Short-Term Rental? Long-Term Lease? Make Sure You Have the Right Policy to protect your property. If you’re a landlord switching from short-term rentals to long-term leases, it’s important to understand that each rental type carries different financial and legal risks. Make sure you know what your property requires and carefully review every short-term rental agreement to avoid costly mistakes.

Key Takeaways

Short-term and long-term rentals have different risks. They need different insurance to protect your property and money.

Short-term rentals need special insurance. This covers guest damage, liability, and lost income. Long-term rentals usually need standard landlord insurance. Sometimes, you may need extra coverage.

Always tell your insurance company how you use your property. Check your policy often. This helps you avoid gaps in coverage and keeps you protected.

Short-Term vs Long-Term: Key Differences

Rental Types Overview

It is important to know how short-term and long-term rentals are not the same. The biggest differences are how long people stay, how often new tenants move in, and how you use the property. Look at the table below to see these differences:

Aspect | Short-Term Rentals | Long-Term Rentals |

|---|---|---|

Lease Duration | Daily, weekly, or monthly basis | Usually 12 months or more |

Tenant Turnover | More frequent turnover, higher vacancy rates | Lower turnover, consistent occupancy |

Property Use | Fully furnished with amenities for temporary stays | Often unfurnished or semi-furnished for stable residence |

Short-term rentals are used by vacationers or people on business trips. Long-term rentals are for people who want a place to live.

Profitability and Management

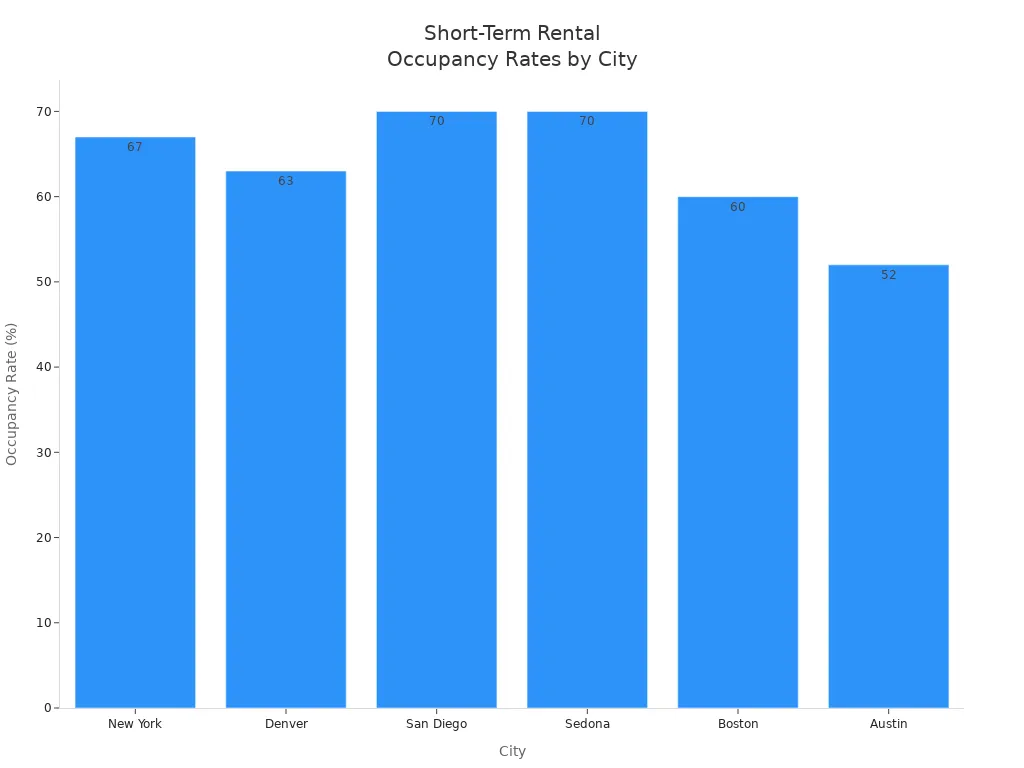

Short-term rentals can make more money during busy times. But you might have empty rooms when it is slow. For example, in places like San Diego and Sedona, short-term rentals are filled about 60% to 70% of the time. How much you earn can change with the season or local events.

Short-term rentals need more work. You have to check in guests, clean, and fix things often. You also need to watch for damage and change prices when needed. Long-term rentals do not need as much daily work. But you still must keep the property nice and be fair to tenants.

Legal and Compliance

Short-term rentals have more rules in many cities. You might need special permits, business licenses, and inspections. Some places make you collect hotel or tourist taxes from guests. Homeowners associations can also have rules about short-term rentals.

Tip: Short-term rentals often need commercial insurance because standard landlord policies may not cover business use.

Long-term rentals have fewer rules to follow. You still must obey safety laws and local codes. But you usually do not need special permits. Standard landlord insurance is often enough, but always check your policy.

Short-Term Rental? Long-Term Lease? Make Sure You Have the Right Policy

Unique Risks

Owning a rental property means you face different risks. The risks depend on if you have short-term or long-term tenants. Short-term rentals, like vacation homes or Airbnb, have many new guests. This means more chances for damage or accidents. You might lose money if something goes wrong. Your furniture and appliances can get worn out faster. Guests may not care for your place like long-term tenants do.

Some common risks with short-term rentals are:

Guests getting hurt, like slipping or falling

Accidents in pools or hot tubs

Fires from cooking or bad wiring

Damage to stairs or gym equipment

Legal trouble if a guest gets injured

You also need to think about business use exclusions. Regular homeowners insurance does not cover business use. If you run a short-term rental, your policy might not pay for guest injuries or damage. Even landlord insurance for long-term leases often does not cover short-term guests or business problems.

Note: If you have a short-term rental or a long-term lease, you need the right policy. This protects you from these special risks. Special short-term rental insurance covers guest stays, business problems, and lost income if your place is damaged.

Long-term rentals have their own risks too. You might have damage from tenants, unpaid rent, or legal fights. But these risks are easier to guess because you have fewer people moving in and out. Standard landlord insurance usually covers damage, liability, and lost rent for long-term leases.

Coverage Gaps

Short-term rental or long-term lease, you need the right policy. If not, you could have big coverage gaps. Many landlords do not know that the wrong insurance leaves them unprotected. Here are some common gaps:

No help if you lose rent when your place can’t be used

Not enough coverage for injuries during a guest’s stay

No coverage for your own furniture or appliances

No help with legal costs for tenant problems or evictions

No coverage when your place is empty between guests or tenants

If you use regular homeowners insurance for a short-term rental, your claim might get denied. Homeowners insurance is for your main home, not rentals. It does not cover business use or lost income. Landlord insurance for long-term leases helps some, but it may not cover all the money you make from short-term rentals. Loss of Rents coverage in landlord policies is often limited and may not match what you really lose.

Short-term rental or long-term lease, you need the right policy for your rental type. Special short-term rental insurance pays for lost income based on your bookings. It also covers guest damage, liability, and cancellations. Platform protections, like Airbnb’s AirCover, help a little but do not replace real insurance.

Tip: Always tell your insurance company how you use your property. If you do not say you have a short-term rental, your claim could be denied. If you switch from long-term to short-term rental, update your policy right away.

Short-term rental or long-term lease, you need the right policy for your property. GSP Insurance Group can help you check your coverage, explain your choices, and protect your property.

Short-Term Rental Policies

Short-Term Rental Agreement

A good short-term rental agreement keeps you and your property safe. Every vacation rental agreement should have important details. Write down the full names and contact info for all adult guests. Say when guests check in and check out. Set how many people can stay, based on safety and insurance. List all fees, like security deposits and payment rules. Explain when you can keep a deposit if there is damage. Add a clear cancellation policy and when guests get refunds. Write house rules about noise, pets, and smoking. Tell guests what chores they must do and how to report problems. Include rules about who pays for damage or injuries. Suggest that guests get travel or renters insurance. Always give emergency phone numbers. Your short-term lease agreement must follow state laws and platform rules. A detailed agreement lets you ask for payment if guests break things or cancel bookings if they break rules. Liability and indemnification rules help protect you and your guests.

Specialized Insurance

Standard landlord insurance does not cover all vacation rental risks. You need special insurance for your short-term rental. These policies protect you from damage by guests, frequent guest changes, and business use. Some companies offer commercial homeowners policies for short-term rentals. These policies cover guest damage, liability, lost income, and even problems like bed bugs or squatters. Special insurance fills the gaps that regular landlord policies miss and matches your short-term lease agreement needs.

Guest Liability

Guest liability is a big worry in any short-term rental agreement. Common claims are slip-and-fall accidents, pool injuries, dog bites, and fire dangers. Your short-term lease agreement should talk about these risks. Short-term rental insurance pays for lawsuits, legal bills, and settlements if a guest or neighbor gets hurt. It also protects you from claims about noise, theft, or illegal acts. By using the right rental policies and lease agreement, you lower your risk and keep your property safe.

Long-Term Lease Policies

Standard Coverage

If you own a long-term rental, you need the right insurance. This helps protect your property and money. Most long-term rental policies give you several types of coverage:

The building is protected from fire, lightning, wind, hail, ice, and snow.

Liability coverage pays if someone gets hurt on your property. It also covers legal and medical bills.

Loss of rent coverage helps if your place can’t be lived in after a covered event.

Your appliances or tools, like a lawnmower or fridge, are covered if you leave them for tenants.

Standard policies do not cover flood or earthquake damage. You must buy extra insurance for those. The price of your policy depends on where your property is, its condition, and how much coverage you want. These policies do not cover your tenants’ things. You should tell your tenants to get renters insurance for their own stuff.

Add-Ons

You can add more protection to your long-term rental policy. Many landlords pick these popular add-ons:

Vandalism coverage pays for damage caused by people.

Flood insurance or sewer backup coverage helps with water problems.

Earthquake insurance is good for places that might have quakes.

Rent guarantee insurance helps if tenants stop paying rent.

Ordinance and law coverage pays for repairs to meet new rules.

Personal property coverage protects your own furniture or appliances.

Endorsements cover sheds, garages, or other extra buildings.

Some landlords bundle their policies or get umbrella insurance for more liability protection. These add-ons help you deal with surprises and keep your lease working well.

Tenant Management

Good tenant management helps you avoid many insurance claims. If you check tenants carefully, you lower the risk of damage, late rent, or legal trouble. You should look at backgrounds, credit, jobs, and references before renting. Insurance companies notice when you manage tenants well. They may give you better prices or terms for your policy. Bad tenant management can make your insurance cost more or even get canceled. Regular inspections and clear lease rules help stop problems like leaks, fire dangers, or changes you did not allow. If you stay involved, you protect your rental and keep insurance costs low.

Comparing Policies

Coverage Differences

It is important to know how these insurance policies are not the same. Each one protects your property in its own way. Look at this table to see the main differences:

Aspect | Short-Term Rental Insurance | Long-Term Rental Insurance |

|---|---|---|

Rental Duration | Less than 6 months, many renters each year | 6 months or longer, stable tenants |

Property Coverage | Broad coverage for frequent guest damage | Focused on building structure |

Liability Coverage | Protects against guest injuries and accidents | Protects against tenant or visitor injuries |

Income Loss Protection | Pays if you lose income from canceled bookings | Pays if you lose rent when property is unlivable |

Policy Flexibility | Highly customizable for unique needs | More stable, like homeowner’s insurance |

Tenant Belongings Coverage | Not covered | Not covered |

Risk Profile | Higher risk from guest turnover | Lower risk from steady tenants |

Examples | Airbnb, VRBO, vacation homes | Year-long residential rentals |

Short-term rentals need flexible insurance. This is because you have lots of guests. There are more chances for things to get broken. Long-term rentals are more steady. The insurance is mostly for the building and regular rent.

Deductibles

A deductible is what you pay before insurance helps. You should check your policy for this amount. If your property is near the coast or in a risky area, you might have special deductibles. These can be for hurricanes or wind and hail. Sometimes, these deductibles are higher than normal. Living near the coast means extra risks. You could have floods, storms, or rising water. Insurance companies might charge more or change your coverage. You can make your property safer by raising it up or using materials that do not get ruined by water.

Tip: Always ask your agent about hurricane or wind/hail deductibles. These can change what you pay after a storm.

GSP Insurance Group can help you look at your policy. They can explain what is covered. They will help you get the right protection for your rental, no matter where it is.

Policy Review and Next Steps

Assess Your Needs

Start by looking at how you use your property. If you switch between short-term and long-term rentals, your insurance needs change. Follow these steps to make sure you have the right protection:

Tell your insurance company when you change your rental strategy. This helps you avoid coverage gaps.

Check if your current policy covers short-term or long-term rentals. Many homeowner policies do not cover business use.

Think about extra coverage for natural disasters, lost rent, or damage to your property.

Look at your property’s age, location, and number of units. These factors affect your insurance rates.

Ask your tenants to get renters insurance. Your policy does not protect their belongings.

Compare different insurance companies and policies. Find one that matches your property’s risks.

Tip: If you rent your property often or for short stays, you may need commercial insurance. This gives you better protection for guest-related risks.

Update Your Policy

You should review your insurance policy at least once a year or when you make big changes to your property. This keeps your coverage up to date with your property’s value and how you use it. If you add new features, like a pool or security system, tell your insurance agent. These changes can affect your coverage and rates. Regular reviews help you spot gaps before they become problems.

Get Expert Help

Insurance can feel confusing, but you do not have to figure it out alone. An insurance expert can help you compare policies, find discounts, and choose the right coverage for your property. Experts know about special risks in your area, like hurricanes or floods. They can explain what your policy covers and what it does not. When you work with GSP Insurance Group, you get advice that fits your property and your needs. This helps you avoid costly mistakes and keeps your investment safe.

Call GSP Insurance Group today for a policy review or a quote. Protect your property and your peace of mind.

Choosing the right insurance protects your property and income. Review your short-term rental agreement often. Use this checklist:

Read every short-term rental agreement before signing.

Confirm lease terms in your short-term rental agreement.

Check payment rules in your short-term rental agreement.

Set move-in dates in your short-term rental agreement.

Make sure your short-term rental agreement follows local laws.

Ask tenants for proof of insurance in your short-term rental agreement.

Add property rules to your short-term rental agreement.

Update your insurance after each short-term rental agreement.

Compare policies for each short-term rental agreement.

Contact GSP Insurance Group to review your short-term rental agreement and get expert advice.

GSP Insurance Group helps you understand every short-term rental agreement. Reach out today for a quote or policy review.

FAQ

What insurance do you need for a short-term rental?

You need special short-term rental insurance. This insurance helps if a guest gets hurt. It also pays for damage to your property. If you lose money because of a problem, it can help too. Regular landlord insurance does not cover every short-term rental risk.

Does homeowners insurance cover long-term tenants?

No, homeowners insurance does not cover rentals. You need landlord insurance for long-term leases. Landlord insurance protects your building. It also covers you if someone gets hurt. If your place cannot be lived in, it pays for lost rent.

Tip: Always change your policy when you change how you rent. This helps you get your claim paid.

How do hurricane deductibles affect your rental insurance?

Hurricane deductibles are usually higher than normal ones. You will pay more after a storm. Ask your agent about hurricane and wind/hail deductibles before you buy.

Contact GSP Insurance Group today for a policy review or quote. Keep your rental and your peace of mind safe.