GSP Insurance Group Blog |

|

Introduction We recently did an analysis of insurance rates across the Lowcountry, and we thought you might be interested in seeing the results. Homeowners Insurance Rate Increases The average increase in homeowner's insurance rates is 6% statewide, but it varies by county. In Charleston and other coastal areas such as Beaufort, Bluffton, and Hilton Head homeowners can expect to see higher than the statewide average increase. Some areas in the Lowcountry saw increases as high as 14%, while others (more inland) saw a decrease of up to 5%. There have been several other contributing factors to rising Home Insurance costs in Coastal parts of the Lowcountry as several coastal insurers have gone insolvent, while others have pulled out of the market completely. Gulfstream Property and Casualty, St. Johns Insurance Company, Avatar Property and Casualty, and most recently Fed Nat have all either gone insolvent or are "restructuring". This leaves the Lowcountry and many other coastal areas with less options and many times higher than normal annual increases. Car Insurance Rate Increases This is a nationwide problem. Car insurance rates are rising across the country due to an increase in car accidents and a rise in the cost of repairing cars. The increase in car insurance rates is also due to a rise in the cost of car parts for repairs, which are often needed after an accident. A few other factors that affect all your insurance costs Inflation Rate Inflation is one of many culprits for rising insurance costs. However, there are a few ways to save money on your rates. One way is to shop around for new insurance companies. You should also consider getting quotes from a local independent agent who offers personalized service and competitive rates. Finally, if you're interested in learning more about how to save on auto insurance or homeowners coverage, check out our other blog posts! Credit Score Credit score is based on your past history of paying bills on time and how much debt you have. If you have missed payments, this will affect your credit score and can make it more difficult for you to qualify for lower insurance rates. If your credit score is good, then chances are that you'll qualify for lower insurance premiums because the company knows that they're more likely to get paid back by someone with a good track record than someone who has been late in the past. Conclusion Don't despair as we have many options to help our clients find the best coverage for the best value. GSP Insurance Group works with 50+ carriers to find the best options for you. Give us a call today at 843.707.4473, email us at [email protected] or check out our website at www.gspins.com. AuthorTyler Grizzle is a Partner at GSP Insurance Group

0 Comments

Here are the top reasons you should buy your business insurance from us: Buying business insurance is easy. The process itself can be done in a matter of minutes, and it's a single step that will save you time and stress down the road. You'll have peace of mind knowing that your business is protected, no matter what happens. The right type of coverage can be selected based on your personal preferences and needs as the owner or manager of a small business. If you're unsure where to start, we recommend checking out our comprehensive guide or contacting us directly so we can help find the best fit for your company's needs! You should buy your business insurance from us because we'll find the right coverage for your company's needs.

We offer a wide range of options, and finding the right coverage depends on your budget and what you need covered. But here are some examples:

IntroductionLife has lots of surprises—some good, some bad, and some downright disastrous. Whether you're a renter or a homeowner, the right insurance can help keep the bad ones from being tragic. Even if you live in the safest neighborhood in town or drive the most reliable car on the road, damage to a property and its contents can be devastating without adequate insurance coverage. The same goes for liability suits against you or your family as a result of bodily injuries to others or even damage to their property caused by an accident on your premises. In other words: Don't take chances with your home and auto insurance policies!

Save money by getting auto and home insurance quotes from several top companiesTo get the best deal, we recommend that you get quotes from several top companies. You can use our tool to see how much you’ll pay for car or home insurance in your state. We’ll connect you with major carriers so that you can compare rates and find the right fit for your needs. There are many factors that affect how much it costs to insure a car or a home, including:

Using this tool is easy! Just enter your zip code and the details of your vehicle and/or home into the fields below. Then click "Get Quotes" button below. You will receive instant quotes from several different insurers that offer coverage in your area. We also have a blog with useful information about auto and homeowners’ insurance as well as a tool that can help you find out if you qualify for any local discounts on these policies. Conclusion: Well, that’s it for this guide to home and car insurance comparison! We hope that you now have a better understanding of these two types of insurance policies, how they are different from each other, what they each cover, etc. By following the tips provided in this article you should be able to find an affordable policy that offers the right coverage for your needs! You can reach us at or 843.707.4473 or 833.414.3040 or email us at [email protected]. GSP Insurance Group is headquartered in Bluffton, South Carolina (near Hilton Head & Beaufort) and serve clients in Georgia and South Carolina. As a small business owner, you rely on your vehicles every day to service your customers. Let GSP Insurance Group find the right Business Auto policy to protect yourself and all you’ve built.

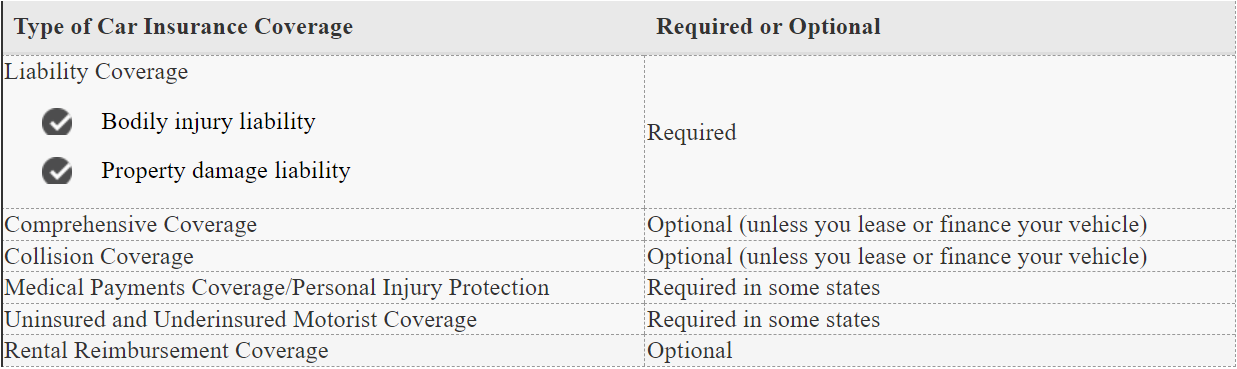

• Primary liability limits up to $2 million—much higher than what’s available from a personal auto policy—to protect your business • Coverages to protect you in virtually any vehicle you buy, rent, lease or borrow for your business … coverage for employees using personal vehicles for business-related incidentals … and coverage for business vehicles borrowed or rented for personal use • Policies that can include up to 20 vehicles and all your employees … with unlimited jobsite trips • Rental Reimbursement to help keep you on the road if your vehicle is down due to a covered incident • Roadside Assistance is available, too We offer great rates for all: new to experienced drivers … those with clean records to those with a few dings … and new ventures to established businesses. GSP Insurance Group has all the resources, knowledge, and carrier relationships to find the best coverage and value for you and your business. Give us a call at 843.707.4473 or email us at [email protected] and check out our website at www.gspins.com.  Full coverage is a term we hear a lot in the insurance industry. It's something that, quite frankly does not exist and should never, ever, ever be used by an insurance agent. If your insurance agent uses the term full coverage, you should run as quick, fast and as far as you possibly can, because there is no insurance policy out there that covers everything in every situation, it does not exist. LIABILITY COVERAGE Liability coverage is typically included in all auto insurance policies, as it's required by law in most states. Bodily injury liability coverage helps pay for another person's medical expenses if you cause an accident. Property damage liability coverage helps pay for damage you cause to another person's property in a car accident. Each state sets minimum liability coverage limits that drivers must purchase. Typically, the liability coverage in an auto insurance policy will contain three limits: The maximum payment for bodily injury per person The maximum payable for bodily injury per accident The maximum payable for property damage You may want to go beyond the state requirements and buy a policy with higher liability limits. Higher coverage limits typically mean you'll pay higher premiums, but you'll have more protection if you cause an accident. COMPREHENSIVE AND COLLISION COVERAGE If you are still paying off an auto loan or if you have a lease on your vehicle, your lienholder or financing company usually requires collision coverage and comprehensive coverage. Otherwise, if your vehicle is paid off, these two coverages are typically optional on a car insurance policy. Collision coverage helps pay to repair or replace your vehicle if it's damaged in a collision with another vehicle or object (such as a fence). Remember, collision coverage helps protect your vehicle, while property damage liability helps pay for damage you cause to another driver's vehicle. Comprehensive coverage helps pay to repair or replace your vehicle if it's stolen or damaged by things like hail, animal damage or vandalism. Comprehensive and collision coverage each have deductibles and limits. A deductible is the amount you pay out of pocket toward a covered claim. A limit is the maximum amount your insurance will pay out for a covered claim. RENTAL REIMBURSEMENT COVERAGE Rental reimbursement coverage helps pay for a rental car while yours is being repaired after a covered loss. Be sure to check the coverage limits — typically, rental reimbursement pays up to a certain dollar amount per day, for a set number of days. UNINSURED AND UNDERINSURED MOTORIST COVERAGE Uninsured motorist coverage helps protect you against drivers without insurance. If you're injured in an accident caused by another driver, that driver's liability insurance will usually help cover medical expenses you incur — unless that driver doesn't have auto liability coverage. In that case, your uninsured motorist coverage would help pay for expenses related to your injuries. Underinsured motorist coverage works similarly: It takes effect if the other driver who caused the accident has insurance, but their liability coverage limits are lower than the limits that trigger underinsured motorists coverage in your state. Check your state’s insurance requirements or ask your agent for more information about this coverage. MEDICAL PAYMENTS COVERAGE/PERSONAL INJURY PROTECTION Medical payments coverage helps pay for your (or your passengers') medical expenses after an accident, regardless of who is at fault. Covered expenses may include things like surgery or X-rays. Personal injury protection (PIP) isn't available in all states, but it's required in some states. PIP works similarly to medical payments coverage — it helps cover your medical expenses resulting from a covered loss. In some cases, it may also help you pay for other expenses while you're healing. These expenses may include child care services and lost income as a result of your injuries. While there's technically no such thing as "full coverage" auto insurance, you can choose from a number of car insurance coverages to help protect you, your assets, your passengers and your vehicle. At GSP Insurance Group we pride ourselves on providing savings and a customer experience second to none. You can reach us at or 843.707.4473 or 833.414.3040 or email us at [email protected]. We are headquartered in Bluffton, South Carolina (near Hilton Head & Beaufort) and serve clients in Georgia and South Carolina. |

Contact Us(843) 707-4473 Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed