GSP Insurance Group Blog |

An attractive nuisance is a term used in insurance and legal circles to describe a dangerous condition on a property that may attract children and cause harm or injury. This could be anything from a swimming pool or trampoline to a construction site or abandoned building. In this blog post, we will take a closer look at what an attractive nuisance is, why it matters in insurance, and how property owners can protect themselves.

1 Comment

Auto insurance is an essential investment for vehicle owners to protect their financial interests in case of an accident or loss. However, there are two main types of auto insurance policies available in the market - personal auto insurance and commercial auto insurance. In this blog post, we will discuss the differences between these two policies and help you understand which one is suitable for you.  Auto insurance is an important investment for vehicle owners to protect themselves from financial losses in the event of an accident or loss. However, it's crucial to ensure that your auto insurance policy reflects the nature of your vehicle use accurately. If you have a vehicle that you use for business purposes on a personal insurance policy and get into an accident, several consequences could arise. In this blog post, we will discuss what happens if you have a vehicle that you use for business purposes on a personal insurance policy when you get into an accident. Full coverage insurance typically refers to a combination of two types of car insurance: liability coverage and comprehensive coverage.

Liability coverage is the minimum amount of insurance required by most state governments. It covers the costs of any damage or injury that you may cause to another driver or their vehicle in the event of an accident for which you are at fault. The coverage is typically split into two parts: bodily injury liability coverage and property damage liability coverage. Comprehensive coverage, on the other hand, is optional and covers damage to your own vehicle from non-collision events such as theft, vandalism, or natural disasters. When people refer to "full coverage" they usually mean they have purchased both liability coverage and comprehensive coverage. It is important to note that this term is not standard and defined in the car insurance industry and the definition can vary by provider and state. It is always a good idea to check with your insurance provider for the specifics of the coverage you are paying for and make sure you are getting the coverage you need and want. Introduction

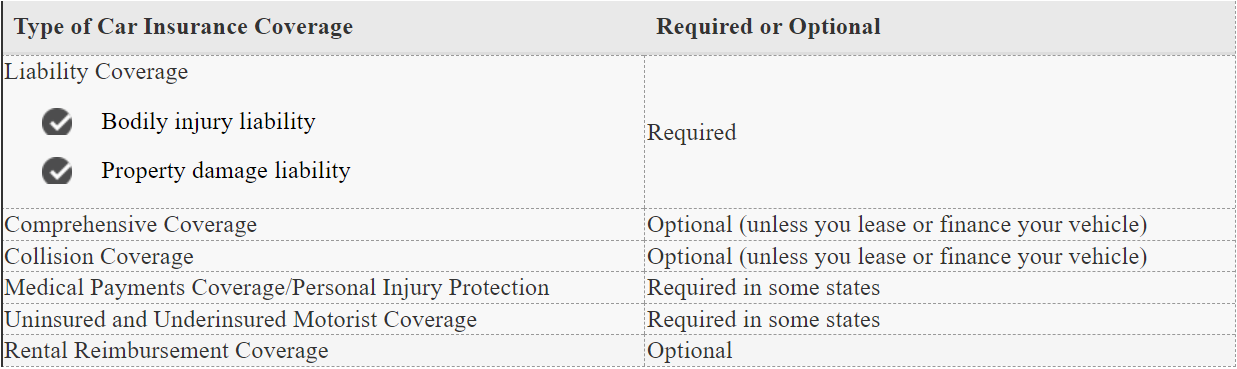

Auto insurance is a must for virtually all drivers, but the amount of coverage you need and the company you choose are important factors in your insurance costs. What types of vehicles do you own? Do they require special coverage or safety features? Do they have high mileage? Are they used primarily for pleasure or commuting to work? Your answers to these questions will help you find an auto insurance policy that offers just the right amount of protection without breaking your budget. The Basics of Auto Insurance Auto insurance is a type of insurance that covers damage or injuries caused by automobiles. It also covers medical expenses for the insured, their passengers and third parties who are injured in an accident involving the insured automobile. Auto insurance can be divided into three types: liability, collision and comprehensive. The first type is liability, which covers the costs incurred by an insured party to repair or replace property damaged or destroyed by an insured vehicle. This includes any bodily injuries caused by the same vehicle up to liability limits set forth by law in your state of residence. The second type is collision coverage, which pays for repairs to your car when it collides with another object or vehicle - including pets! The third and final type is comprehensive coverage, which pays for damages unrelated to accidents such as vandalism and weather-related incidents like hailstorms (not counting hurricanes). Shopping for a New Policy When you're shopping for a new policy, focus on what your needs are. If you own a home and have young children, for example, you'll want to get the most affordable coverage that will still protect your family in case of an accident. You should also look into how much money you can afford. Set up a budget that allows room for insurance payments and other monthly expenses like utilities and groceries—these things aren't cheap! Try to make sure that the amount of money spent on auto insurance doesn't take away from any other areas of your budget; this way, if something unexpected happens (like a major car repair), it won't be as stressful financially as it would be otherwise. Finally—and this is important! —be aware of all the discounts offered by different companies when choosing an insurer or agency. Discounts include things like having clean driving records over time; being part of certain organizations such as AAA; living in safe neighborhoods with low crime rates; driving less than 20 miles per day or owning more than one vehicle (or both). These discounts can help lower premiums while still providing adequate protection against accidents and bodily injury claims brought upon by others on the roadways around us every day. Choosing the Right Car Insurance Company The most important step in finding the right car insurance company is to get multiple quotes. You should talk to an independent agent that works with multiple companies and allow them to shop around to find you the best coverage and rates. You should also ask about any discounts available based on factors such as marital status and credit score—these could help save you hundreds of dollars each year! How to Lower Your Auto Insurance Rates Enlist and independent agent to shop around for the best auto insurance rates. Check your credit score and ask about discounts. If you have a good credit score (below 590), most insurance companies will give you a discount on your policy—sometimes as much as 20%. And if you've never been in an accident, some insurers may offer additional savings on top of this. Get a safe driver discount—and ask about it again. Some states require all insurers to offer a safe driver discount to customers who maintain good driving records without any accidents or moving violations within three years of applying for coverage; other states don't enforce this requirement but still require insurers to offer some type of reward if they're available in that state. To find out what types of rewards are available where you live, check with each individual company before shopping around: often times there'll be one or two carriers that won't offer any safe driver discounts at all because they aren't legally required to do so (and therefore don't want to get into trouble). Does Credit Matter With Insurance? Yes, your credit score is a factor in determining your auto insurance rates. However, it's not the only factor, and there are ways to improve your credit score if it's not currently on par with what you want. The best way to save money on auto insurance? Read on! Conclusion This is a great time to shop around for car insurance. It’s important to find the best deal for your needs, and if you’re not sure where to start, we can help! Our friendly agents are ready to answer any questions you have about auto insurance coverage.  Full coverage is a term we hear a lot in the insurance industry. It's something that, quite frankly does not exist and should never, ever, ever be used by an insurance agent. If your insurance agent uses the term full coverage, you should run as quick, fast and as far as you possibly can, because there is no insurance policy out there that covers everything in every situation, it does not exist. LIABILITY COVERAGE Liability coverage is typically included in all auto insurance policies, as it's required by law in most states. Bodily injury liability coverage helps pay for another person's medical expenses if you cause an accident. Property damage liability coverage helps pay for damage you cause to another person's property in a car accident. Each state sets minimum liability coverage limits that drivers must purchase. Typically, the liability coverage in an auto insurance policy will contain three limits: The maximum payment for bodily injury per person The maximum payable for bodily injury per accident The maximum payable for property damage You may want to go beyond the state requirements and buy a policy with higher liability limits. Higher coverage limits typically mean you'll pay higher premiums, but you'll have more protection if you cause an accident. COMPREHENSIVE AND COLLISION COVERAGE If you are still paying off an auto loan or if you have a lease on your vehicle, your lienholder or financing company usually requires collision coverage and comprehensive coverage. Otherwise, if your vehicle is paid off, these two coverages are typically optional on a car insurance policy. Collision coverage helps pay to repair or replace your vehicle if it's damaged in a collision with another vehicle or object (such as a fence). Remember, collision coverage helps protect your vehicle, while property damage liability helps pay for damage you cause to another driver's vehicle. Comprehensive coverage helps pay to repair or replace your vehicle if it's stolen or damaged by things like hail, animal damage or vandalism. Comprehensive and collision coverage each have deductibles and limits. A deductible is the amount you pay out of pocket toward a covered claim. A limit is the maximum amount your insurance will pay out for a covered claim. RENTAL REIMBURSEMENT COVERAGE Rental reimbursement coverage helps pay for a rental car while yours is being repaired after a covered loss. Be sure to check the coverage limits — typically, rental reimbursement pays up to a certain dollar amount per day, for a set number of days. UNINSURED AND UNDERINSURED MOTORIST COVERAGE Uninsured motorist coverage helps protect you against drivers without insurance. If you're injured in an accident caused by another driver, that driver's liability insurance will usually help cover medical expenses you incur — unless that driver doesn't have auto liability coverage. In that case, your uninsured motorist coverage would help pay for expenses related to your injuries. Underinsured motorist coverage works similarly: It takes effect if the other driver who caused the accident has insurance, but their liability coverage limits are lower than the limits that trigger underinsured motorists coverage in your state. Check your state’s insurance requirements or ask your agent for more information about this coverage. MEDICAL PAYMENTS COVERAGE/PERSONAL INJURY PROTECTION Medical payments coverage helps pay for your (or your passengers') medical expenses after an accident, regardless of who is at fault. Covered expenses may include things like surgery or X-rays. Personal injury protection (PIP) isn't available in all states, but it's required in some states. PIP works similarly to medical payments coverage — it helps cover your medical expenses resulting from a covered loss. In some cases, it may also help you pay for other expenses while you're healing. These expenses may include child care services and lost income as a result of your injuries. While there's technically no such thing as "full coverage" auto insurance, you can choose from a number of car insurance coverages to help protect you, your assets, your passengers and your vehicle. At GSP Insurance Group we pride ourselves on providing savings and a customer experience second to none. You can reach us at or 843.707.4473 or 833.414.3040 or email us at [email protected]. We are headquartered in Bluffton, South Carolina (near Hilton Head & Beaufort) and serve clients in Georgia and South Carolina. |

Contact Us(843) 707-4473 Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed