments can help with small bills, even if you did nothing wrong. Check your policy for details.

Can you increase your coverage after an accident happens?

No, you cannot raise limits after an accident. You need to set the right coverage before something goes wrong. Review your policy each year to make sure you have enough protection.

What if your dog bites a guest?

Some policies cover dog bites, but not all breeds or situations. Check your policy for animal exclusions. If you have questions, ask your local agent for help.