GSP Insurance Group Blog |

Why is life insurance important?Life insurance is an important financial tool that provides a safety net for your loved ones in the event of your death. It ensures that your family is protected from the financial strain that can arise from outstanding debts, mortgage payments, funeral expenses, and other financial obligations. Life insurance provides much-needed peace of mind, knowing that your loved ones will be taken care of financially, even when you're no longer there to provide for them. There are several types of life insurance policies to choose from, such as term life insurance and permanent life insurance, each offering its advantages and benefits. In this article, we will explore why life insurance is important and how it can provide financial stability and security for your family during challenging times.

0 Comments

What is an Independent Agent? An independent agent is a professional who works with multiple insurance companies, offering a wide range of coverage options to his or her clients. Unlike captive agents who exclusively represent a single insurance company, an independent insurance agency has the flexibility to choose from a variety of insurance products across different carriers. This allows them to provide unbiased advice and tailor insurance solutions that best meet the needs of their clients. Independent agents are well-versed in the insurance industry and stay up to date with changing policies and regulations. They are able to educate their clients about the different types of insurance and help them make informed decisions. By working with an independent agent, individuals and businesses can benefit from personalized customer service, competitive prices, and access to a broader range of coverage options. Whether it's health insurance, auto insurance, or life insurance, an independent agent can guide clients through the process of selecting the right policies for their specific needs.

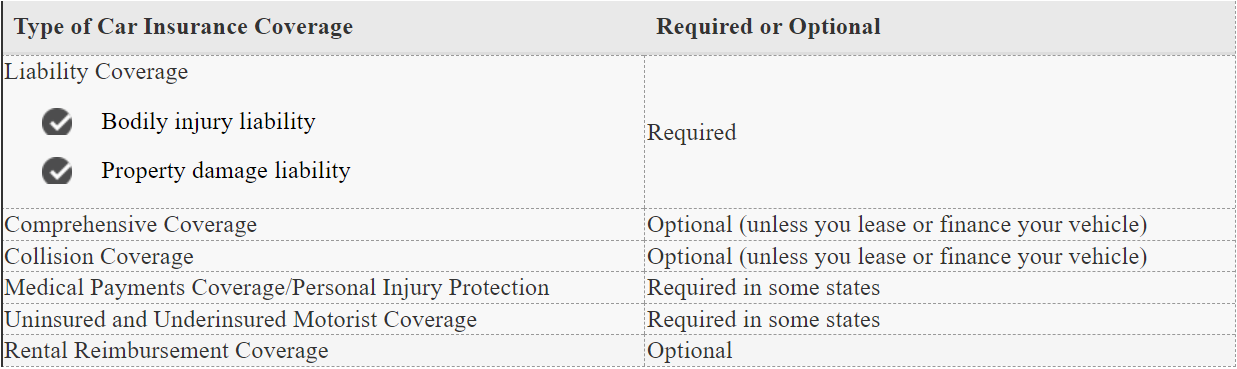

Introduction South Carolina, a state known for its picturesque landscapes and welcoming communities, is currently facing unprecedented challenges in the home and auto insurance market. Within this vibrant state, Beaufort County has emerged as a battleground where residents are grappling with the impact of rising insurance rates. Across the board, homeowners and drivers are witnessing an alarming increase in premiums. Additionally, the market is witnessing a growing trend of carriers either withdrawing altogether or implementing stricter underwriting guidelines and higher down payment requirements. This phenomenon has earned the title of the "hardest insurance market" in a generation across the country. In this blog article, we will delve into the state of the home and auto insurance market in Beaufort County, explore the factors contributing to the difficulties, and provide insights on how to navigate this challenging landscape.  South Carolina's beautiful coastal region has always been a prime location for homeowners looking to enjoy the stunning beaches and year-round sunny weather. However, this picturesque region has faced its share of natural disasters, including hurricanes, flooding, and severe storms, leading to a significant impact on the coastal home insurance market. Over the past few years, South Carolina's coastal insurance market has undergone some significant changes. Let's take a closer look at the current state of the coastal home insurance market in South Carolina.  Full coverage is a term we hear a lot in the insurance industry. It's something that, quite frankly does not exist and should never, ever, ever be used by an insurance agent. If your insurance agent uses the term full coverage, you should run as quick, fast and as far as you possibly can, because there is no insurance policy out there that covers everything in every situation, it does not exist. LIABILITY COVERAGE Liability coverage is typically included in all auto insurance policies, as it's required by law in most states. Bodily injury liability coverage helps pay for another person's medical expenses if you cause an accident. Property damage liability coverage helps pay for damage you cause to another person's property in a car accident. Each state sets minimum liability coverage limits that drivers must purchase. Typically, the liability coverage in an auto insurance policy will contain three limits: The maximum payment for bodily injury per person The maximum payable for bodily injury per accident The maximum payable for property damage You may want to go beyond the state requirements and buy a policy with higher liability limits. Higher coverage limits typically mean you'll pay higher premiums, but you'll have more protection if you cause an accident. COMPREHENSIVE AND COLLISION COVERAGE If you are still paying off an auto loan or if you have a lease on your vehicle, your lienholder or financing company usually requires collision coverage and comprehensive coverage. Otherwise, if your vehicle is paid off, these two coverages are typically optional on a car insurance policy. Collision coverage helps pay to repair or replace your vehicle if it's damaged in a collision with another vehicle or object (such as a fence). Remember, collision coverage helps protect your vehicle, while property damage liability helps pay for damage you cause to another driver's vehicle. Comprehensive coverage helps pay to repair or replace your vehicle if it's stolen or damaged by things like hail, animal damage or vandalism. Comprehensive and collision coverage each have deductibles and limits. A deductible is the amount you pay out of pocket toward a covered claim. A limit is the maximum amount your insurance will pay out for a covered claim. RENTAL REIMBURSEMENT COVERAGE Rental reimbursement coverage helps pay for a rental car while yours is being repaired after a covered loss. Be sure to check the coverage limits — typically, rental reimbursement pays up to a certain dollar amount per day, for a set number of days. UNINSURED AND UNDERINSURED MOTORIST COVERAGE Uninsured motorist coverage helps protect you against drivers without insurance. If you're injured in an accident caused by another driver, that driver's liability insurance will usually help cover medical expenses you incur — unless that driver doesn't have auto liability coverage. In that case, your uninsured motorist coverage would help pay for expenses related to your injuries. Underinsured motorist coverage works similarly: It takes effect if the other driver who caused the accident has insurance, but their liability coverage limits are lower than the limits that trigger underinsured motorists coverage in your state. Check your state’s insurance requirements or ask your agent for more information about this coverage. MEDICAL PAYMENTS COVERAGE/PERSONAL INJURY PROTECTION Medical payments coverage helps pay for your (or your passengers') medical expenses after an accident, regardless of who is at fault. Covered expenses may include things like surgery or X-rays. Personal injury protection (PIP) isn't available in all states, but it's required in some states. PIP works similarly to medical payments coverage — it helps cover your medical expenses resulting from a covered loss. In some cases, it may also help you pay for other expenses while you're healing. These expenses may include child care services and lost income as a result of your injuries. While there's technically no such thing as "full coverage" auto insurance, you can choose from a number of car insurance coverages to help protect you, your assets, your passengers and your vehicle. At GSP Insurance Group we pride ourselves on providing savings and a customer experience second to none. You can reach us at or 843.707.4473 or 833.414.3040 or email us at [email protected]. We are headquartered in Bluffton, South Carolina (near Hilton Head & Beaufort) and serve clients in Georgia and South Carolina. |

Contact Us(843) 707-4473 Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed