Imagine you wake up and see your home is damaged after a storm. You make a claim with your home insurance. Then you find out your deductible is much higher than you thought. Homeowners insurance deductibles can change, especially if wind & hail or a named storm causes damage. In places like Georgia and South Carolina, storms happen a lot. These storms can cause repairs that cost a lot of money. Wind and hail claims are about 34% of all homeowners insurance claims. The average cost for these claims is close to $11,695. Knowing which deductible applies to your home insurance policy helps you avoid surprises. It also helps you manage your insurance costs. Look over your homeowner’s insurance policy so you know what to expect if something bad happens.

Key Takeaways

Homeowners insurance deductibles are different for each damage type. AOP covers most risks, but not wind, hail, or named storms. Wind/hail deductibles are for wind or hail damage. Named storm deductibles are only for named storms like hurricanes.

Wind/hail and named storm deductibles usually cost more money. They are a percent of your home’s insured value. This means you may pay thousands before insurance pays.

Picking the right deductible depends on where you live. It also depends on your risk and your budget. Higher deductibles make your monthly payments lower. But you pay more yourself after damage happens.

Always check your insurance policy to see which deductible applies. This helps you plan your money and avoid surprises after a claim.

Ask your insurance agent if you have questions. They can help you pick a deductible that fits your needs. This helps protect your home and your money.

Homeowners Insurance Deductibles Overview

What Are Deductibles?

When you get homeowners insurance, you agree to pay some money first if you have a claim. This money is called your insurance deductible. You pick this amount when you start your policy. Deductibles can be a set dollar amount or a percent of your home’s value. For example, you might have a $1,000 deductible. Or you could have a 2% deductible on a $250,000 house, which means you pay $5,000 before insurance helps.

There are three main types of homeowners insurance deductibles you should know:

AOP deductible: This means “all other perils.” It covers most things except wind, hail, or named storm damage.

Wind/hail deductibles: These are used when wind or hail causes damage, no matter the storm.

Named storm deductibles: These are only for damage from an official named storm, like a hurricane or tropical storm.

Why They Matter

It is important to understand your homeowners insurance deductibles. You need to know which deductible is used for each kind of damage. If a storm hits your house in Georgia or South Carolina, you might have to pay a wind/hail deductible or a named storm deductible. These can be much higher than your regular AOP deductible. Higher deductibles mean you pay more before insurance helps. Picking a higher deductible can make your premium lower, but you take on more risk if you need to file a claim.

Tip: Always look at your policy so you know which deductible is used for wind, hail, or other damage. This helps you avoid surprises if you need to use your insurance.

Key Differences

Each deductible works in a different way. The table below shows how AOP, wind/hail, and named storm deductibles are different:

Deductible Type | What It Covers | How It’s Calculated | When It Applies |

|---|---|---|---|

AOP Deductible | All perils except wind, hail, or named storms | Fire, theft, water (not flood) | |

Wind/Hail Deductible | Wind or hail damage from any storm | Percentage of dwelling coverage | Tornado, thunderstorm, hurricane |

Named Storm Deductible | Damage from official named storms | Percentage of dwelling coverage | Hurricane, tropical storm |

Wind/hail deductibles usually cost more because they use a percent of your home’s insured value. For example, a 2% wind/hail deductible on a $300,000 house means you pay $6,000 before insurance pays the rest. Different wind deductibles may be used based on where you live and the storm type. Not all insurance companies offer every choice, so you should check your policy closely.

AOP Deductible in Home Insurance

Definition

You may see the term “AOP deductible” on your home insurance policy. AOP stands for “all other perils.” This means the deductible applies to most types of damage or loss that your insurance covers, except for wind, hail, or named storms. Some people also call it the all perils deductible. When you have a covered loss, you pay the AOP deductible first, and then your insurance pays the rest.

When It Applies

The AOP deductible comes into play for many common home insurance claims. For example, if you have a fire in your kitchen or someone breaks into your house and steals your belongings, you would use your AOP deductible. It does not apply if wind, hail, or a named storm causes the damage. In Georgia and South Carolina, you might see more wind or storm claims, but many other risks still use the AOP deductible.

Note: Always check your policy to see which deductible applies before you file a claim. This helps you avoid surprises and plan for out-of-pocket costs.

Typical Costs

Most home insurance policies set the AOP deductible as a flat dollar amount. You usually choose this amount when you buy your policy. Common choices range from $500 to $5,000. If you pick a higher AOP deductible, your monthly insurance cost may go down, but you will pay more if you need to make a claim. For example, if you have a $1,000 AOP deductible and a fire causes $10,000 in damage, you pay the first $1,000 and your insurance covers the rest.

AOP deductibles help you manage your risk and control your home insurance costs. Understanding how your deductible works gives you peace of mind and helps you make smart choices for your home.

Wind/Hail Deductibles

What Is Wind & Hail Coverage?

It is important to know how wind & hail coverage works. This part of your insurance helps if wind or hail damages your house. If a tornado, thunderstorm, or hurricane brings strong winds or hail, your insurance helps pay for repairs. Wind/hail deductibles are used when wind, hail, tornadoes, or wind-driven rain cause damage. These deductibles are not the same as your regular deductible. In Georgia and South Carolina, storms with wind and hail happen more often. That is why you need to understand this part of your insurance.

Tip: Check your policy to see if you have a wind/hail deductible. This helps you plan for costs if a storm damages your home.

When Wind/Hail Deductibles Apply

You use your wind/hail deductible when you file a claim for wind or hail damage. For example, if a thunderstorm breaks your windows or a tornado damages your roof, you pay the wind/hail deductible. It does not matter if the storm has a name. Insurance companies have rules for when these deductibles are used. They often follow official weather warnings. You should read your policy to know when your wind/hail deductible starts. Named storm deductibles are different. They only apply when a storm gets an official name, like a hurricane.

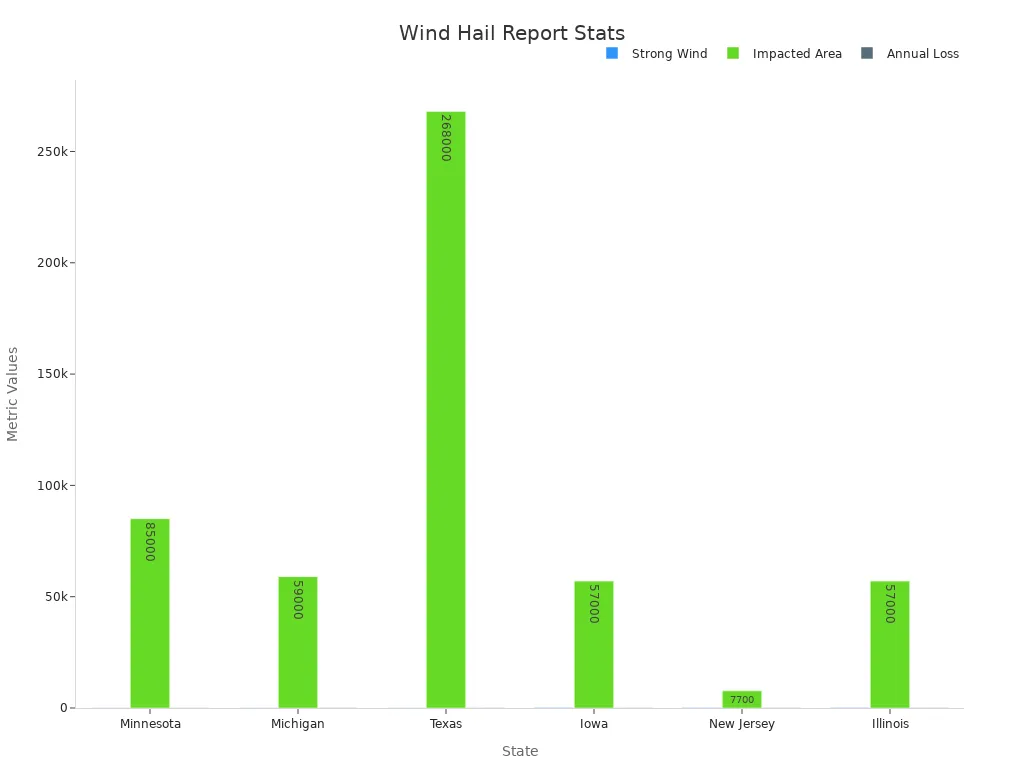

Wind and hail events happen a lot in the Southeast. In 2022, wind and hail made up 40.7% of all insurance claims. The average claim for wind or hail damage was about $13,511. One in 35 homes had a wind or hail claim from 2018 to 2022. The table below shows how wind events affect different states:

State | Number of Strong Wind Events | Impacted Area (Square Miles) | Expected Annual Loss (USD) |

|---|---|---|---|

Minnesota | 80 | ~85,000 | 112 million |

Michigan | 103 | ~59,000 | 108 million |

Texas | 62 | ~268,000 | 96 million |

Iowa | 179 | ~57,000 | 93 million |

New Jersey | 225 | ~7,700 | 85 million |

Illinois | 181 | ~57,000 | 57 million |

Cost Structure

Wind/hail deductibles usually cost more than your regular deductible. Insurance companies often set these as a percent of your home’s insured value. This is usually between 1% and 5%. For example, if your home is insured for $300,000 and you have a 2% wind/hail deductible, you pay $6,000 before insurance pays the rest. In some high-risk places, the percent can be as high as 10%. Sometimes, you may see a flat dollar amount, but percent deductibles are more common in Georgia and South Carolina.

This is because wind and hail can cause a lot of damage. State laws often make insurance companies use percent deductibles for hurricanes and big storms. Some companies let you buy Wind and Hail Deductible Buydown policies. These let you lower your deductible if you pay more each month. Wind/hail deductibles can make your monthly payments lower, but you will pay more if you have wind or hail damage.

Wind/hail deductibles are not the same as named storm deductibles. Named storm deductibles only apply when a hurricane or tropical storm gets an official name. Your wind/hail deductible covers all wind and hail events, even if the storm is not named. Always look at your insurance policy so you know which deductible is used for each kind of storm or damage.

Named Storm Deductibles in Homeowners Insurance

What Is a Named Storm?

A named storm is a big weather event with an official name. The National Weather Service or the National Hurricane Center gives these names. Hurricanes and tropical storms are examples of named storms. You might hear names like Hurricane Michael or Tropical Storm Elsa on TV. Insurance companies use these names to decide when a special deductible is used.

Named storms, like hurricanes, are measured by wind speed. The wind speed is checked as a 1-minute average at 33 feet above the ground.

The Saffir-Simpson scale puts hurricanes into groups by wind speed. Hurricanes in Category 3 or higher are called “major hurricanes” because they can do a lot of damage.

When a hurricane is Category 3 or more, even strong houses can lose roofs or get serious damage.

Insurance policies often have a hurricane deductible just for named storms.

Note: The Saffir-Simpson scale only uses wind speed. It does not look at rain or flooding.

When This Deductible Applies

You use a named storm deductible if a named storm damages your home. This could be a hurricane or a tropical storm. Your insurance policy will say when the deductible starts and ends. For example, it might start 24 hours before the storm gets its name. It could end 48 hours after the storm is downgraded. If a storm is not named, a different deductible might be used.

People in Georgia or South Carolina know hurricanes and tropical storms can happen. If you make a claim for named storm damage, your insurance company uses the named storm deductible. They do not use your regular deductible.

How It’s Calculated

A named storm deductible is usually a percent of your home’s insured value. Most policies set this between 1% and 5%. In some risky places, it can go up to 10%. For example, if your home is insured for $300,000 and your deductible is 5%, you pay $15,000 before insurance pays the rest. Some policies use a set dollar amount, but percent deductibles are more common for hurricanes.

A hurricane deductible is often higher than your regular deductible. This means you need to plan for bigger costs if you have a named storm claim. Policies may use the deductible per event, per season, or per year. Always check your policy so you know how much you might pay if a hurricane or tropical storm damages your home.

Example: If Hurricane Elsa damages your roof and your home is insured for $400,000 with a 3% named storm deductible, you pay $12,000 before insurance helps with repairs.

Comparing and Choosing Deductibles

Comparison Table

Choosing the right deductible for your homeowners insurance can feel confusing. You want to see how each option stacks up. The table below gives you a clear look at the main differences between AOP, wind/hail, and named storm deductibles. It also shows how often people file claims and how much those claims usually cost. This helps you see which deductible might fit your needs best.

Deductible Type | Claim Frequency (per 1000 homes) | Claim Severity (Average $) | Deductible Range | Coverage Range (in $1,000s) |

|---|---|---|---|---|

AOP | Min: 2 | Min: $2,000 | $500 – $5,000 (flat) | $100 – $1,000 |

Wind/Hail | Min: 5 | Min: $4,000 | 1% – 5% (of coverage) | $100 – $1,000 |

Named Storm | Min: 1 | Min: $10,000 | 1% – 10% (of coverage) | $100 – $1,000 |

This table lets you quickly compare how often claims happen, how much they cost, and how each deductible works. You can see that wind/hail deductible claims happen more often than named storm claims. The average claim cost for named storms is much higher. The average deductible is higher than the median, which means some people pay much more out of pocket.

Factors to Consider

When you choose a deductible, you need to think about where you live, your risk level, and your budget. If you live in Georgia or South Carolina, you know storms, wind, and hail can hit hard. Homes in areas that are high risk for wind or hail damage often have higher premiums. Picking the right deductible helps you manage your insurance costs.

Your risk profile matters, too. If your home uses strong building materials or has security features, you might face fewer claims. If you live near the coast or in a place with lots of storms, you may want to look at your wind/hail deductible closely. Higher deductibles usually mean lower monthly payments, but you need to be ready to pay more if you file a claim.

Studies show that most people choose a deductible between $500 and $1,500. This range helps balance your monthly costs and the amount you pay if you have a loss. Many people only file a claim if the damage is much higher than their deductible. You should pick a deductible that you can afford to pay at any time, not just when things are going well.

Tips for Choosing

Here are some practical steps to help you pick the right deductible for your home insurance:

Review your location and risk. If you live in a high risk for wind or hail damage area, check your wind/hail deductible first.

Compare your monthly premium with your deductible. Use online calculators or ask your agent for help.

Look at your past claims. If you rarely file claims, a higher deductible might save you money.

Make sure you can pay your deductible at any time. Set aside savings if you choose a higher amount.

Read your policy details. Check for special rules about wind, hail, or named storm deductibles.

Think about your home’s value and coverage needs. Higher coverage means higher deductibles if you use a percent-based option.

Ask questions if you do not understand your policy. Your insurance agent can explain how each deductible works.

Stay updated on changes. Insurance companies sometimes change deductible rules after big storms.

Use a decision-making chart. List your premium, deductible, and risk level to see which option fits your budget.

Get advice from a trusted insurance professional if you feel unsure.

Tip: Always choose a deductible that fits your budget and risk level. Do not pick a high deductible just to save on premiums if you cannot afford to pay it after a storm.

Choosing the right deductible helps you protect your home and your wallet. Take time to review your options, especially if you live in Georgia or South Carolina. Understanding your wind/hail deductible and named storm deductible can save you from surprises when you need help the most.

You have learned how AOP, wind/hail, and named storm deductibles are different. Many people just keep the deductible that comes with their policy. But you can make better choices if you look at your policy.

Families who make more money often pick higher deductibles. This helps them pay less each month.

People who live where storms or damage happen a lot usually pick lower deductibles. This means they pay less if something bad happens.

Most people do not change their deductible, even when new choices are offered.

If you have questions, talk to an insurance expert you trust. Knowing about your deductible helps you get ready for surprises in Georgia or South Carolina.

FAQ

What is the difference between a wind/hail deductible and a named storm deductible?

A wind/hail deductible is used for any wind or hail damage. It does not matter if the storm has a name. A named storm deductible is only used when an official storm, like a hurricane, causes damage.

Can I choose my deductible amount?

You can usually pick your AOP deductible amount. Wind/hail and named storm deductibles may have set choices. These depend on where you live in Georgia or South Carolina. Ask your agent to learn about your options.

Why are percentage deductibles higher for storms?

Big storms like hurricanes can cause lots of damage. Insurance companies use percentage deductibles to share the risk with you. This helps keep insurance costs lower in places with many storms.

What happens if I cannot pay my deductible after a storm?

You must pay your deductible before insurance pays the rest. If you cannot pay, repairs might take longer. Try to save money for your deductible so you can fix your home fast.

How do I find out which deductible applies to my claim?

Look at your policy or call your insurance agent. The kind of damage and what caused it decide which deductible you use. Always check your policy before you file a claim.