GSP Insurance Group Blog |

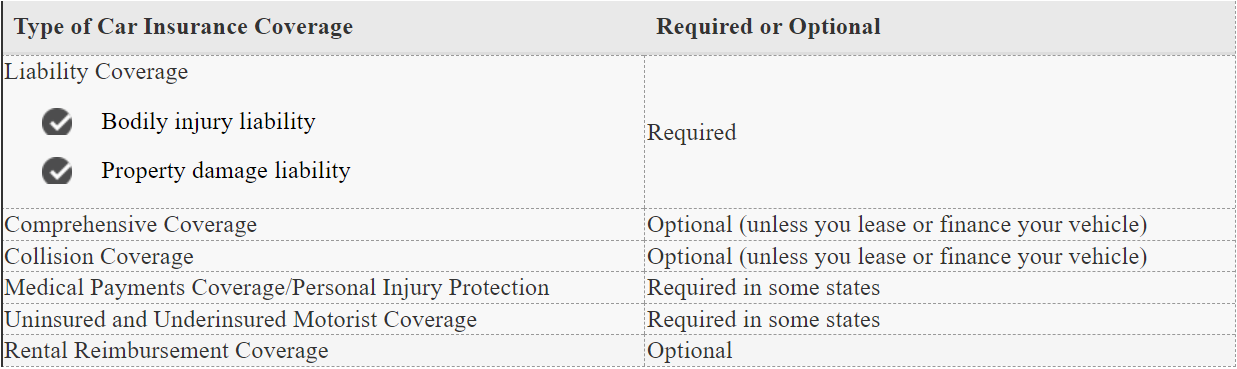

Full coverage is a term we hear a lot in the insurance industry. It's something that, quite frankly does not exist and should never, ever, ever be used by an insurance agent. If your insurance agent uses the term full coverage, you should run as quick, fast and as far as you possibly can, because there is no insurance policy out there that covers everything in every situation, it does not exist. LIABILITY COVERAGE Liability coverage is typically included in all auto insurance policies, as it's required by law in most states. Bodily injury liability coverage helps pay for another person's medical expenses if you cause an accident. Property damage liability coverage helps pay for damage you cause to another person's property in a car accident. Each state sets minimum liability coverage limits that drivers must purchase. Typically, the liability coverage in an auto insurance policy will contain three limits: The maximum payment for bodily injury per person The maximum payable for bodily injury per accident The maximum payable for property damage You may want to go beyond the state requirements and buy a policy with higher liability limits. Higher coverage limits typically mean you'll pay higher premiums, but you'll have more protection if you cause an accident. COMPREHENSIVE AND COLLISION COVERAGE If you are still paying off an auto loan or if you have a lease on your vehicle, your lienholder or financing company usually requires collision coverage and comprehensive coverage. Otherwise, if your vehicle is paid off, these two coverages are typically optional on a car insurance policy. Collision coverage helps pay to repair or replace your vehicle if it's damaged in a collision with another vehicle or object (such as a fence). Remember, collision coverage helps protect your vehicle, while property damage liability helps pay for damage you cause to another driver's vehicle. Comprehensive coverage helps pay to repair or replace your vehicle if it's stolen or damaged by things like hail, animal damage or vandalism. Comprehensive and collision coverage each have deductibles and limits. A deductible is the amount you pay out of pocket toward a covered claim. A limit is the maximum amount your insurance will pay out for a covered claim. RENTAL REIMBURSEMENT COVERAGE Rental reimbursement coverage helps pay for a rental car while yours is being repaired after a covered loss. Be sure to check the coverage limits — typically, rental reimbursement pays up to a certain dollar amount per day, for a set number of days. UNINSURED AND UNDERINSURED MOTORIST COVERAGE Uninsured motorist coverage helps protect you against drivers without insurance. If you're injured in an accident caused by another driver, that driver's liability insurance will usually help cover medical expenses you incur — unless that driver doesn't have auto liability coverage. In that case, your uninsured motorist coverage would help pay for expenses related to your injuries. Underinsured motorist coverage works similarly: It takes effect if the other driver who caused the accident has insurance, but their liability coverage limits are lower than the limits that trigger underinsured motorists coverage in your state. Check your state’s insurance requirements or ask your agent for more information about this coverage. MEDICAL PAYMENTS COVERAGE/PERSONAL INJURY PROTECTION Medical payments coverage helps pay for your (or your passengers') medical expenses after an accident, regardless of who is at fault. Covered expenses may include things like surgery or X-rays. Personal injury protection (PIP) isn't available in all states, but it's required in some states. PIP works similarly to medical payments coverage — it helps cover your medical expenses resulting from a covered loss. In some cases, it may also help you pay for other expenses while you're healing. These expenses may include child care services and lost income as a result of your injuries. While there's technically no such thing as "full coverage" auto insurance, you can choose from a number of car insurance coverages to help protect you, your assets, your passengers and your vehicle. At GSP Insurance Group we pride ourselves on providing savings and a customer experience second to none. You can reach us at or 843.707.4473 or 833.414.3040 or email us at [email protected]. We are headquartered in Bluffton, South Carolina (near Hilton Head & Beaufort) and serve clients in Georgia and South Carolina.

0 Comments

Leave a Reply. |

Contact Us(843) 707-4473 Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed